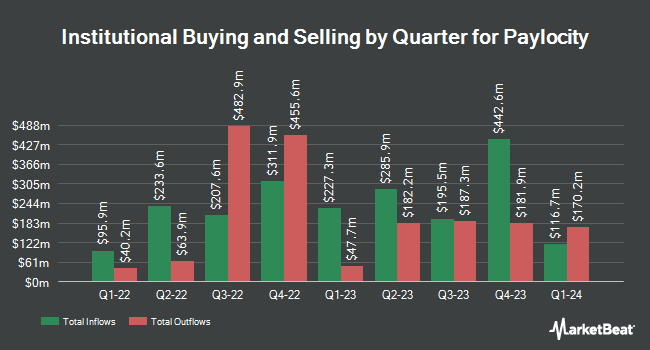

Victory Capital Management Inc. increased its stake in Paylocity Holding Co. (NASDAQ:PCTY - Free Report) by 297.6% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 119,560 shares of the software maker's stock after purchasing an additional 89,487 shares during the quarter. Victory Capital Management Inc. owned 0.21% of Paylocity worth $19,724,000 at the end of the most recent quarter.

Several other large investors also recently modified their holdings of PCTY. International Assets Investment Management LLC boosted its holdings in shares of Paylocity by 16,397.9% during the 3rd quarter. International Assets Investment Management LLC now owns 7,754 shares of the software maker's stock valued at $1,279,000 after purchasing an additional 7,707 shares during the last quarter. Cetera Advisors LLC purchased a new stake in shares of Paylocity in the 1st quarter worth $729,000. Price T Rowe Associates Inc. MD raised its holdings in shares of Paylocity by 3.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 8,833,794 shares of the software maker's stock valued at $1,518,176,000 after acquiring an additional 278,607 shares in the last quarter. Capital Research Global Investors bought a new position in Paylocity during the 1st quarter worth about $46,902,000. Finally, Plato Investment Management Ltd lifted its position in shares of Paylocity by 4,853.3% in the 1st quarter. Plato Investment Management Ltd now owns 3,715 shares of the software maker's stock worth $638,000 after purchasing an additional 3,640 shares during the period. Institutional investors own 94.76% of the company's stock.

Insiders Place Their Bets

In other Paylocity news, SVP Rachit Lohani sold 658 shares of the stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $162.83, for a total value of $107,142.14. Following the sale, the senior vice president now directly owns 39,764 shares of the company's stock, valued at $6,474,772.12. This trade represents a 1.63 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director Jeffrey T. Diehl sold 29,606 shares of the business's stock in a transaction on Tuesday, November 5th. The shares were sold at an average price of $196.55, for a total transaction of $5,819,059.30. Following the transaction, the director now directly owns 11,755 shares of the company's stock, valued at approximately $2,310,445.25. This trade represents a 71.58 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 31,842 shares of company stock worth $6,243,313 in the last three months. 21.91% of the stock is owned by insiders.

Analysts Set New Price Targets

Several equities research analysts have weighed in on the company. Mizuho raised their price target on Paylocity from $175.00 to $180.00 and gave the stock a "neutral" rating in a report on Monday, November 4th. Needham & Company LLC raised their target price on Paylocity from $200.00 to $220.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. StockNews.com lowered shares of Paylocity from a "buy" rating to a "hold" rating in a research note on Saturday, November 9th. Truist Financial raised their price target on shares of Paylocity from $195.00 to $210.00 and gave the stock a "buy" rating in a research note on Friday, November 1st. Finally, BMO Capital Markets boosted their target price on shares of Paylocity from $175.00 to $203.00 and gave the company an "outperform" rating in a report on Thursday, October 31st. Four investment analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $196.64.

View Our Latest Analysis on Paylocity

Paylocity Stock Down 0.4 %

PCTY traded down $0.79 during trading hours on Tuesday, reaching $194.78. 382,117 shares of the stock traded hands, compared to its average volume of 501,513. The firm's fifty day simple moving average is $175.69 and its two-hundred day simple moving average is $158.89. The company has a debt-to-equity ratio of 0.29, a current ratio of 1.32 and a quick ratio of 1.32. The company has a market cap of $10.86 billion, a price-to-earnings ratio of 50.04, a PEG ratio of 4.96 and a beta of 0.93. Paylocity Holding Co. has a fifty-two week low of $129.94 and a fifty-two week high of $215.68.

About Paylocity

(

Free Report)

Paylocity Holding Corporation engages in the provision of cloud-based human capital management and payroll software solutions for workforce in the United States. The company offers payroll software solution for global payroll, expense management, tax services, on demand payment, and garnishment managed services; and time and labor management software for time and attendance, scheduling, and time collection.

Further Reading

Before you consider Paylocity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paylocity wasn't on the list.

While Paylocity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.