Victory Capital Management Inc. decreased its position in Fidelis Insurance Holdings Limited (NYSE:FIHL - Free Report) by 15.7% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 861,850 shares of the company's stock after selling 160,940 shares during the period. Victory Capital Management Inc. owned approximately 0.73% of Fidelis Insurance worth $15,565,000 as of its most recent SEC filing.

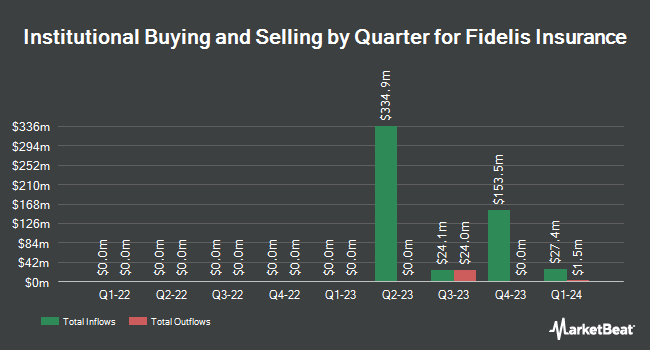

Several other institutional investors and hedge funds have also recently bought and sold shares of FIHL. Summit Global Investments bought a new position in shares of Fidelis Insurance in the third quarter valued at approximately $238,000. Principal Financial Group Inc. bought a new position in shares of Fidelis Insurance in the third quarter valued at approximately $1,144,000. Diversified Trust Co bought a new position in shares of Fidelis Insurance in the third quarter valued at approximately $2,457,000. Sanctuary Advisors LLC bought a new position in shares of Fidelis Insurance in the second quarter valued at approximately $618,000. Finally, Ghisallo Capital Management LLC boosted its holdings in shares of Fidelis Insurance by 1,038.8% in the second quarter. Ghisallo Capital Management LLC now owns 400,000 shares of the company's stock valued at $6,524,000 after acquiring an additional 364,875 shares in the last quarter. Institutional investors own 81.99% of the company's stock.

Fidelis Insurance Stock Performance

Shares of NYSE:FIHL remained flat at $19.91 during trading on Wednesday. 426,933 shares of the stock traded hands, compared to its average volume of 567,555. Fidelis Insurance Holdings Limited has a 12 month low of $11.55 and a 12 month high of $21.32. The company's fifty day moving average is $18.04 and its 200-day moving average is $17.51. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.68 and a current ratio of 0.68. The company has a market capitalization of $2.35 billion, a price-to-earnings ratio of 5.03 and a beta of -0.01.

Fidelis Insurance Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Shareholders of record on Friday, November 29th will be paid a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a yield of 2.01%. The ex-dividend date of this dividend is Friday, November 29th. Fidelis Insurance's payout ratio is currently 10.10%.

Wall Street Analysts Forecast Growth

FIHL has been the subject of several recent research reports. Keefe, Bruyette & Woods increased their target price on shares of Fidelis Insurance from $25.00 to $26.00 and gave the company an "outperform" rating in a research note on Thursday, November 14th. JMP Securities reissued a "market outperform" rating and set a $24.00 target price on shares of Fidelis Insurance in a research note on Friday, August 16th. Barclays initiated coverage on shares of Fidelis Insurance in a research note on Wednesday, September 4th. They set an "equal weight" rating and a $21.00 target price for the company. Finally, The Goldman Sachs Group initiated coverage on shares of Fidelis Insurance in a research note on Tuesday, September 17th. They set a "neutral" rating and a $18.50 target price for the company. Four equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $20.69.

View Our Latest Stock Report on FIHL

Fidelis Insurance Company Profile

(

Free Report)

Fidelis Insurance Holdings Limited, a specialty insurer, provides insurance and reinsurance solutions in Bermuda, the Republic of Ireland, and the United Kingdom. It operates in three segments: Specialty, Reinsurance, and Bespoke segments. The Specialty segment offers aviation and aerospace, energy, marine, property direct and facultative, and other specialty risk solutions.

Recommended Stories

Before you consider Fidelis Insurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidelis Insurance wasn't on the list.

While Fidelis Insurance currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.