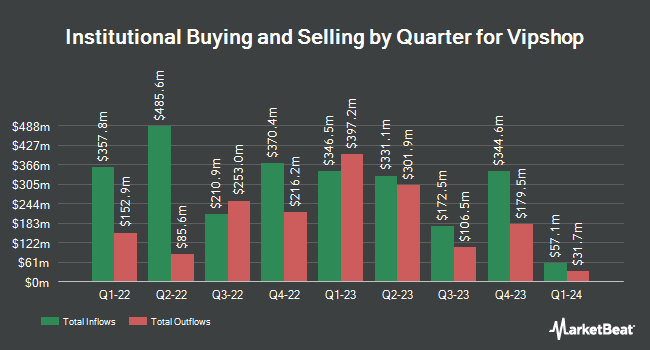

Royal London Asset Management Ltd. cut its holdings in Vipshop Holdings Limited (NYSE:VIPS - Free Report) by 42.3% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 323,200 shares of the technology company's stock after selling 236,500 shares during the period. Royal London Asset Management Ltd. owned 0.06% of Vipshop worth $4,354,000 as of its most recent filing with the SEC.

Several other large investors have also made changes to their positions in VIPS. Vinva Investment Management Ltd lifted its holdings in shares of Vipshop by 23.0% during the fourth quarter. Vinva Investment Management Ltd now owns 23,952 shares of the technology company's stock worth $318,000 after buying an additional 4,472 shares during the last quarter. Catalyst Funds Management Pty Ltd acquired a new stake in Vipshop during the fourth quarter worth about $1,577,000. Skandinaviska Enskilda Banken AB publ grew its position in Vipshop by 12.2% during the fourth quarter. Skandinaviska Enskilda Banken AB publ now owns 70,114 shares of the technology company's stock worth $931,000 after buying an additional 7,606 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. increased its stake in Vipshop by 32.0% during the fourth quarter. Connor Clark & Lunn Investment Management Ltd. now owns 1,119,045 shares of the technology company's stock valued at $15,074,000 after acquiring an additional 270,986 shares during the period. Finally, Daiwa Securities Group Inc. raised its holdings in Vipshop by 5.7% in the 4th quarter. Daiwa Securities Group Inc. now owns 25,900 shares of the technology company's stock valued at $349,000 after acquiring an additional 1,400 shares in the last quarter. Institutional investors and hedge funds own 48.82% of the company's stock.

Analyst Ratings Changes

VIPS has been the topic of a number of research reports. StockNews.com upgraded Vipshop from a "hold" rating to a "buy" rating in a research report on Friday, February 21st. Barclays increased their price objective on shares of Vipshop from $19.00 to $20.00 and gave the company an "overweight" rating in a research note on Tuesday, February 25th. Five analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $15.75.

Get Our Latest Research Report on VIPS

Vipshop Stock Performance

Shares of NYSE:VIPS traded up $0.18 on Thursday, hitting $16.51. The stock had a trading volume of 1,616,444 shares, compared to its average volume of 3,727,737. The company has a market capitalization of $8.47 billion, a price-to-earnings ratio of 7.90, a price-to-earnings-growth ratio of 1.52 and a beta of 0.30. Vipshop Holdings Limited has a twelve month low of $11.50 and a twelve month high of $17.94. The firm's 50 day moving average price is $15.39 and its 200-day moving average price is $14.53.

Vipshop (NYSE:VIPS - Get Free Report) last released its quarterly earnings results on Wednesday, February 26th. The technology company reported $0.65 EPS for the quarter, missing analysts' consensus estimates of $0.70 by ($0.05). The business had revenue of $4.55 billion for the quarter, compared to the consensus estimate of $3.82 billion. Vipshop had a return on equity of 20.89% and a net margin of 7.50%. As a group, sell-side analysts predict that Vipshop Holdings Limited will post 1.95 EPS for the current year.

Vipshop Dividend Announcement

The business also recently announced an annual dividend, which will be paid on Friday, April 25th. Stockholders of record on Friday, April 11th will be given a dividend of $0.43 per share. The ex-dividend date is Friday, April 11th. This represents a dividend yield of 2.9%. Vipshop's payout ratio is 24.24%.

About Vipshop

(

Free Report)

Vipshop Holdings Limited operates online platforms in the People's Republic of China. It operates in Vip.com, Shan Shan Outlets, and Others segments. The company offers womenswear, menswear, sportswear and sporting goods, shoes and bags, accessories, baby and children products, skincare and cosmetics, home goods and other lifestyle products, and supermarket products.

Featured Articles

Before you consider Vipshop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vipshop wasn't on the list.

While Vipshop currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.