Victory Capital Management Inc. trimmed its stake in LegalZoom.com, Inc. (NASDAQ:LZ - Free Report) by 39.6% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 78,321 shares of the company's stock after selling 51,454 shares during the quarter. Victory Capital Management Inc.'s holdings in LegalZoom.com were worth $588,000 as of its most recent SEC filing.

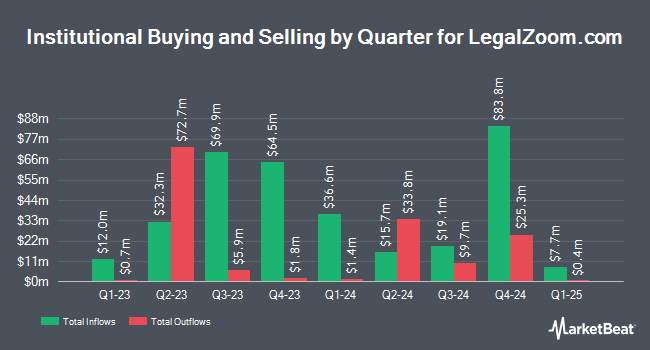

Several other hedge funds and other institutional investors have also recently bought and sold shares of LZ. Quarry LP raised its position in shares of LegalZoom.com by 83.4% during the third quarter. Quarry LP now owns 8,206 shares of the company's stock worth $52,000 after purchasing an additional 3,732 shares during the period. Wexford Capital LP bought a new stake in LegalZoom.com during the 3rd quarter valued at $64,000. Olympiad Research LP acquired a new position in LegalZoom.com during the fourth quarter worth $78,000. Paloma Partners Management Co bought a new position in shares of LegalZoom.com in the third quarter valued at $81,000. Finally, Clearline Capital LP acquired a new position in shares of LegalZoom.com during the third quarter valued at about $126,000. 81.99% of the stock is owned by institutional investors.

LegalZoom.com Price Performance

Shares of LegalZoom.com stock traded up $0.09 during trading hours on Tuesday, hitting $9.36. 1,466,728 shares of the company's stock traded hands, compared to its average volume of 1,691,809. The company has a fifty day simple moving average of $9.11 and a 200-day simple moving average of $7.99. The stock has a market capitalization of $1.65 billion, a price-to-earnings ratio of 72.01, a PEG ratio of 1.73 and a beta of 1.09. LegalZoom.com, Inc. has a 12-month low of $5.33 and a 12-month high of $13.56.

Analyst Ratings Changes

A number of equities research analysts recently weighed in on the stock. JPMorgan Chase & Co. upped their target price on shares of LegalZoom.com from $9.00 to $11.00 and gave the stock an "overweight" rating in a report on Tuesday, February 11th. William Blair reissued a "market perform" rating on shares of LegalZoom.com in a research note on Thursday, February 27th. JMP Securities reaffirmed a "market perform" rating on shares of LegalZoom.com in a research report on Tuesday, February 11th. Barclays increased their price target on LegalZoom.com from $8.00 to $9.00 and gave the company an "equal weight" rating in a research report on Thursday, February 27th. Finally, UBS Group assumed coverage on LegalZoom.com in a research note on Friday, December 6th. They set a "neutral" rating and a $9.00 price objective on the stock. Two equities research analysts have rated the stock with a sell rating, six have issued a hold rating and two have given a buy rating to the stock. According to data from MarketBeat.com, LegalZoom.com currently has an average rating of "Hold" and a consensus price target of $9.19.

View Our Latest Analysis on LZ

LegalZoom.com Company Profile

(

Free Report)

LegalZoom.com, Inc, together with its subsidiaries, operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States. The company's platform offers business formation products, such as limited liability company, incorporation of C and S corporations, nonprofit formations, doing-business-as, corporate changes and filings, business licenses, legal forms, and beneficial ownership information reports; intellectual property products consisting of trademark and patent applications, and copyright registrations; and tax services, including business and personal tax preparations.

Recommended Stories

Before you consider LegalZoom.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LegalZoom.com wasn't on the list.

While LegalZoom.com currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.