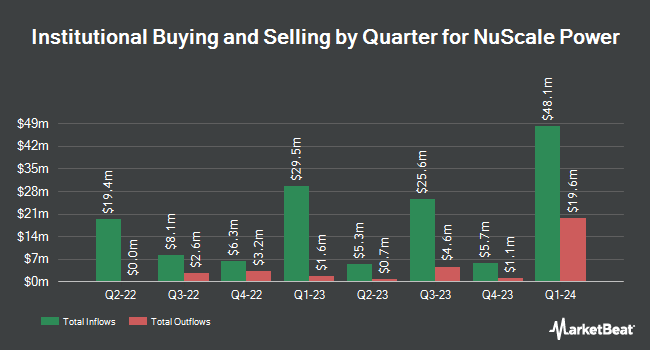

Virtu Financial LLC bought a new stake in shares of NuScale Power Co. (NYSE:SMR - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm bought 54,981 shares of the company's stock, valued at approximately $986,000.

Several other institutional investors and hedge funds have also modified their holdings of SMR. Teacher Retirement System of Texas acquired a new stake in NuScale Power during the fourth quarter valued at $674,000. Privium Fund Management B.V. purchased a new stake in shares of NuScale Power during the 4th quarter worth about $6,455,000. Fox Hill Wealth Management lifted its holdings in shares of NuScale Power by 31.2% during the 4th quarter. Fox Hill Wealth Management now owns 89,007 shares of the company's stock valued at $1,596,000 after buying an additional 21,146 shares during the last quarter. Horizon Kinetics Asset Management LLC bought a new stake in shares of NuScale Power in the 4th quarter valued at approximately $243,000. Finally, Twin Tree Management LP acquired a new position in NuScale Power in the fourth quarter worth approximately $42,000. 78.37% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Separately, UBS Group reduced their target price on shares of NuScale Power from $25.00 to $17.00 and set a "neutral" rating for the company in a research note on Friday, March 7th.

Get Our Latest Stock Analysis on SMR

NuScale Power Stock Down 5.8 %

Shares of NYSE SMR traded down $0.99 during mid-day trading on Thursday, reaching $16.13. 5,501,721 shares of the company traded hands, compared to its average volume of 8,174,385. The company's fifty day moving average is $20.60 and its two-hundred day moving average is $19.45. The company has a debt-to-equity ratio of 0.26, a quick ratio of 2.24 and a current ratio of 2.24. NuScale Power Co. has a fifty-two week low of $0.13 and a fifty-two week high of $32.30. The stock has a market cap of $4.56 billion, a PE ratio of -16.98 and a beta of 1.58.

Insider Activity

In other NuScale Power news, VP Jacqueline F. Engel sold 24,618 shares of the company's stock in a transaction that occurred on Tuesday, March 4th. The stock was sold at an average price of $14.52, for a total value of $357,453.36. Following the completion of the transaction, the vice president now owns 1,149 shares of the company's stock, valued at $16,683.48. This represents a 95.54 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, CFO Robert Ramsey Hamady sold 31,496 shares of NuScale Power stock in a transaction that occurred on Friday, March 7th. The stock was sold at an average price of $15.70, for a total value of $494,487.20. Following the sale, the chief financial officer now directly owns 29,985 shares in the company, valued at $470,764.50. The trade was a 51.23 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 720,682 shares of company stock valued at $12,840,747 over the last 90 days. 1.96% of the stock is currently owned by company insiders.

NuScale Power Company Profile

(

Free Report)

NuScale Power Corporation engages in the development and sale of modular light water reactor nuclear power plants to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications. It offers NuScale Power Module (NPM), a water reactor that can generate 77 megawatts of electricity (MWe); and VOYGR power plant designs for three facility sizes that are capable of housing from one to four and six or twelve NPMs.

See Also

Before you consider NuScale Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NuScale Power wasn't on the list.

While NuScale Power currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.