Victory Capital Management Inc. raised its position in shares of PubMatic, Inc. (NASDAQ:PUBM - Free Report) by 99.2% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 72,083 shares of the company's stock after acquiring an additional 35,898 shares during the period. Victory Capital Management Inc. owned approximately 0.15% of PubMatic worth $1,072,000 at the end of the most recent reporting period.

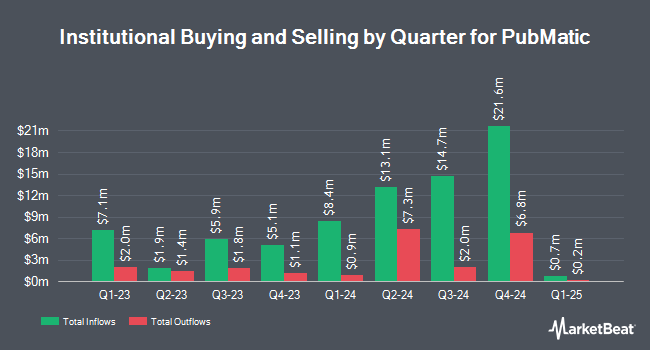

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Millennium Management LLC purchased a new stake in shares of PubMatic during the 2nd quarter worth about $6,582,000. Acadian Asset Management LLC raised its stake in shares of PubMatic by 28,255.4% in the 2nd quarter. Acadian Asset Management LLC now owns 291,493 shares of the company's stock valued at $5,915,000 after acquiring an additional 290,465 shares during the period. Renaissance Technologies LLC lifted its holdings in shares of PubMatic by 28.8% during the 2nd quarter. Renaissance Technologies LLC now owns 1,188,700 shares of the company's stock valued at $24,142,000 after acquiring an additional 265,700 shares in the last quarter. Cubist Systematic Strategies LLC boosted its position in PubMatic by 54.4% during the 2nd quarter. Cubist Systematic Strategies LLC now owns 264,988 shares of the company's stock worth $5,382,000 after purchasing an additional 93,327 shares during the period. Finally, Sei Investments Co. increased its holdings in PubMatic by 190.6% in the 2nd quarter. Sei Investments Co. now owns 70,129 shares of the company's stock valued at $1,424,000 after purchasing an additional 45,998 shares in the last quarter. 64.26% of the stock is currently owned by institutional investors and hedge funds.

PubMatic Stock Performance

NASDAQ:PUBM opened at $15.79 on Wednesday. The company has a market capitalization of $754.29 million, a price-to-earnings ratio of 50.94 and a beta of 1.39. PubMatic, Inc. has a one year low of $13.18 and a one year high of $25.36. The stock has a 50-day simple moving average of $15.09 and a 200 day simple moving average of $17.84.

Analysts Set New Price Targets

A number of research analysts have commented on the company. Royal Bank of Canada reduced their price objective on PubMatic from $26.00 to $23.00 and set an "outperform" rating on the stock in a research note on Tuesday, August 20th. Raymond James cut PubMatic from an "outperform" rating to a "market perform" rating in a report on Friday, August 9th. Evercore ISI lifted their price objective on shares of PubMatic from $20.00 to $22.00 and gave the company an "outperform" rating in a research note on Wednesday, November 13th. B. Riley reduced their target price on shares of PubMatic from $31.00 to $22.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. Finally, Jefferies Financial Group decreased their price objective on shares of PubMatic from $26.00 to $16.00 and set a "hold" rating for the company in a research report on Friday, August 9th. Three analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $21.71.

Check Out Our Latest Stock Analysis on PubMatic

Insiders Place Their Bets

In other news, General Counsel Andrew Woods sold 2,710 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $15.30, for a total value of $41,463.00. Following the transaction, the general counsel now directly owns 26,739 shares in the company, valued at approximately $409,106.70. This trade represents a 9.20 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CEO Rajeev K. Goel sold 25,000 shares of the business's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $15.25, for a total transaction of $381,250.00. The disclosure for this sale can be found here. Insiders have sold a total of 103,869 shares of company stock valued at $1,525,262 in the last quarter. Insiders own 2.90% of the company's stock.

About PubMatic

(

Free Report)

PubMatic, Inc, a technology company, engages in the provision of a cloud infrastructure platform that enables real-time programmatic advertising transactions for digital content creators, advertisers, agencies, agency trading desks, and demand side platforms worldwide. Its PubMatic SSP, a sell-side platform, used for the purchase and sale of digital advertising inventory for publishers and buyers.

Featured Articles

Before you consider PubMatic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PubMatic wasn't on the list.

While PubMatic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.