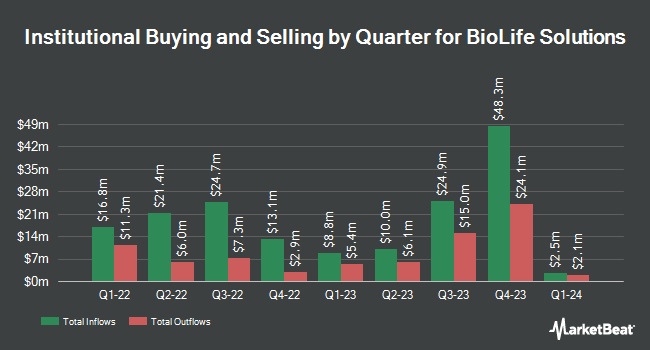

Victory Capital Management Inc. decreased its holdings in shares of BioLife Solutions, Inc. (NASDAQ:BLFS - Free Report) by 50.5% in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 41,934 shares of the medical equipment provider's stock after selling 42,851 shares during the period. Victory Capital Management Inc. owned approximately 0.09% of BioLife Solutions worth $1,050,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the stock. Summit Global Investments acquired a new stake in shares of BioLife Solutions in the third quarter valued at approximately $228,000. Principal Financial Group Inc. boosted its holdings in shares of BioLife Solutions by 4.7% during the 3rd quarter. Principal Financial Group Inc. now owns 190,715 shares of the medical equipment provider's stock worth $4,776,000 after buying an additional 8,580 shares during the period. Harbor Capital Advisors Inc. increased its stake in shares of BioLife Solutions by 31.0% during the third quarter. Harbor Capital Advisors Inc. now owns 52,449 shares of the medical equipment provider's stock worth $1,313,000 after purchasing an additional 12,421 shares during the period. Raymond James & Associates increased its position in BioLife Solutions by 4.3% during the 3rd quarter. Raymond James & Associates now owns 139,997 shares of the medical equipment provider's stock worth $3,506,000 after buying an additional 5,803 shares during the period. Finally, GAMMA Investing LLC raised its stake in BioLife Solutions by 29.4% in the 3rd quarter. GAMMA Investing LLC now owns 3,295 shares of the medical equipment provider's stock worth $83,000 after purchasing an additional 748 shares in the last quarter. Institutional investors own 93.24% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have recently weighed in on BLFS shares. Craig Hallum upped their price target on shares of BioLife Solutions from $30.00 to $32.00 and gave the stock a "buy" rating in a report on Wednesday, November 13th. TD Cowen boosted their target price on shares of BioLife Solutions from $28.00 to $31.00 and gave the stock a "buy" rating in a report on Wednesday, November 13th. Northland Securities raised their price objective on BioLife Solutions from $26.00 to $28.00 and gave the stock an "outperform" rating in a research report on Friday, August 9th. Finally, HC Wainwright dropped their target price on shares of BioLife Solutions from $29.00 to $27.00 and set a "buy" rating on the stock in a report on Monday, November 18th. One analyst has rated the stock with a sell rating and six have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $27.50.

Check Out Our Latest Report on BioLife Solutions

Insider Activity at BioLife Solutions

In other BioLife Solutions news, CRO Garrie Richardson sold 3,070 shares of BioLife Solutions stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $25.12, for a total transaction of $77,118.40. Following the completion of the transaction, the executive now owns 114,773 shares of the company's stock, valued at $2,883,097.76. The trade was a 2.61 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, EVP Aby J. Mathew sold 17,604 shares of the stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $20.05, for a total transaction of $352,960.20. Following the completion of the sale, the executive vice president now directly owns 284,442 shares in the company, valued at approximately $5,703,062.10. The trade was a 5.83 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 69,644 shares of company stock worth $1,527,503. Company insiders own 2.20% of the company's stock.

BioLife Solutions Stock Performance

NASDAQ BLFS traded up $0.10 on Thursday, hitting $27.16. 294,459 shares of the stock traded hands, compared to its average volume of 389,794. The firm has a market capitalization of $1.26 billion, a price-to-earnings ratio of -25.62 and a beta of 1.88. The business's fifty day moving average is $24.16 and its two-hundred day moving average is $23.16. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.78 and a current ratio of 2.78. BioLife Solutions, Inc. has a 12 month low of $11.91 and a 12 month high of $28.88.

BioLife Solutions Company Profile

(

Free Report)

BioLife Solutions, Inc develops, manufactures, and markets bioproduction tools and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally. The company's products are used in the basic and applied research, and commercial manufacturing of biologic-based therapies.

Read More

Before you consider BioLife Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioLife Solutions wasn't on the list.

While BioLife Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.