Virtu Financial LLC boosted its stake in shares of MakeMyTrip Limited (NASDAQ:MMYT - Free Report) by 338.3% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 11,593 shares of the technology company's stock after acquiring an additional 8,948 shares during the period. Virtu Financial LLC's holdings in MakeMyTrip were worth $1,078,000 at the end of the most recent reporting period.

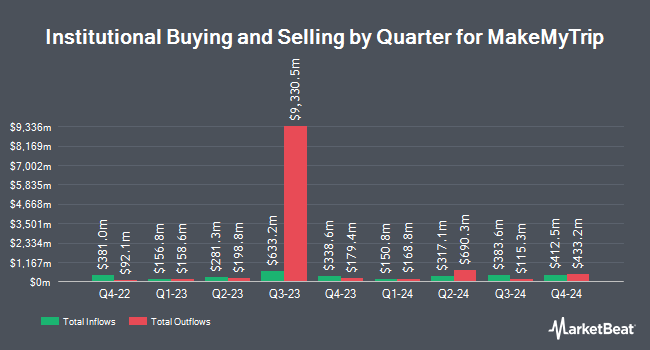

A number of other institutional investors have also recently modified their holdings of the stock. Baillie Gifford & Co. lifted its position in MakeMyTrip by 85.7% during the second quarter. Baillie Gifford & Co. now owns 4,072,452 shares of the technology company's stock worth $342,493,000 after purchasing an additional 1,879,726 shares during the period. Jennison Associates LLC raised its position in shares of MakeMyTrip by 282.4% in the 3rd quarter. Jennison Associates LLC now owns 2,316,572 shares of the technology company's stock valued at $215,325,000 after buying an additional 1,710,773 shares in the last quarter. FMR LLC lifted its holdings in shares of MakeMyTrip by 51.2% during the 3rd quarter. FMR LLC now owns 3,635,473 shares of the technology company's stock worth $337,917,000 after acquiring an additional 1,230,916 shares during the period. Marshall Wace LLP boosted its position in shares of MakeMyTrip by 129.2% during the 2nd quarter. Marshall Wace LLP now owns 956,172 shares of the technology company's stock worth $80,414,000 after acquiring an additional 539,067 shares in the last quarter. Finally, Wasatch Advisors LP bought a new position in MakeMyTrip in the third quarter valued at approximately $44,521,000. 51.89% of the stock is currently owned by institutional investors.

MakeMyTrip Price Performance

MakeMyTrip stock traded down $0.33 during mid-day trading on Friday, reaching $117.17. The company had a trading volume of 345,371 shares, compared to its average volume of 710,085. The business has a fifty day simple moving average of $106.93 and a 200 day simple moving average of $96.16. The company has a market cap of $12.86 billion, a P/E ratio of 64.03, a P/E/G ratio of 6.74 and a beta of 1.27. MakeMyTrip Limited has a fifty-two week low of $43.31 and a fifty-two week high of $123.00. The company has a current ratio of 2.82, a quick ratio of 2.81 and a debt-to-equity ratio of 0.19.

MakeMyTrip (NASDAQ:MMYT - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The technology company reported $0.36 earnings per share for the quarter, beating the consensus estimate of $0.26 by $0.10. The company had revenue of $210.99 million for the quarter, compared to the consensus estimate of $214.90 million. MakeMyTrip had a return on equity of 11.54% and a net margin of 26.64%. During the same quarter last year, the business posted $0.18 EPS. On average, equities research analysts predict that MakeMyTrip Limited will post 1.29 earnings per share for the current year.

Analysts Set New Price Targets

Several research firms have weighed in on MMYT. Bank of America upped their target price on MakeMyTrip from $112.00 to $119.00 and gave the stock a "buy" rating in a research note on Thursday, October 24th. StockNews.com lowered MakeMyTrip from a "hold" rating to a "sell" rating in a research note on Wednesday, November 20th.

Check Out Our Latest Report on MakeMyTrip

MakeMyTrip Profile

(

Free Report)

MakeMyTrip Limited, an online travel company, sells travel products and solutions in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, and Indonesia. The company operates through three segments: Air Ticketing, Hotels and Packages, and Bus Ticketing.

See Also

Before you consider MakeMyTrip, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MakeMyTrip wasn't on the list.

While MakeMyTrip currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.