Victory Capital Management Inc. reduced its position in Copa Holdings, S.A. (NYSE:CPA - Free Report) by 4.3% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 272,481 shares of the transportation company's stock after selling 12,315 shares during the quarter. Victory Capital Management Inc. owned about 0.65% of Copa worth $23,946,000 at the end of the most recent reporting period.

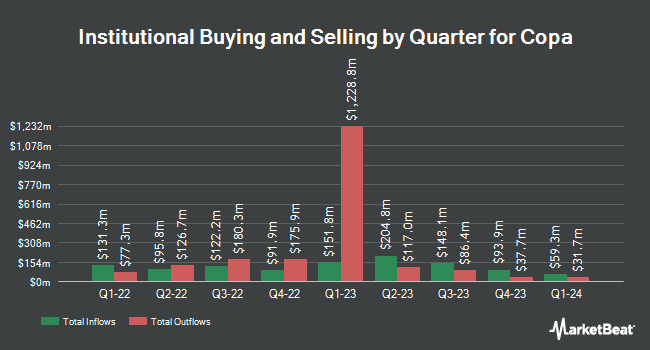

Several other hedge funds have also recently added to or reduced their stakes in CPA. Marathon Asset Management Ltd raised its position in shares of Copa by 1.3% in the fourth quarter. Marathon Asset Management Ltd now owns 521,402 shares of the transportation company's stock valued at $45,821,000 after buying an additional 6,723 shares during the last quarter. Wishbone Management LP grew its stake in Copa by 20.0% during the 3rd quarter. Wishbone Management LP now owns 420,000 shares of the transportation company's stock valued at $39,413,000 after acquiring an additional 70,000 shares in the last quarter. Cape Ann Asset Management Ltd acquired a new stake in Copa in the 4th quarter valued at about $20,195,000. Fourth Sail Capital LP lifted its stake in Copa by 32.4% in the 4th quarter. Fourth Sail Capital LP now owns 207,790 shares of the transportation company's stock worth $18,261,000 after purchasing an additional 50,805 shares in the last quarter. Finally, Point72 Asset Management L.P. acquired a new position in shares of Copa during the 3rd quarter worth approximately $14,094,000. 70.09% of the stock is owned by institutional investors and hedge funds.

Copa Trading Up 0.9 %

Shares of NYSE:CPA traded up $0.82 during midday trading on Friday, reaching $92.82. 341,362 shares of the company's stock were exchanged, compared to its average volume of 287,958. The firm's 50 day simple moving average is $92.40 and its two-hundred day simple moving average is $93.06. Copa Holdings, S.A. has a fifty-two week low of $80.01 and a fifty-two week high of $114.00. The company has a debt-to-equity ratio of 0.60, a current ratio of 1.10 and a quick ratio of 0.99. The stock has a market cap of $3.90 billion, a price-to-earnings ratio of 6.38, a P/E/G ratio of 0.87 and a beta of 1.42.

Copa (NYSE:CPA - Get Free Report) last released its quarterly earnings results on Wednesday, February 12th. The transportation company reported $3.99 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.84 by $0.15. Copa had a net margin of 17.67% and a return on equity of 26.70%. As a group, sell-side analysts forecast that Copa Holdings, S.A. will post 15.48 EPS for the current fiscal year.

Copa Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, March 14th. Stockholders of record on Friday, February 28th will be given a dividend of $1.61 per share. The ex-dividend date of this dividend is Friday, February 28th. This represents a $6.44 annualized dividend and a dividend yield of 6.94%. Copa's dividend payout ratio is currently 44.23%.

Wall Street Analyst Weigh In

A number of brokerages recently commented on CPA. Cowen reiterated a "buy" rating on shares of Copa in a research report on Tuesday, February 18th. UBS Group boosted their price target on shares of Copa from $160.00 to $180.00 and gave the company a "buy" rating in a research report on Tuesday, January 7th. Finally, StockNews.com cut shares of Copa from a "buy" rating to a "hold" rating in a research report on Wednesday, February 5th. One analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average price target of $153.29.

Read Our Latest Research Report on CPA

About Copa

(

Free Report)

Copa Holdings, SA, through its subsidiaries, provides airline passenger and cargo services. The company offers approximately 375 daily scheduled flights to 82 destinations in 32 countries in North, Central, and South America, as well as the Caribbean from its Panama City hub. As of December 31, 2023, it operated a fleet of 106 aircraft comprising 76 Boeing 737-Next Generation aircraft, 29 Boeing 737 MAX 9 aircraft, and one Boeing 737-800 Boeing Converted Freighter.

Featured Articles

Before you consider Copa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Copa wasn't on the list.

While Copa currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.