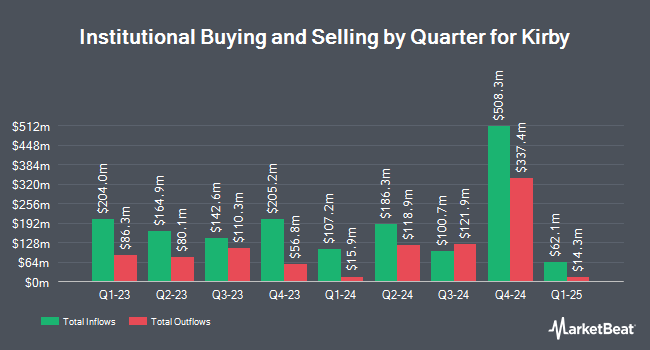

Victory Capital Management Inc. grew its holdings in shares of Kirby Co. (NYSE:KEX - Free Report) by 68.7% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 477,233 shares of the shipping company's stock after purchasing an additional 194,410 shares during the period. Victory Capital Management Inc. owned 0.82% of Kirby worth $58,428,000 as of its most recent SEC filing.

Other institutional investors have also modified their holdings of the company. Farther Finance Advisors LLC boosted its position in shares of Kirby by 420.0% during the 3rd quarter. Farther Finance Advisors LLC now owns 208 shares of the shipping company's stock valued at $25,000 after purchasing an additional 168 shares in the last quarter. International Assets Investment Management LLC bought a new position in Kirby during the second quarter valued at approximately $26,000. ORG Wealth Partners LLC acquired a new position in Kirby during the third quarter valued at approximately $30,000. ORG Partners LLC acquired a new position in Kirby during the second quarter valued at approximately $32,000. Finally, Opal Wealth Advisors LLC acquired a new stake in shares of Kirby in the second quarter worth $33,000. Institutional investors own 96.15% of the company's stock.

Kirby Trading Down 1.5 %

Shares of KEX stock traded down $1.90 on Friday, reaching $128.05. The company had a trading volume of 125,871 shares, compared to its average volume of 456,158. The company has a 50-day moving average of $121.93 and a 200-day moving average of $119.53. Kirby Co. has a 12 month low of $72.11 and a 12 month high of $132.04. The company has a current ratio of 1.67, a quick ratio of 1.05 and a debt-to-equity ratio of 0.29. The stock has a market cap of $7.35 billion, a PE ratio of 24.94, a PEG ratio of 0.76 and a beta of 1.17.

Kirby (NYSE:KEX - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The shipping company reported $1.55 earnings per share for the quarter, topping analysts' consensus estimates of $1.47 by $0.08. The firm had revenue of $831.10 million during the quarter, compared to the consensus estimate of $824.42 million. Kirby had a return on equity of 9.43% and a net margin of 9.37%. The business's revenue was up 8.7% on a year-over-year basis. During the same quarter in the prior year, the firm posted $1.05 EPS. On average, equities analysts forecast that Kirby Co. will post 5.44 earnings per share for the current year.

Analyst Ratings Changes

KEX has been the topic of a number of research reports. StockNews.com lowered shares of Kirby from a "buy" rating to a "hold" rating in a research report on Sunday, September 22nd. Bank of America upped their price target on shares of Kirby from $138.00 to $141.00 and gave the stock a "buy" rating in a research report on Tuesday, July 23rd. One investment analyst has rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $123.80.

Read Our Latest Report on KEX

Insider Buying and Selling at Kirby

In related news, VP Amy D. Husted sold 2,853 shares of the firm's stock in a transaction on Thursday, September 19th. The stock was sold at an average price of $126.54, for a total value of $361,018.62. Following the transaction, the vice president now owns 5,280 shares in the company, valued at approximately $668,131.20. This trade represents a 35.08 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO David W. Grzebinski sold 26,358 shares of the firm's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $120.46, for a total value of $3,175,084.68. Following the completion of the sale, the chief executive officer now directly owns 63,399 shares in the company, valued at $7,637,043.54. This trade represents a 29.37 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 60,596 shares of company stock valued at $7,515,760 in the last quarter. 1.50% of the stock is currently owned by insiders.

About Kirby

(

Free Report)

Kirby Corporation operates domestic tank barges in the United States. Its Marine Transportation segment provides marine transportation service and towing vessel transporting bulk liquid product, as well as operates tank barge throughout the Mississippi River System, on the Gulf Intracoastal Waterway, coastwise along three United States coasts, and in Alaska and Hawaii.

Featured Articles

Before you consider Kirby, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kirby wasn't on the list.

While Kirby currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.