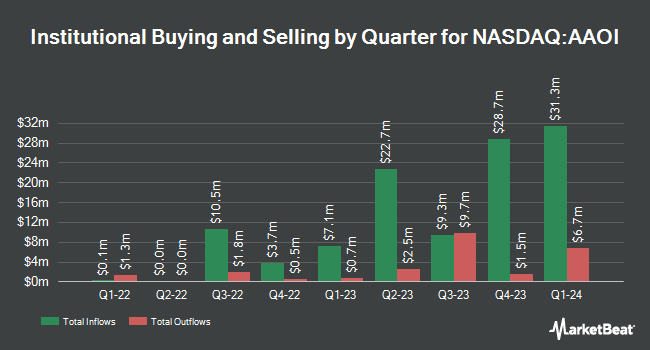

Virtu Financial LLC bought a new stake in Applied Optoelectronics, Inc. (NASDAQ:AAOI - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 24,634 shares of the semiconductor company's stock, valued at approximately $353,000. Virtu Financial LLC owned about 0.05% of Applied Optoelectronics at the end of the most recent quarter.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Westfield Capital Management Co. LP acquired a new position in shares of Applied Optoelectronics in the third quarter valued at approximately $19,019,000. Whale Rock Capital Management LLC purchased a new stake in Applied Optoelectronics in the 3rd quarter worth approximately $16,145,000. Shellback Capital LP acquired a new position in Applied Optoelectronics in the 2nd quarter valued at $8,617,000. Royce & Associates LP lifted its stake in shares of Applied Optoelectronics by 47.7% during the 3rd quarter. Royce & Associates LP now owns 1,596,545 shares of the semiconductor company's stock worth $22,847,000 after purchasing an additional 515,489 shares during the period. Finally, JAT Capital Mgmt LP acquired a new stake in shares of Applied Optoelectronics during the third quarter worth $6,470,000. 61.72% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research firms recently commented on AAOI. Rosenblatt Securities upped their target price on Applied Optoelectronics from $27.50 to $44.00 and gave the company a "buy" rating in a research note on Friday. StockNews.com raised shares of Applied Optoelectronics to a "sell" rating in a research note on Friday, October 25th. Northland Securities increased their price objective on shares of Applied Optoelectronics from $18.00 to $25.00 and gave the stock an "outperform" rating in a report on Friday, November 8th. Raymond James boosted their target price on shares of Applied Optoelectronics from $17.00 to $23.00 and gave the company an "outperform" rating in a report on Friday, November 8th. Finally, B. Riley downgraded shares of Applied Optoelectronics from a "neutral" rating to a "sell" rating and set a $14.00 price target on the stock. in a research note on Tuesday, December 10th. Two research analysts have rated the stock with a sell rating, one has issued a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $23.00.

Read Our Latest Stock Report on AAOI

Applied Optoelectronics Trading Down 8.5 %

Shares of NASDAQ:AAOI traded down $2.98 during trading on Tuesday, reaching $32.11. 3,133,577 shares of the stock were exchanged, compared to its average volume of 2,738,017. The firm's 50-day moving average price is $26.76 and its 200 day moving average price is $16.22. The firm has a market cap of $1.45 billion, a price-to-earnings ratio of -15.59 and a beta of 2.37. Applied Optoelectronics, Inc. has a 12-month low of $6.70 and a 12-month high of $44.50. The company has a debt-to-equity ratio of 0.36, a quick ratio of 1.06 and a current ratio of 1.61.

Insider Transactions at Applied Optoelectronics

In other news, insider Hung-Lun (Fred) Chang sold 20,323 shares of the stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $30.35, for a total value of $616,803.05. Following the completion of the sale, the insider now owns 195,572 shares in the company, valued at approximately $5,935,610.20. This trade represents a 9.41 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, insider David C. Kuo sold 10,000 shares of the firm's stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $26.93, for a total value of $269,300.00. Following the sale, the insider now owns 118,122 shares in the company, valued at approximately $3,181,025.46. The trade was a 7.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 86,769 shares of company stock valued at $2,813,037 over the last 90 days. Corporate insiders own 5.40% of the company's stock.

About Applied Optoelectronics

(

Free Report)

Applied Optoelectronics, Inc designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China. It offers optical modules, optical filters, lasers, laser components, subassemblies, transmitters and transceivers, turn-key equipment, headend, node, distribution equipment, and amplifiers.

Featured Stories

Before you consider Applied Optoelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Optoelectronics wasn't on the list.

While Applied Optoelectronics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.