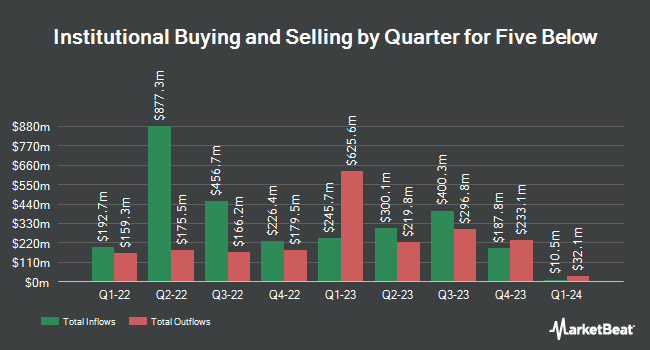

Victory Capital Management Inc. lessened its stake in shares of Five Below, Inc. (NASDAQ:FIVE - Free Report) by 34.5% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 15,522 shares of the specialty retailer's stock after selling 8,190 shares during the period. Victory Capital Management Inc.'s holdings in Five Below were worth $1,371,000 as of its most recent SEC filing.

A number of other institutional investors also recently modified their holdings of FIVE. Janney Montgomery Scott LLC boosted its stake in Five Below by 72.8% during the 3rd quarter. Janney Montgomery Scott LLC now owns 21,815 shares of the specialty retailer's stock valued at $1,927,000 after purchasing an additional 9,188 shares during the period. Cetera Investment Advisers grew its holdings in shares of Five Below by 1,842.1% during the 1st quarter. Cetera Investment Advisers now owns 22,528 shares of the specialty retailer's stock worth $4,086,000 after purchasing an additional 21,368 shares in the last quarter. International Assets Investment Management LLC increased its position in shares of Five Below by 1,379.0% during the third quarter. International Assets Investment Management LLC now owns 16,875 shares of the specialty retailer's stock valued at $1,491,000 after purchasing an additional 15,734 shares during the period. Advisors Asset Management Inc. raised its stake in shares of Five Below by 19.1% in the first quarter. Advisors Asset Management Inc. now owns 2,415 shares of the specialty retailer's stock valued at $438,000 after purchasing an additional 387 shares in the last quarter. Finally, SG Americas Securities LLC bought a new position in Five Below in the third quarter worth $501,000.

Five Below Trading Down 3.0 %

Shares of NASDAQ FIVE traded down $2.71 during midday trading on Tuesday, reaching $88.90. The company's stock had a trading volume of 2,061,232 shares, compared to its average volume of 1,477,313. Five Below, Inc. has a fifty-two week low of $64.87 and a fifty-two week high of $216.18. The stock has a 50 day simple moving average of $91.01 and a 200-day simple moving average of $96.46. The stock has a market capitalization of $4.89 billion, a price-to-earnings ratio of 17.49, a PEG ratio of 0.96 and a beta of 1.20.

Five Below (NASDAQ:FIVE - Get Free Report) last issued its quarterly earnings results on Wednesday, August 28th. The specialty retailer reported $0.54 EPS for the quarter, hitting the consensus estimate of $0.54. Five Below had a net margin of 7.57% and a return on equity of 18.16%. The firm had revenue of $830.07 million for the quarter, compared to analysts' expectations of $821.95 million. As a group, equities analysts anticipate that Five Below, Inc. will post 4.57 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on the stock. Evercore ISI raised their price target on shares of Five Below from $100.00 to $104.00 and gave the stock an "in-line" rating in a research note on Tuesday, October 22nd. Craig Hallum raised their price target on Five Below from $102.00 to $125.00 and gave the company a "buy" rating in a report on Wednesday, October 2nd. JPMorgan Chase & Co. cut shares of Five Below from a "neutral" rating to an "underweight" rating and raised their price objective for the company from $89.00 to $95.00 in a research note on Thursday, September 19th. Citigroup reduced their price objective on shares of Five Below from $92.00 to $85.00 and set a "neutral" rating on the stock in a research note on Wednesday, August 21st. Finally, KeyCorp cut shares of Five Below from an "overweight" rating to a "sector weight" rating in a research report on Thursday, November 7th. Three research analysts have rated the stock with a sell rating, thirteen have assigned a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $106.05.

Read Our Latest Research Report on FIVE

Five Below Company Profile

(

Free Report)

Five Below, Inc operates as a specialty value retailer in the United States. The company offers range of accessories, which includes novelty socks, sunglasses, jewelry, scarves, gloves, hair accessories, athletic tops and bottoms, and t-shirts, as well as nail polish, lip gloss, fragrance, and branded cosmetics; and personalized living space products, such as lamps, posters, frames, fleece blankets, plush items, pillows, candles, incense, lighting, novelty décor, accent furniture, and related items, as well as provides storage options.

See Also

Before you consider Five Below, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Below wasn't on the list.

While Five Below currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.