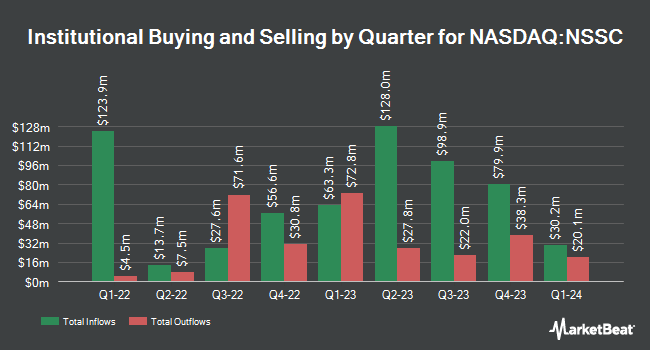

Victory Capital Management Inc. lessened its holdings in Napco Security Technologies, Inc. (NASDAQ:NSSC - Free Report) by 49.9% during the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 35,838 shares of the industrial products company's stock after selling 35,749 shares during the period. Victory Capital Management Inc. owned approximately 0.10% of Napco Security Technologies worth $1,450,000 at the end of the most recent reporting period.

Several other institutional investors also recently modified their holdings of NSSC. First Horizon Advisors Inc. raised its holdings in shares of Napco Security Technologies by 810.3% in the 2nd quarter. First Horizon Advisors Inc. now owns 528 shares of the industrial products company's stock worth $27,000 after purchasing an additional 470 shares during the period. Quarry LP lifted its holdings in Napco Security Technologies by 91.2% during the second quarter. Quarry LP now owns 654 shares of the industrial products company's stock valued at $34,000 after purchasing an additional 312 shares during the last quarter. Farther Finance Advisors LLC boosted its position in Napco Security Technologies by 72,300.0% during the third quarter. Farther Finance Advisors LLC now owns 724 shares of the industrial products company's stock worth $29,000 after purchasing an additional 723 shares during the period. EntryPoint Capital LLC purchased a new position in shares of Napco Security Technologies in the first quarter worth about $46,000. Finally, Bessemer Group Inc. bought a new stake in shares of Napco Security Technologies in the first quarter valued at approximately $63,000. 85.07% of the stock is owned by institutional investors.

Napco Security Technologies Price Performance

NSSC stock traded down $0.04 during midday trading on Tuesday, reaching $40.02. The company had a trading volume of 312,629 shares, compared to its average volume of 454,385. Napco Security Technologies, Inc. has a 1 year low of $28.25 and a 1 year high of $58.09. The firm has a 50-day moving average price of $39.11 and a 200-day moving average price of $46.27. The company has a market capitalization of $1.47 billion, a P/E ratio of 29.04 and a beta of 1.64.

Napco Security Technologies (NASDAQ:NSSC - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The industrial products company reported $0.30 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.35 by ($0.05). The firm had revenue of $44.00 million for the quarter, compared to the consensus estimate of $46.56 million. Napco Security Technologies had a return on equity of 29.56% and a net margin of 26.43%. The company's revenue for the quarter was up 5.5% on a year-over-year basis. During the same period last year, the firm earned $0.28 EPS. On average, equities analysts predict that Napco Security Technologies, Inc. will post 1.49 EPS for the current year.

Napco Security Technologies Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, January 3rd. Shareholders of record on Thursday, December 12th will be paid a dividend of $0.125 per share. This represents a $0.50 annualized dividend and a dividend yield of 1.25%. The ex-dividend date is Thursday, December 12th. Napco Security Technologies's dividend payout ratio (DPR) is presently 36.76%.

Analysts Set New Price Targets

NSSC has been the subject of a number of analyst reports. StockNews.com lowered Napco Security Technologies from a "hold" rating to a "sell" rating in a report on Monday. Craig Hallum reduced their target price on Napco Security Technologies from $65.00 to $48.00 and set a "buy" rating for the company in a report on Tuesday, November 5th. DA Davidson cut their price objective on shares of Napco Security Technologies from $55.00 to $48.00 and set a "buy" rating for the company in a research report on Tuesday, November 5th. Needham & Company LLC boosted their price objective on shares of Napco Security Technologies from $52.00 to $57.00 and gave the company a "buy" rating in a research note on Tuesday, August 27th. Finally, Lake Street Capital lowered their target price on shares of Napco Security Technologies from $60.00 to $41.00 and set a "buy" rating on the stock in a research note on Tuesday, November 5th. One analyst has rated the stock with a sell rating, two have given a hold rating and five have given a buy rating to the stock. According to MarketBeat, Napco Security Technologies currently has an average rating of "Moderate Buy" and a consensus target price of $47.14.

Check Out Our Latest Research Report on Napco Security Technologies

Insider Transactions at Napco Security Technologies

In other news, Director Paul Stephen Beeber sold 708 shares of the business's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $37.12, for a total value of $26,280.96. Following the completion of the sale, the director now owns 2,681 shares of the company's stock, valued at approximately $99,518.72. The trade was a 20.89 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 5.24% of the company's stock.

About Napco Security Technologies

(

Free Report)

Napco Security Technologies, Inc develops, manufactures, and sells electronic security systems for commercial, residential, institutional, industrial, and governmental applications in the United States and internationally. Its access control systems include various types of identification readers, control panels, PC-based computers, and electronically activated door-locking devices; intrusion and fire alarm systems, consists of various detectors, a control panel, a digital keypad and signaling equipment; and door locking devices comprise microprocessor-based electronic door locks with push button, card readers and bio-metric operation, door alarms, mechanical door locks, and simple dead bolt locks.

See Also

Before you consider Napco Security Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Napco Security Technologies wasn't on the list.

While Napco Security Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.