Victory Capital Management Inc. grew its position in shares of Qiagen (NYSE:QGEN - Free Report) by 62.6% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 2,574,705 shares of the company's stock after acquiring an additional 991,325 shares during the quarter. Victory Capital Management Inc. owned 1.13% of Qiagen worth $117,329,000 at the end of the most recent reporting period.

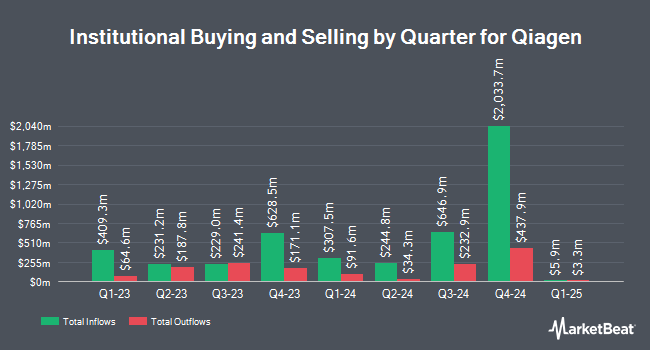

Several other hedge funds also recently made changes to their positions in QGEN. Janney Montgomery Scott LLC lifted its position in shares of Qiagen by 18.3% in the first quarter. Janney Montgomery Scott LLC now owns 7,433 shares of the company's stock worth $320,000 after purchasing an additional 1,151 shares in the last quarter. Envestnet Portfolio Solutions Inc. bought a new stake in Qiagen during the 1st quarter worth about $386,000. Forsta AP Fonden acquired a new position in shares of Qiagen during the 1st quarter worth about $834,000. US Bancorp DE grew its holdings in shares of Qiagen by 124.4% in the 1st quarter. US Bancorp DE now owns 75,529 shares of the company's stock valued at $3,247,000 after acquiring an additional 41,868 shares in the last quarter. Finally, Acadian Asset Management LLC increased its position in shares of Qiagen by 10.3% in the first quarter. Acadian Asset Management LLC now owns 45,471 shares of the company's stock valued at $1,944,000 after acquiring an additional 4,253 shares during the last quarter. 70.00% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several brokerages recently commented on QGEN. Robert W. Baird increased their price target on Qiagen from $49.00 to $52.00 and gave the company an "outperform" rating in a research report on Friday, August 2nd. Hsbc Global Res raised Qiagen to a "hold" rating in a report on Thursday, October 17th. Finally, HSBC cut shares of Qiagen from a "buy" rating to a "hold" rating and set a $49.00 target price for the company. in a research note on Thursday, October 17th. Four research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $50.88.

Read Our Latest Stock Analysis on QGEN

Qiagen Stock Performance

Shares of QGEN stock traded down $0.60 during midday trading on Wednesday, hitting $42.63. 803,279 shares of the company were exchanged, compared to its average volume of 1,166,503. Qiagen has a 52 week low of $39.03 and a 52 week high of $47.44. The firm has a market capitalization of $9.73 billion, a P/E ratio of 109.31, a PEG ratio of 3.29 and a beta of 0.41. The firm's 50 day moving average price is $43.96 and its two-hundred day moving average price is $43.77. The company has a debt-to-equity ratio of 0.39, a quick ratio of 1.46 and a current ratio of 2.17.

Qiagen Company Profile

(

Free Report)

QIAGEN N.V. offers sample to insight solutions that transform biological materials into molecular insights worldwide. The company provides primary sample technology consumables, such as nucleic stabilization and purification kits for primary sample materials, manual and automated processing for genotyping, gene expression, and viral and bacterial analysis, as well as silica membranes and magnetic bead technologies; secondary sample technology consumables, including kits and components for purification of nucleic acids from secondary sample materials; and instruments for nucleic acid purification and accessories.

Read More

Before you consider Qiagen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qiagen wasn't on the list.

While Qiagen currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.