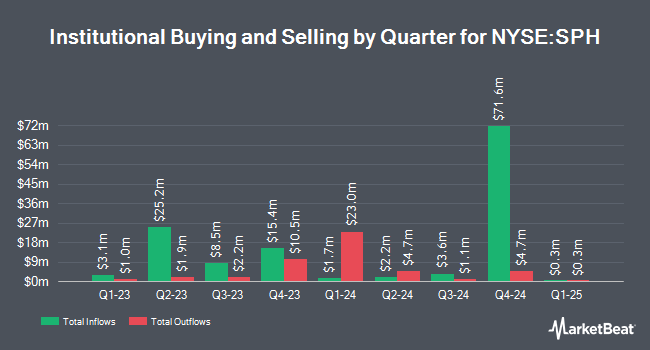

Virtu Financial LLC purchased a new stake in shares of Suburban Propane Partners, L.P. (NYSE:SPH - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 12,612 shares of the energy company's stock, valued at approximately $217,000.

A number of other hedge funds also recently added to or reduced their stakes in SPH. Cetera Trust Company N.A purchased a new position in shares of Suburban Propane Partners in the fourth quarter worth $28,000. Wingate Wealth Advisors Inc. purchased a new position in Suburban Propane Partners in the 4th quarter worth about $31,000. Duncker Streett & Co. Inc. bought a new position in Suburban Propane Partners during the 4th quarter valued at about $34,000. Vision Financial Markets LLC purchased a new stake in shares of Suburban Propane Partners during the 4th quarter valued at about $34,000. Finally, Tandem Financial LLC bought a new stake in shares of Suburban Propane Partners in the fourth quarter worth approximately $39,000. 30.94% of the stock is currently owned by hedge funds and other institutional investors.

Suburban Propane Partners Stock Performance

Suburban Propane Partners stock traded up $0.27 during midday trading on Tuesday, reaching $21.28. 33,721 shares of the company traded hands, compared to its average volume of 200,514. The company has a debt-to-equity ratio of 2.39, a current ratio of 0.70 and a quick ratio of 0.51. Suburban Propane Partners, L.P. has a 12 month low of $15.20 and a 12 month high of $22.24. The firm has a market capitalization of $1.37 billion, a price-to-earnings ratio of 20.07 and a beta of 0.46. The business has a 50 day moving average of $20.83 and a two-hundred day moving average of $19.20.

Suburban Propane Partners (NYSE:SPH - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The energy company reported $0.30 EPS for the quarter, missing the consensus estimate of $0.76 by ($0.46). Suburban Propane Partners had a return on equity of 11.81% and a net margin of 5.18%. During the same period in the prior year, the business posted $0.38 earnings per share.

Suburban Propane Partners Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, February 11th. Investors of record on Tuesday, February 4th were issued a $0.325 dividend. This represents a $1.30 dividend on an annualized basis and a dividend yield of 6.11%. The ex-dividend date of this dividend was Tuesday, February 4th. Suburban Propane Partners's payout ratio is 122.64%.

Insider Activity at Suburban Propane Partners

In other news, SVP Douglas Brinkworth sold 2,000 shares of Suburban Propane Partners stock in a transaction dated Wednesday, March 12th. The stock was sold at an average price of $20.50, for a total transaction of $41,000.00. Following the transaction, the senior vice president now directly owns 159,355 shares of the company's stock, valued at $3,266,777.50. The trade was a 1.24 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP Michael A. Schueler sold 7,746 shares of the firm's stock in a transaction that occurred on Tuesday, February 11th. The stock was sold at an average price of $20.93, for a total transaction of $162,123.78. Following the sale, the vice president now owns 11,133 shares in the company, valued at approximately $233,013.69. The trade was a 41.03 % decrease in their position. The disclosure for this sale can be found here. 1.30% of the stock is currently owned by company insiders.

Suburban Propane Partners Profile

(

Free Report)

Suburban Propane Partners, L.P., through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, fuel oil, and refined fuels in the United States. The company operates through four segments: Propane, Fuel Oil and Refined Fuels, Natural Gas and Electricity, and All Other.

See Also

Before you consider Suburban Propane Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suburban Propane Partners wasn't on the list.

While Suburban Propane Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.