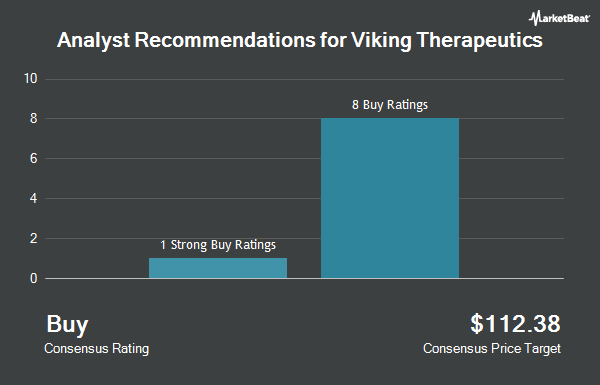

Viking Therapeutics, Inc. (NASDAQ:VKTX - Get Free Report) has earned an average recommendation of "Buy" from the thirteen analysts that are presently covering the firm, Marketbeat Ratings reports. Eleven research analysts have rated the stock with a buy recommendation and two have issued a strong buy recommendation on the company. The average 1 year target price among analysts that have covered the stock in the last year is $106.75.

A number of research analysts recently issued reports on the company. Oppenheimer reiterated an "outperform" rating and issued a $138.00 target price on shares of Viking Therapeutics in a report on Wednesday, September 25th. B. Riley started coverage on Viking Therapeutics in a research note on Friday, November 22nd. They issued a "buy" rating and a $109.00 price objective for the company. William Blair restated an "outperform" rating on shares of Viking Therapeutics in a research note on Wednesday, November 20th. Piper Sandler began coverage on shares of Viking Therapeutics in a report on Monday, December 2nd. They issued an "overweight" rating and a $74.00 target price on the stock. Finally, StockNews.com upgraded shares of Viking Therapeutics to a "sell" rating in a report on Tuesday, October 15th.

Check Out Our Latest Stock Analysis on VKTX

Viking Therapeutics Stock Down 1.8 %

NASDAQ VKTX traded down $0.84 during trading on Friday, hitting $47.03. The stock had a trading volume of 3,244,605 shares, compared to its average volume of 4,438,160. The company has a market capitalization of $5.24 billion, a PE ratio of -50.57 and a beta of 0.88. The firm has a 50 day moving average price of $59.67 and a 200 day moving average price of $58.50. Viking Therapeutics has a twelve month low of $17.23 and a twelve month high of $99.41.

Viking Therapeutics (NASDAQ:VKTX - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The biotechnology company reported ($0.22) earnings per share for the quarter, topping the consensus estimate of ($0.24) by $0.02. During the same quarter in the previous year, the company earned ($0.23) EPS. On average, sell-side analysts anticipate that Viking Therapeutics will post -0.97 earnings per share for the current year.

Insider Transactions at Viking Therapeutics

In other news, Director Lawson Macartney sold 2,000 shares of the stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $68.67, for a total transaction of $137,340.00. Following the completion of the sale, the director now owns 47,965 shares in the company, valued at approximately $3,293,756.55. This represents a 4.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Greg Zante sold 131,687 shares of the business's stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $76.61, for a total value of $10,088,541.07. Following the completion of the transaction, the chief financial officer now owns 149,366 shares in the company, valued at $11,442,929.26. This trade represents a 46.85 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 371,117 shares of company stock worth $27,140,009. Corporate insiders own 4.70% of the company's stock.

Hedge Funds Weigh In On Viking Therapeutics

Hedge funds and other institutional investors have recently bought and sold shares of the company. International Assets Investment Management LLC increased its position in Viking Therapeutics by 10,775.6% during the 3rd quarter. International Assets Investment Management LLC now owns 1,004,033 shares of the biotechnology company's stock worth $63,565,000 after purchasing an additional 994,801 shares during the period. Perpetual Ltd grew its holdings in Viking Therapeutics by 55.4% during the third quarter. Perpetual Ltd now owns 1,269,152 shares of the biotechnology company's stock worth $80,350,000 after acquiring an additional 452,344 shares during the period. Fiera Capital Corp acquired a new stake in Viking Therapeutics in the third quarter valued at $18,443,000. Eventide Asset Management LLC boosted its position in shares of Viking Therapeutics by 79.1% during the 3rd quarter. Eventide Asset Management LLC now owns 452,969 shares of the biotechnology company's stock worth $28,677,000 after purchasing an additional 200,000 shares in the last quarter. Finally, Nepsis Inc. acquired a new position in shares of Viking Therapeutics during the 3rd quarter worth $11,251,000. 76.03% of the stock is currently owned by hedge funds and other institutional investors.

About Viking Therapeutics

(

Get Free ReportViking Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders. The company's lead drug candidate is VK2809, an orally available tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta (TRß), which is in Phase IIb clinical trials to treat patients with biopsy-confirmed non-alcoholic steatohepatitis, as well as NAFLD.

Further Reading

Before you consider Viking Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viking Therapeutics wasn't on the list.

While Viking Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.