Victory Capital (NASDAQ:VCTR - Free Report) had its price target upped by Morgan Stanley from $64.00 to $66.00 in a research report report published on Friday morning,Benzinga reports. They currently have an equal weight rating on the stock.

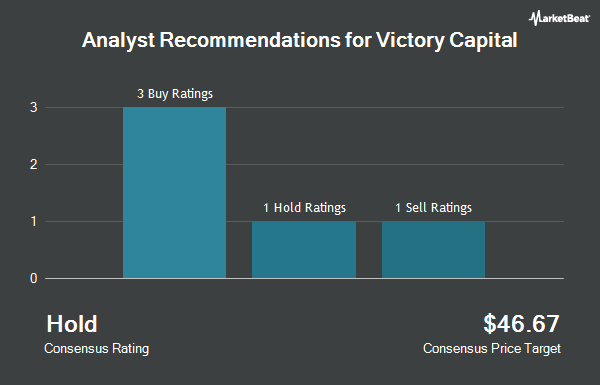

A number of other equities research analysts have also recently commented on the stock. Royal Bank of Canada lifted their price target on shares of Victory Capital from $61.00 to $72.00 and gave the stock an "outperform" rating in a report on Thursday, November 14th. BMO Capital Markets boosted their target price on Victory Capital from $71.00 to $78.00 and gave the company an "outperform" rating in a research note on Thursday. The Goldman Sachs Group increased their price target on Victory Capital from $60.00 to $68.00 and gave the stock a "buy" rating in a research note on Tuesday, November 12th. UBS Group boosted their price objective on Victory Capital from $49.00 to $64.00 and gave the company a "neutral" rating in a research note on Tuesday, October 22nd. Finally, Barclays upped their price objective on shares of Victory Capital from $59.00 to $69.00 and gave the company an "equal weight" rating in a report on Monday, November 11th. Four equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat.com, Victory Capital currently has an average rating of "Moderate Buy" and a consensus target price of $64.67.

View Our Latest Report on VCTR

Victory Capital Stock Performance

VCTR traded up $2.87 during trading on Friday, hitting $65.46. 990,448 shares of the company traded hands, compared to its average volume of 395,993. The firm has a market cap of $4.26 billion, a P/E ratio of 16.28, a price-to-earnings-growth ratio of 0.59 and a beta of 0.89. The company has a quick ratio of 1.19, a current ratio of 1.19 and a debt-to-equity ratio of 0.84. Victory Capital has a one year low of $32.55 and a one year high of $73.42. The stock's fifty day moving average is $64.19 and its 200 day moving average is $55.90.

Victory Capital Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 23rd. Investors of record on Monday, December 9th will be paid a dividend of $0.44 per share. The ex-dividend date of this dividend is Monday, December 9th. This represents a $1.76 annualized dividend and a yield of 2.69%. This is a boost from Victory Capital's previous quarterly dividend of $0.41. Victory Capital's payout ratio is currently 43.78%.

Institutional Trading of Victory Capital

Several institutional investors and hedge funds have recently bought and sold shares of the company. Principal Financial Group Inc. grew its holdings in shares of Victory Capital by 1.5% during the third quarter. Principal Financial Group Inc. now owns 47,626 shares of the company's stock worth $2,638,000 after purchasing an additional 722 shares in the last quarter. Franklin Resources Inc. grew its stake in Victory Capital by 113.2% in the 3rd quarter. Franklin Resources Inc. now owns 1,980,019 shares of the company's stock worth $115,990,000 after buying an additional 1,051,459 shares in the last quarter. World Investment Advisors LLC bought a new position in shares of Victory Capital in the 3rd quarter worth $918,000. Sanctuary Advisors LLC purchased a new stake in shares of Victory Capital during the 3rd quarter valued at $648,000. Finally, McIlrath & Eck LLC bought a new stake in shares of Victory Capital during the 3rd quarter worth $565,000. 87.71% of the stock is currently owned by hedge funds and other institutional investors.

About Victory Capital

(

Get Free Report)

Victory Capital Holdings, Inc, together with its subsidiaries, operates as an asset management company in the United States and internationally. It offers investment advisory, fund administration, fund compliance, fund transfer agent, fund distribution, and other management services. The company provides specialized investment strategies to institutions, intermediaries, retirement platforms, and individual investors.

Further Reading

Before you consider Victory Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Victory Capital wasn't on the list.

While Victory Capital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.