Victory Capital Management Inc. lowered its holdings in shares of Genworth Financial, Inc. (NYSE:GNW - Free Report) by 14.0% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 564,240 shares of the financial services provider's stock after selling 92,198 shares during the period. Victory Capital Management Inc. owned 0.13% of Genworth Financial worth $3,944,000 as of its most recent SEC filing.

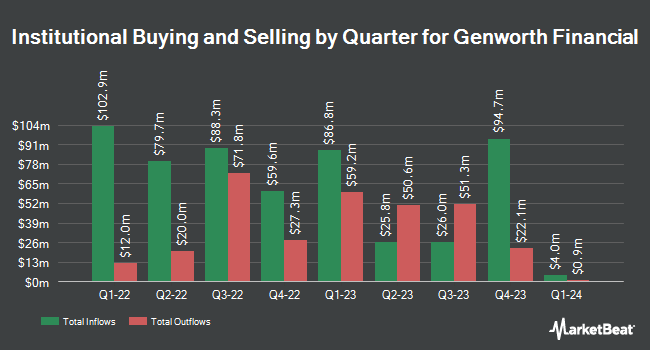

A number of other large investors have also recently bought and sold shares of GNW. Repertoire Partners LP acquired a new stake in shares of Genworth Financial in the 3rd quarter worth $6,850,000. Whitefort Capital Management LP lifted its stake in shares of Genworth Financial by 49.6% in the 3rd quarter. Whitefort Capital Management LP now owns 2,986,960 shares of the financial services provider's stock worth $20,461,000 after acquiring an additional 990,000 shares during the period. FMR LLC lifted its stake in shares of Genworth Financial by 18.7% in the 3rd quarter. FMR LLC now owns 5,675,896 shares of the financial services provider's stock worth $38,880,000 after acquiring an additional 894,053 shares during the period. Verition Fund Management LLC lifted its stake in shares of Genworth Financial by 900.7% in the 3rd quarter. Verition Fund Management LLC now owns 970,185 shares of the financial services provider's stock worth $6,646,000 after acquiring an additional 873,237 shares during the period. Finally, Barclays PLC lifted its stake in shares of Genworth Financial by 291.2% in the 3rd quarter. Barclays PLC now owns 744,853 shares of the financial services provider's stock worth $5,103,000 after acquiring an additional 554,462 shares during the period. Institutional investors and hedge funds own 81.85% of the company's stock.

Genworth Financial Price Performance

Shares of GNW traded up $0.10 during trading hours on Wednesday, reaching $6.90. The company had a trading volume of 3,962,932 shares, compared to its average volume of 3,007,825. The firm has a 50 day simple moving average of $6.94 and a 200-day simple moving average of $7.03. The company has a current ratio of 0.29, a quick ratio of 0.29 and a debt-to-equity ratio of 0.16. The company has a market capitalization of $2.89 billion, a price-to-earnings ratio of 10.14 and a beta of 1.02. Genworth Financial, Inc. has a 12-month low of $5.67 and a 12-month high of $7.90.

Genworth Financial (NYSE:GNW - Get Free Report) last announced its quarterly earnings results on Tuesday, February 18th. The financial services provider reported $0.04 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.18 by ($0.14). The company had revenue of $1.82 billion during the quarter. Genworth Financial had a net margin of 4.10% and a return on equity of 2.96%. During the same period in the previous year, the company earned ($0.51) EPS.

Analyst Ratings Changes

Separately, StockNews.com downgraded shares of Genworth Financial from a "buy" rating to a "hold" rating in a report on Wednesday, November 20th.

Check Out Our Latest Analysis on GNW

Genworth Financial Profile

(

Free Report)

Genworth Financial, Inc, together with its subsidiaries, provides mortgage and long-term care insurance products in the United States and internationally. It operates in three segments: Enact, Long-Term Care Insurance, and Life and Annuities. The Enact segment offers private mortgage insurance products primarily insuring prime-based, individually underwritten residential mortgage loans; and pool mortgage insurance products.

See Also

Before you consider Genworth Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genworth Financial wasn't on the list.

While Genworth Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.