Victory Capital Management Inc. lessened its holdings in Axon Enterprise, Inc. (NASDAQ:AXON - Free Report) by 8.2% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 39,074 shares of the biotechnology company's stock after selling 3,502 shares during the quarter. Victory Capital Management Inc. owned 0.05% of Axon Enterprise worth $15,614,000 at the end of the most recent reporting period.

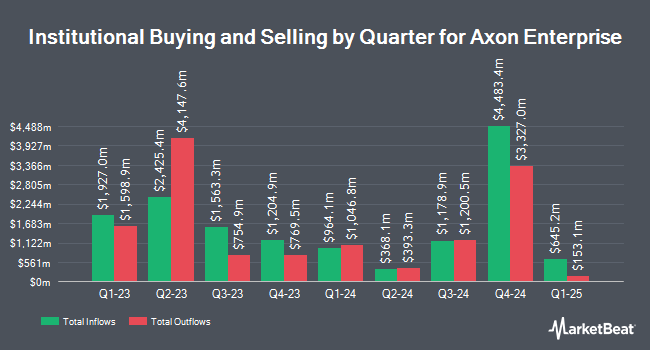

Several other institutional investors have also added to or reduced their stakes in AXON. Quent Capital LLC grew its holdings in Axon Enterprise by 1,875.0% in the third quarter. Quent Capital LLC now owns 79 shares of the biotechnology company's stock valued at $32,000 after purchasing an additional 75 shares during the period. Blue Trust Inc. boosted its stake in shares of Axon Enterprise by 987.5% in the second quarter. Blue Trust Inc. now owns 87 shares of the biotechnology company's stock worth $27,000 after acquiring an additional 79 shares during the last quarter. Friedenthal Financial acquired a new stake in shares of Axon Enterprise in the third quarter worth approximately $51,000. Reston Wealth Management LLC acquired a new stake in shares of Axon Enterprise in the third quarter worth approximately $60,000. Finally, Asset Dedication LLC acquired a new stake in shares of Axon Enterprise in the second quarter worth approximately $47,000. Institutional investors and hedge funds own 79.08% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently issued reports on the company. The Goldman Sachs Group lifted their price target on Axon Enterprise from $385.00 to $441.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Craig Hallum boosted their price objective on Axon Enterprise from $370.00 to $376.00 and gave the stock a "buy" rating in a research note on Wednesday, August 7th. Barclays boosted their price objective on Axon Enterprise from $381.00 to $387.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 7th. Northland Securities boosted their price objective on Axon Enterprise from $365.00 to $550.00 and gave the stock an "outperform" rating in a research note on Monday, November 11th. Finally, JMP Securities boosted their price objective on Axon Enterprise from $430.00 to $500.00 and gave the stock a "market outperform" rating in a research note on Thursday, October 31st. Two research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $427.83.

View Our Latest Stock Analysis on AXON

Axon Enterprise Trading Down 0.1 %

Shares of AXON stock traded down $0.38 during mid-day trading on Wednesday, hitting $609.82. 572,326 shares of the company's stock were exchanged, compared to its average volume of 553,775. Axon Enterprise, Inc. has a fifty-two week low of $224.28 and a fifty-two week high of $624.84. The stock has a 50-day simple moving average of $453.48 and a two-hundred day simple moving average of $363.68. The company has a quick ratio of 2.63, a current ratio of 2.96 and a debt-to-equity ratio of 0.32. The stock has a market cap of $46.50 billion, a price-to-earnings ratio of 157.58, a PEG ratio of 15.05 and a beta of 0.94.

Insider Activity at Axon Enterprise

In related news, Director Julie A. Cullivan sold 900 shares of the business's stock in a transaction that occurred on Thursday, September 5th. The stock was sold at an average price of $353.53, for a total transaction of $318,177.00. Following the transaction, the director now directly owns 3,653 shares of the company's stock, valued at approximately $1,291,445.09. The trade was a 19.77 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, President Joshua Isner sold 25,811 shares of the company's stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $359.84, for a total transaction of $9,287,830.24. Following the completion of the transaction, the president now owns 228,166 shares of the company's stock, valued at $82,103,253.44. This trade represents a 10.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 410,556 shares of company stock worth $161,192,754. 5.70% of the stock is owned by insiders.

Axon Enterprise Profile

(

Free Report)

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Recommended Stories

Before you consider Axon Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axon Enterprise wasn't on the list.

While Axon Enterprise currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.