Vinva Investment Management Ltd decreased its stake in shares of Zoom Video Communications, Inc. (NASDAQ:ZM - Free Report) by 10.1% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 76,288 shares of the company's stock after selling 8,530 shares during the period. Vinva Investment Management Ltd's holdings in Zoom Video Communications were worth $5,306,000 as of its most recent SEC filing.

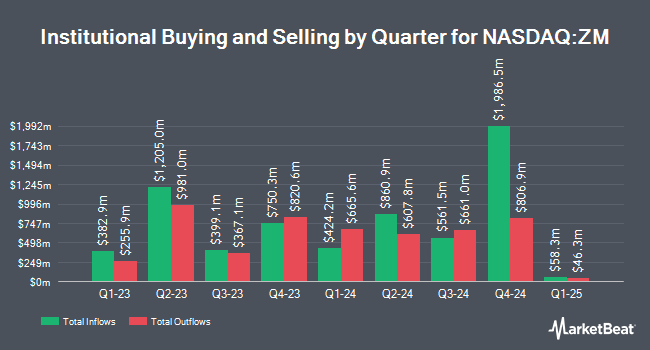

Other large investors have also recently modified their holdings of the company. Jacobs Levy Equity Management Inc. bought a new stake in Zoom Video Communications during the first quarter worth about $260,000. California State Teachers Retirement System boosted its stake in Zoom Video Communications by 1.7% during the first quarter. California State Teachers Retirement System now owns 396,209 shares of the company's stock worth $25,900,000 after acquiring an additional 6,630 shares in the last quarter. Tidal Investments LLC boosted its stake in Zoom Video Communications by 89.7% during the first quarter. Tidal Investments LLC now owns 34,352 shares of the company's stock worth $2,246,000 after acquiring an additional 16,248 shares in the last quarter. Comerica Bank boosted its stake in Zoom Video Communications by 15.6% during the first quarter. Comerica Bank now owns 4,966 shares of the company's stock worth $325,000 after acquiring an additional 670 shares in the last quarter. Finally, iA Global Asset Management Inc. boosted its stake in Zoom Video Communications by 27.3% during the first quarter. iA Global Asset Management Inc. now owns 4,060 shares of the company's stock worth $265,000 after acquiring an additional 870 shares in the last quarter. Institutional investors own 66.54% of the company's stock.

Analyst Upgrades and Downgrades

ZM has been the topic of several research reports. Robert W. Baird dropped their price objective on shares of Zoom Video Communications from $84.00 to $77.00 and set an "outperform" rating on the stock in a research note on Thursday, August 22nd. Wells Fargo & Company boosted their price objective on shares of Zoom Video Communications from $60.00 to $70.00 and gave the stock an "underweight" rating in a research note on Tuesday. Royal Bank of Canada reiterated an "outperform" rating and issued a $95.00 target price on shares of Zoom Video Communications in a research note on Tuesday. Deutsche Bank Aktiengesellschaft upped their target price on shares of Zoom Video Communications from $71.00 to $75.00 and gave the stock a "hold" rating in a research note on Friday, August 23rd. Finally, Benchmark upped their target price on shares of Zoom Video Communications from $85.00 to $97.00 and gave the stock a "buy" rating in a research note on Tuesday. Two analysts have rated the stock with a sell rating, fifteen have assigned a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat, Zoom Video Communications has an average rating of "Hold" and an average target price of $85.19.

Read Our Latest Research Report on Zoom Video Communications

Insider Buying and Selling at Zoom Video Communications

In other Zoom Video Communications news, COO Aparna Bawa sold 880 shares of the company's stock in a transaction that occurred on Thursday, September 5th. The shares were sold at an average price of $68.09, for a total value of $59,919.20. Following the completion of the transaction, the chief operating officer now directly owns 2,809 shares in the company, valued at $191,264.81. This represents a 23.85 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Eric S. Yuan sold 178,571 shares of the company's stock in a transaction that occurred on Tuesday, November 5th. The stock was sold at an average price of $76.91, for a total transaction of $13,733,895.61. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 367,108 shares of company stock valued at $26,796,191. Insiders own 10.78% of the company's stock.

Zoom Video Communications Trading Down 3.1 %

ZM stock traded down $2.67 during midday trading on Friday, reaching $82.69. 3,233,858 shares of the company's stock traded hands, compared to its average volume of 3,355,966. Zoom Video Communications, Inc. has a 52-week low of $55.06 and a 52-week high of $92.80. The stock has a market cap of $25.45 billion, a P/E ratio of 27.56, a PEG ratio of 5.69 and a beta of -0.05. The stock's 50-day moving average is $75.22 and its 200 day moving average is $66.30.

About Zoom Video Communications

(

Free Report)

Zoom Video Communications, Inc provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

Further Reading

Before you consider Zoom Video Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoom Video Communications wasn't on the list.

While Zoom Video Communications currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.