Victory Capital Management Inc. lifted its position in shares of Royal Caribbean Cruises Ltd. (NYSE:RCL - Free Report) by 5.3% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 85,684 shares of the company's stock after purchasing an additional 4,300 shares during the period. Victory Capital Management Inc.'s holdings in Royal Caribbean Cruises were worth $19,766,000 at the end of the most recent reporting period.

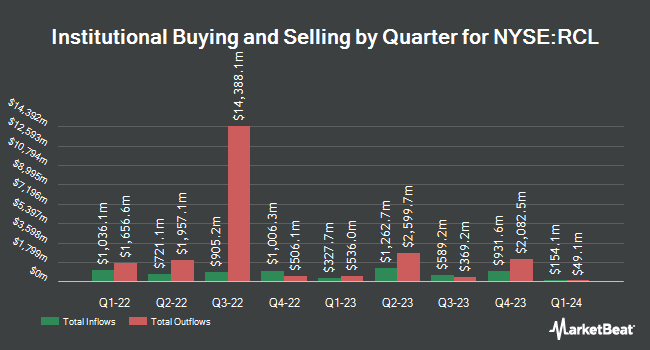

Several other institutional investors and hedge funds have also made changes to their positions in RCL. Venturi Wealth Management LLC lifted its stake in Royal Caribbean Cruises by 511.0% in the fourth quarter. Venturi Wealth Management LLC now owns 2,157 shares of the company's stock valued at $498,000 after buying an additional 1,804 shares during the last quarter. Park Avenue Securities LLC increased its holdings in shares of Royal Caribbean Cruises by 20.1% in the 4th quarter. Park Avenue Securities LLC now owns 6,630 shares of the company's stock valued at $1,530,000 after acquiring an additional 1,111 shares during the period. Sanctuary Advisors LLC raised its position in Royal Caribbean Cruises by 76.1% in the 3rd quarter. Sanctuary Advisors LLC now owns 28,991 shares of the company's stock valued at $5,142,000 after purchasing an additional 12,530 shares during the last quarter. Lorne Steinberg Wealth Management Inc. acquired a new stake in Royal Caribbean Cruises during the 4th quarter worth $231,000. Finally, Principal Financial Group Inc. increased its stake in Royal Caribbean Cruises by 2.7% in the fourth quarter. Principal Financial Group Inc. now owns 291,027 shares of the company's stock valued at $67,137,000 after purchasing an additional 7,740 shares during the period. 87.53% of the stock is owned by hedge funds and other institutional investors.

Royal Caribbean Cruises Stock Performance

RCL opened at $207.07 on Wednesday. Royal Caribbean Cruises Ltd. has a 1-year low of $125.06 and a 1-year high of $277.08. The stock has a market cap of $55.73 billion, a P/E ratio of 19.37, a P/E/G ratio of 0.90 and a beta of 2.53. The stock's 50 day simple moving average is $242.53 and its 200 day simple moving average is $219.34. The company has a debt-to-equity ratio of 2.39, a current ratio of 0.17 and a quick ratio of 0.15.

Royal Caribbean Cruises (NYSE:RCL - Get Free Report) last posted its earnings results on Tuesday, January 28th. The company reported $1.63 earnings per share for the quarter, beating the consensus estimate of $1.50 by $0.13. Royal Caribbean Cruises had a return on equity of 48.97% and a net margin of 17.46%. During the same period last year, the business earned $1.25 EPS. As a group, equities analysts anticipate that Royal Caribbean Cruises Ltd. will post 14.9 EPS for the current fiscal year.

Royal Caribbean Cruises Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, April 4th. Shareholders of record on Friday, March 7th will be issued a $0.75 dividend. This represents a $3.00 annualized dividend and a dividend yield of 1.45%. The ex-dividend date of this dividend is Friday, March 7th. This is an increase from Royal Caribbean Cruises's previous quarterly dividend of $0.55. Royal Caribbean Cruises's dividend payout ratio is 28.06%.

Royal Caribbean Cruises announced that its board has approved a stock buyback program on Wednesday, February 12th that permits the company to repurchase $1.00 billion in shares. This repurchase authorization permits the company to repurchase up to 1.5% of its shares through open market purchases. Shares repurchase programs are often a sign that the company's board believes its shares are undervalued.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently commented on RCL shares. Macquarie upped their target price on shares of Royal Caribbean Cruises from $250.00 to $300.00 and gave the company an "outperform" rating in a report on Thursday, January 30th. Tigress Financial upped their price objective on Royal Caribbean Cruises from $270.00 to $330.00 and gave the company a "buy" rating in a research note on Friday, February 7th. Morgan Stanley lifted their target price on Royal Caribbean Cruises from $210.00 to $225.00 and gave the company an "equal weight" rating in a research note on Monday, February 3rd. UBS Group increased their price target on Royal Caribbean Cruises from $271.00 to $301.00 and gave the stock a "buy" rating in a report on Tuesday, February 4th. Finally, Sanford C. Bernstein began coverage on shares of Royal Caribbean Cruises in a research report on Tuesday, November 26th. They issued an "outperform" rating and a $290.00 price objective on the stock. Three research analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the stock. According to data from MarketBeat.com, Royal Caribbean Cruises presently has an average rating of "Moderate Buy" and an average target price of $283.53.

View Our Latest Report on RCL

Insider Activity

In other Royal Caribbean Cruises news, CEO Jason T. Liberty sold 58,000 shares of the company's stock in a transaction dated Tuesday, February 18th. The shares were sold at an average price of $261.95, for a total value of $15,193,100.00. Following the transaction, the chief executive officer now directly owns 143,214 shares in the company, valued at approximately $37,514,907.30. This represents a 28.83 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Richard D. Fain sold 19,500 shares of Royal Caribbean Cruises stock in a transaction dated Thursday, February 13th. The stock was sold at an average price of $256.68, for a total transaction of $5,005,260.00. Following the sale, the director now owns 185,021 shares of the company's stock, valued at approximately $47,491,190.28. This trade represents a 9.53 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 109,492 shares of company stock worth $28,571,705 over the last ninety days. 7.95% of the stock is currently owned by insiders.

Royal Caribbean Cruises Profile

(

Free Report)

Royal Caribbean Cruises Ltd. operates as a cruise company worldwide. The company operates cruises under the Royal Caribbean International, Celebrity Cruises, and Silversea Cruises brands, which comprise a range of itineraries. As of February 21, 2024, it operated 65 ships. Royal Caribbean Cruises Ltd.

Read More

Want to see what other hedge funds are holding RCL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Royal Caribbean Cruises Ltd. (NYSE:RCL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Royal Caribbean Cruises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Caribbean Cruises wasn't on the list.

While Royal Caribbean Cruises currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report