Victory Capital Management Inc. increased its stake in United Therapeutics Co. (NASDAQ:UTHR - Free Report) by 21.9% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 186,819 shares of the biotechnology company's stock after buying an additional 33,599 shares during the period. Victory Capital Management Inc. owned about 0.42% of United Therapeutics worth $66,947,000 at the end of the most recent reporting period.

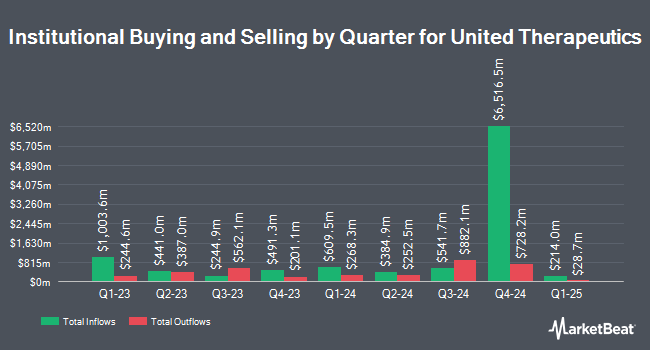

Other hedge funds and other institutional investors also recently modified their holdings of the company. LSV Asset Management lifted its holdings in shares of United Therapeutics by 82.5% in the 2nd quarter. LSV Asset Management now owns 966,370 shares of the biotechnology company's stock worth $307,837,000 after purchasing an additional 436,851 shares during the last quarter. Swedbank AB acquired a new position in shares of United Therapeutics in the 1st quarter valued at $97,316,000. Canada Pension Plan Investment Board boosted its holdings in shares of United Therapeutics by 567.2% in the first quarter. Canada Pension Plan Investment Board now owns 180,800 shares of the biotechnology company's stock worth $41,533,000 after buying an additional 153,700 shares during the period. Assetmark Inc. raised its position in United Therapeutics by 56.9% during the third quarter. Assetmark Inc. now owns 419,957 shares of the biotechnology company's stock valued at $150,492,000 after buying an additional 152,249 shares during the period. Finally, Pacer Advisors Inc. increased its stake in United Therapeutics by 19.6% in the 2nd quarter. Pacer Advisors Inc. now owns 561,834 shares of the biotechnology company's stock valued at $178,972,000 after buying an additional 92,240 shares during the period. Institutional investors own 94.08% of the company's stock.

United Therapeutics Trading Down 6.3 %

UTHR traded down $24.48 on Friday, hitting $361.79. 268,908 shares of the stock traded hands, compared to its average volume of 461,625. The business has a fifty day moving average price of $362.57 and a two-hundred day moving average price of $326.65. The firm has a market capitalization of $16.15 billion, a PE ratio of 16.96, a P/E/G ratio of 1.17 and a beta of 0.56. United Therapeutics Co. has a 52 week low of $208.62 and a 52 week high of $417.82.

United Therapeutics (NASDAQ:UTHR - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The biotechnology company reported $6.39 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $6.16 by $0.23. The business had revenue of $748.90 million for the quarter, compared to analysts' expectations of $722.62 million. United Therapeutics had a return on equity of 19.22% and a net margin of 40.31%. United Therapeutics's quarterly revenue was up 22.9% on a year-over-year basis. During the same period in the previous year, the business posted $5.38 earnings per share. On average, equities research analysts forecast that United Therapeutics Co. will post 25.1 EPS for the current fiscal year.

Analyst Ratings Changes

Several analysts have commented on UTHR shares. Bank of America decreased their target price on shares of United Therapeutics from $303.00 to $280.00 and set an "underperform" rating for the company in a research report on Thursday, August 1st. Jefferies Financial Group upped their price target on United Therapeutics from $315.00 to $432.00 and gave the stock a "buy" rating in a research note on Monday, September 23rd. TD Cowen raised their price objective on United Therapeutics from $350.00 to $400.00 and gave the company a "buy" rating in a research note on Monday, October 21st. HC Wainwright boosted their price objective on shares of United Therapeutics from $400.00 to $425.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Finally, LADENBURG THALM/SH SH raised their target price on shares of United Therapeutics from $319.00 to $344.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. One analyst has rated the stock with a sell rating, two have assigned a hold rating, twelve have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $370.86.

Check Out Our Latest Report on United Therapeutics

Insider Buying and Selling at United Therapeutics

In other news, CEO Martine A. Rothblatt sold 3,600 shares of the stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $344.18, for a total value of $1,239,048.00. Following the completion of the transaction, the chief executive officer now directly owns 130 shares of the company's stock, valued at approximately $44,743.40. This represents a 96.51 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Christopher Causey sold 510 shares of the business's stock in a transaction on Friday, November 1st. The shares were sold at an average price of $376.63, for a total value of $192,081.30. Following the completion of the sale, the director now directly owns 3,675 shares in the company, valued at approximately $1,384,115.25. This represents a 12.19 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 113,396 shares of company stock valued at $42,175,418 in the last 90 days. 11.90% of the stock is currently owned by company insiders.

United Therapeutics Profile

(

Free Report)

United Therapeutics Corporation, a biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally. The company offers Tyvaso DPI, an inhaled dry powder via pre-filled and single-use cartridges; Tyvaso, an inhaled solution via ultrasonic nebulizer; Remodulin (treprostinil) injection to treat patients with pulmonary arterial hypertension (PAH) to diminish symptoms associated with exercise; Orenitram, a tablet dosage form of treprostinil, to delay disease progression and improve exercise capacity in PAH patients; and Adcirca, an oral PDE-5 inhibitor to enhance the exercise ability in PAH patients.

Further Reading

Before you consider United Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Therapeutics wasn't on the list.

While United Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.