Victory Capital Management Inc. reduced its holdings in shares of Kimberly-Clark Co. (NYSE:KMB - Free Report) by 6.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,003,932 shares of the company's stock after selling 66,393 shares during the period. Victory Capital Management Inc. owned approximately 0.30% of Kimberly-Clark worth $142,839,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

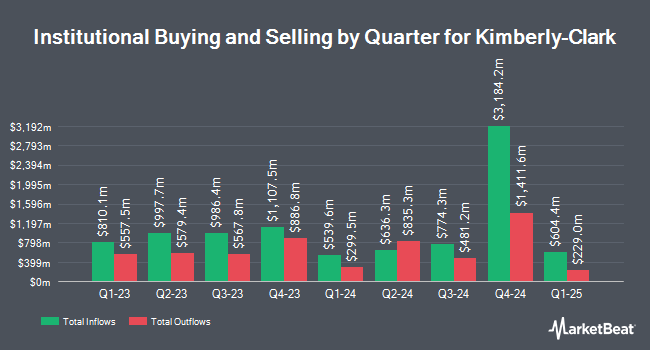

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in KMB. Price T Rowe Associates Inc. MD boosted its position in Kimberly-Clark by 19.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 5,893,146 shares of the company's stock worth $762,279,000 after purchasing an additional 944,920 shares in the last quarter. Wulff Hansen & CO. lifted its stake in shares of Kimberly-Clark by 13,720.0% in the 2nd quarter. Wulff Hansen & CO. now owns 641,524 shares of the company's stock valued at $88,659,000 after purchasing an additional 636,882 shares during the period. Marshall Wace LLP boosted its holdings in Kimberly-Clark by 48.4% during the second quarter. Marshall Wace LLP now owns 1,545,147 shares of the company's stock worth $213,539,000 after buying an additional 503,839 shares in the last quarter. Dimensional Fund Advisors LP grew its position in Kimberly-Clark by 22.4% during the second quarter. Dimensional Fund Advisors LP now owns 1,934,655 shares of the company's stock valued at $267,383,000 after buying an additional 354,501 shares during the period. Finally, Capital World Investors increased its holdings in Kimberly-Clark by 17.8% in the first quarter. Capital World Investors now owns 2,269,492 shares of the company's stock valued at $293,559,000 after buying an additional 342,790 shares in the last quarter. 76.29% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

KMB has been the topic of a number of analyst reports. Royal Bank of Canada restated an "outperform" rating and set a $165.00 target price on shares of Kimberly-Clark in a research report on Wednesday, October 23rd. JPMorgan Chase & Co. reduced their target price on Kimberly-Clark from $142.00 to $140.00 and set an "underweight" rating for the company in a research note on Wednesday, October 23rd. Argus raised shares of Kimberly-Clark to a "hold" rating in a research note on Friday, July 26th. Wells Fargo & Company reduced their price objective on shares of Kimberly-Clark from $138.00 to $134.00 and set an "equal weight" rating for the company in a research report on Wednesday, July 24th. Finally, Deutsche Bank Aktiengesellschaft lifted their target price on shares of Kimberly-Clark from $146.00 to $147.00 and gave the company a "hold" rating in a research report on Tuesday, October 8th. Two equities research analysts have rated the stock with a sell rating, seven have given a hold rating and seven have issued a buy rating to the company. According to MarketBeat, Kimberly-Clark currently has a consensus rating of "Hold" and a consensus price target of $149.93.

Read Our Latest Analysis on Kimberly-Clark

Kimberly-Clark Trading Up 0.0 %

NYSE:KMB traded up $0.05 during trading hours on Wednesday, hitting $132.19. The company had a trading volume of 1,494,585 shares, compared to its average volume of 2,107,837. Kimberly-Clark Co. has a 1 year low of $117.67 and a 1 year high of $149.30. The company has a current ratio of 0.83, a quick ratio of 0.55 and a debt-to-equity ratio of 4.77. The company has a 50-day moving average of $140.40 and a 200 day moving average of $139.23. The company has a market cap of $44.08 billion, a P/E ratio of 17.20, a P/E/G ratio of 2.78 and a beta of 0.40.

Kimberly-Clark (NYSE:KMB - Get Free Report) last released its quarterly earnings data on Tuesday, October 22nd. The company reported $1.83 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.69 by $0.14. The firm had revenue of $4.95 billion during the quarter, compared to analysts' expectations of $5.06 billion. Kimberly-Clark had a net margin of 12.97% and a return on equity of 198.59%. Kimberly-Clark's revenue was down 3.5% compared to the same quarter last year. During the same period last year, the business earned $1.74 earnings per share. Sell-side analysts expect that Kimberly-Clark Co. will post 7.26 earnings per share for the current year.

Kimberly-Clark Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Shareholders of record on Friday, December 6th will be paid a dividend of $1.22 per share. This represents a $4.88 annualized dividend and a yield of 3.69%. Kimberly-Clark's dividend payout ratio (DPR) is 63.29%.

Kimberly-Clark Company Profile

(

Free Report)

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products in the United States. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The company's Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, reusable underwear, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Thinx, Poise, Depend, Plenitud, Softex, and other brand names.

Recommended Stories

Before you consider Kimberly-Clark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimberly-Clark wasn't on the list.

While Kimberly-Clark currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.