Villere ST Denis J & Co. LLC reduced its stake in Caesars Entertainment, Inc. (NASDAQ:CZR - Free Report) by 2.8% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 756,911 shares of the company's stock after selling 21,544 shares during the period. Caesars Entertainment makes up 2.6% of Villere ST Denis J & Co. LLC's portfolio, making the stock its 18th biggest position. Villere ST Denis J & Co. LLC owned approximately 0.36% of Caesars Entertainment worth $31,593,000 as of its most recent filing with the Securities and Exchange Commission.

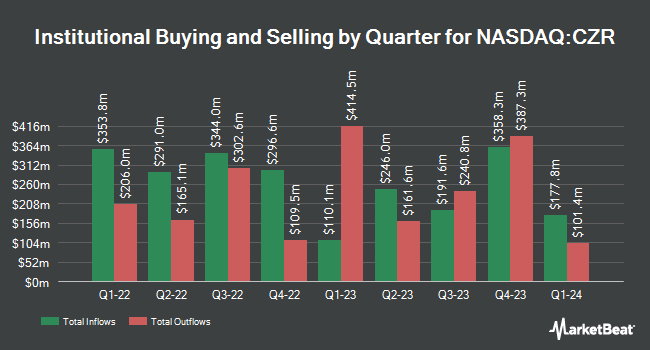

Other institutional investors and hedge funds have also recently modified their holdings of the company. Signaturefd LLC raised its stake in shares of Caesars Entertainment by 9.8% in the third quarter. Signaturefd LLC now owns 2,788 shares of the company's stock worth $116,000 after purchasing an additional 248 shares during the last quarter. American Trust raised its position in Caesars Entertainment by 4.5% in the 1st quarter. American Trust now owns 7,346 shares of the company's stock worth $321,000 after buying an additional 313 shares during the last quarter. Private Advisor Group LLC lifted its stake in Caesars Entertainment by 3.0% during the 3rd quarter. Private Advisor Group LLC now owns 10,850 shares of the company's stock valued at $453,000 after acquiring an additional 317 shares during the period. GAMMA Investing LLC boosted its holdings in shares of Caesars Entertainment by 25.1% during the 3rd quarter. GAMMA Investing LLC now owns 2,010 shares of the company's stock valued at $84,000 after acquiring an additional 403 shares during the last quarter. Finally, Fiduciary Family Office LLC grew its stake in shares of Caesars Entertainment by 1.7% in the third quarter. Fiduciary Family Office LLC now owns 25,215 shares of the company's stock worth $1,052,000 after acquiring an additional 424 shares during the period. 91.79% of the stock is currently owned by institutional investors.

Caesars Entertainment Price Performance

Shares of CZR stock traded down $0.27 on Friday, hitting $40.84. 2,597,385 shares of the stock traded hands, compared to its average volume of 3,718,735. The company has a debt-to-equity ratio of 2.84, a current ratio of 0.84 and a quick ratio of 0.82. Caesars Entertainment, Inc. has a 52 week low of $31.74 and a 52 week high of $50.51. The firm has a 50 day simple moving average of $41.37 and a two-hundred day simple moving average of $38.23. The firm has a market cap of $8.68 billion, a price-to-earnings ratio of -24.45 and a beta of 2.96.

Caesars Entertainment (NASDAQ:CZR - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The company reported ($0.04) EPS for the quarter, missing analysts' consensus estimates of $0.21 by ($0.25). The business had revenue of $2.87 billion for the quarter, compared to the consensus estimate of $2.93 billion. Caesars Entertainment had a negative net margin of 3.20% and a negative return on equity of 4.44%. Caesars Entertainment's revenue was down 4.0% compared to the same quarter last year. During the same period in the prior year, the business earned $0.34 earnings per share. As a group, equities research analysts predict that Caesars Entertainment, Inc. will post -0.54 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on the stock. Jefferies Financial Group dropped their target price on shares of Caesars Entertainment from $62.00 to $60.00 and set a "buy" rating on the stock in a report on Wednesday, July 31st. Stifel Nicolaus raised their price target on Caesars Entertainment from $56.00 to $58.00 and gave the stock a "buy" rating in a research note on Wednesday, October 9th. Susquehanna reiterated a "negative" rating and set a $33.00 price objective on shares of Caesars Entertainment in a research report on Wednesday, July 31st. StockNews.com raised Caesars Entertainment from a "sell" rating to a "hold" rating in a report on Thursday, October 31st. Finally, JMP Securities restated a "market outperform" rating and set a $59.00 price target on shares of Caesars Entertainment in a research note on Monday, October 14th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, Caesars Entertainment has a consensus rating of "Moderate Buy" and an average target price of $54.00.

Read Our Latest Research Report on CZR

About Caesars Entertainment

(

Free Report)

Caesars Entertainment, Inc operates as a gaming and hospitality company. The company owns, leases, or manages domestic properties in 18 states with slot machines, video lottery terminals and e-tables, and hotel rooms, as well as table games, including poker. It also operates and conducts retail and online sports wagering across 31 jurisdictions in North America and operates iGaming in five jurisdictions in North America; sports betting from our retail and online sportsbooks; and other games, such as keno.

Further Reading

Before you consider Caesars Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caesars Entertainment wasn't on the list.

While Caesars Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.