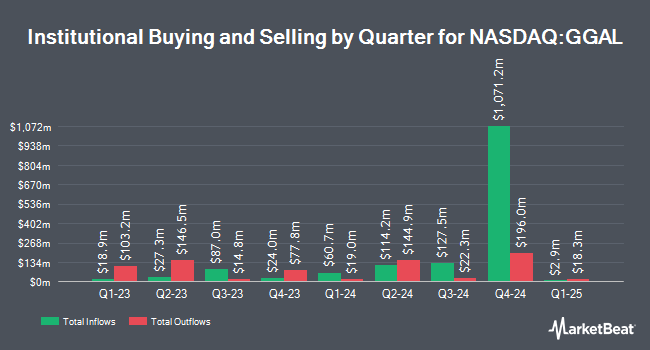

Virtu Financial LLC lifted its holdings in shares of Grupo Financiero Galicia S.A. (NASDAQ:GGAL - Free Report) by 86.5% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 17,331 shares of the bank's stock after purchasing an additional 8,036 shares during the quarter. Virtu Financial LLC's holdings in Grupo Financiero Galicia were worth $1,080,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also modified their holdings of GGAL. R Squared Ltd bought a new position in Grupo Financiero Galicia during the fourth quarter valued at about $27,000. Mirae Asset Global Investments Co. Ltd. increased its holdings in shares of Grupo Financiero Galicia by 41.3% during the 4th quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,134 shares of the bank's stock valued at $136,000 after acquiring an additional 624 shares during the last quarter. Blue Trust Inc. raised its stake in shares of Grupo Financiero Galicia by 78.8% in the 4th quarter. Blue Trust Inc. now owns 2,536 shares of the bank's stock valued at $158,000 after acquiring an additional 1,118 shares in the last quarter. Empowered Funds LLC acquired a new stake in Grupo Financiero Galicia in the 4th quarter worth approximately $167,000. Finally, Burns Matteson Capital Management LLC bought a new stake in Grupo Financiero Galicia during the fourth quarter worth approximately $216,000.

Analyst Ratings Changes

Separately, Morgan Stanley raised shares of Grupo Financiero Galicia from an "underweight" rating to an "overweight" rating and set a $92.00 price target on the stock in a research report on Monday, December 16th. One equities research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $59.00.

Read Our Latest Stock Analysis on Grupo Financiero Galicia

Grupo Financiero Galicia Stock Performance

NASDAQ:GGAL traded down $1.36 during mid-day trading on Thursday, hitting $56.42. 1,383,859 shares of the company's stock traded hands, compared to its average volume of 1,039,116. The firm has a market capitalization of $8.32 billion, a price-to-earnings ratio of 8.31 and a beta of 1.85. The firm has a 50 day moving average of $61.07 and a two-hundred day moving average of $57.16. The company has a current ratio of 1.11, a quick ratio of 1.11 and a debt-to-equity ratio of 0.10. Grupo Financiero Galicia S.A. has a 12 month low of $23.53 and a 12 month high of $74.00.

Grupo Financiero Galicia Company Profile

(

Free Report)

Grupo Financiero Galicia SA, a financial service holding company, provides various financial products and services to individuals and companies in Argentina. The company operates through Banks, NaranjaX, Insurance, and Other Businesses segments. It also offers personal loans; express and mortgage loans; pledge and credit card loans; credit and debit cards; and online banking services, as well as savings, deposits, and checking accounts related services.

See Also

Before you consider Grupo Financiero Galicia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grupo Financiero Galicia wasn't on the list.

While Grupo Financiero Galicia currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.