Victory Capital Management Inc. bought a new position in shares of Vital Farms, Inc. (NASDAQ:VITL - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 22,504 shares of the company's stock, valued at approximately $789,000. Victory Capital Management Inc. owned 0.05% of Vital Farms at the end of the most recent quarter.

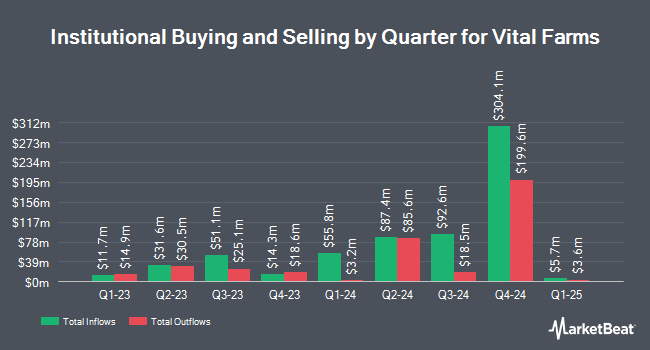

Several other institutional investors and hedge funds have also bought and sold shares of the company. Aigen Investment Management LP purchased a new stake in shares of Vital Farms in the 3rd quarter valued at about $397,000. Versor Investments LP raised its stake in Vital Farms by 336.8% in the third quarter. Versor Investments LP now owns 31,012 shares of the company's stock valued at $1,088,000 after purchasing an additional 23,912 shares in the last quarter. Lifestyle Asset Management Inc. raised its position in shares of Vital Farms by 6.5% during the 3rd quarter. Lifestyle Asset Management Inc. now owns 9,846 shares of the company's stock valued at $345,000 after buying an additional 598 shares in the last quarter. Principal Financial Group Inc. lifted its stake in Vital Farms by 35.6% during the third quarter. Principal Financial Group Inc. now owns 655,811 shares of the company's stock worth $22,999,000 after purchasing an additional 172,249 shares during the last quarter. Finally, Robeco Institutional Asset Management B.V. lifted its position in Vital Farms by 4.4% in the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 7,857 shares of the company's stock worth $276,000 after buying an additional 329 shares during the last quarter. 98.59% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Vital Farms

In related news, insider Matthew Ohayer sold 24,000 shares of the company's stock in a transaction on Monday, October 21st. The stock was sold at an average price of $39.09, for a total value of $938,160.00. Following the sale, the insider now directly owns 7,194,777 shares of the company's stock, valued at $281,243,832.93. This represents a 0.33 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Russell Diez-Canseco sold 44,653 shares of the firm's stock in a transaction on Monday, October 14th. The shares were sold at an average price of $40.07, for a total value of $1,789,245.71. Following the transaction, the chief executive officer now directly owns 537,349 shares of the company's stock, valued at $21,531,574.43. This represents a 7.67 % decrease in their position. The disclosure for this sale can be found here. 27.60% of the stock is currently owned by company insiders.

Vital Farms Trading Up 2.7 %

Shares of Vital Farms stock traded up $0.86 during trading on Friday, reaching $33.20. 1,236,851 shares of the stock were exchanged, compared to its average volume of 816,000. The company has a quick ratio of 2.81, a current ratio of 3.24 and a debt-to-equity ratio of 0.04. The firm has a market cap of $1.45 billion, a price-to-earnings ratio of 29.28 and a beta of 0.97. Vital Farms, Inc. has a 1 year low of $12.82 and a 1 year high of $48.41. The stock's fifty day moving average is $34.76 and its 200 day moving average is $36.70.

Vital Farms (NASDAQ:VITL - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The company reported $0.16 earnings per share for the quarter, topping the consensus estimate of $0.14 by $0.02. Vital Farms had a return on equity of 22.29% and a net margin of 8.68%. The business had revenue of $145.00 million during the quarter, compared to analysts' expectations of $145.27 million. During the same quarter last year, the business posted $0.10 EPS. The business's revenue was up 31.3% on a year-over-year basis. As a group, equities research analysts expect that Vital Farms, Inc. will post 1.11 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of equities research analysts have recently weighed in on the stock. Jefferies Financial Group lowered their price objective on shares of Vital Farms from $45.00 to $41.00 and set a "buy" rating for the company in a report on Monday, November 11th. TD Cowen cut their price target on shares of Vital Farms from $46.00 to $41.00 and set a "buy" rating for the company in a research report on Friday, November 8th. DA Davidson lifted their price objective on Vital Farms from $44.00 to $48.00 and gave the stock a "buy" rating in a report on Thursday, October 10th. Finally, Stifel Nicolaus dropped their target price on Vital Farms from $42.00 to $34.00 and set a "hold" rating for the company in a report on Friday, August 9th. One investment analyst has rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $39.20.

Read Our Latest Stock Report on VITL

About Vital Farms

(

Free Report)

Vital Farms, Inc, a food company, provides pasture-raised products in the United States. It offers shell eggs, butter, hard-boiled eggs, and liquid whole eggs. The company was founded in 2007 and is headquartered in Austin, Texas.

Read More

Before you consider Vital Farms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vital Farms wasn't on the list.

While Vital Farms currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.