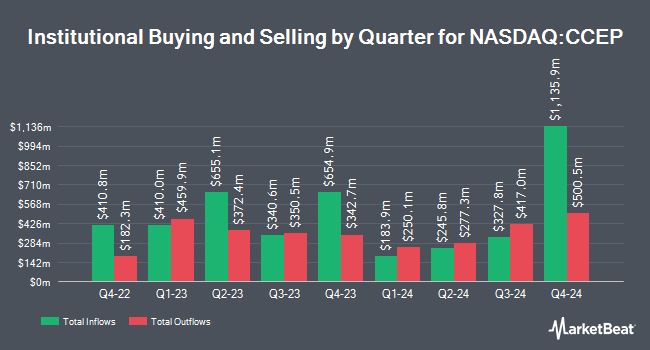

Virtu Financial LLC raised its position in Coca-Cola Europacific Partners PLC (NASDAQ:CCEP - Free Report) by 133.7% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 15,139 shares of the company's stock after purchasing an additional 8,661 shares during the quarter. Virtu Financial LLC's holdings in Coca-Cola Europacific Partners were worth $1,192,000 at the end of the most recent quarter.

Other hedge funds also recently bought and sold shares of the company. Geode Capital Management LLC increased its stake in shares of Coca-Cola Europacific Partners by 2.9% during the 3rd quarter. Geode Capital Management LLC now owns 2,048,176 shares of the company's stock worth $160,138,000 after purchasing an additional 58,247 shares during the last quarter. Public Employees Retirement System of Ohio bought a new stake in Coca-Cola Europacific Partners in the third quarter worth $3,750,000. Nomura Asset Management Co. Ltd. boosted its holdings in Coca-Cola Europacific Partners by 4.3% in the third quarter. Nomura Asset Management Co. Ltd. now owns 76,449 shares of the company's stock worth $6,020,000 after purchasing an additional 3,131 shares in the last quarter. Y Intercept Hong Kong Ltd acquired a new position in Coca-Cola Europacific Partners during the third quarter worth $618,000. Finally, MML Investors Services LLC raised its holdings in Coca-Cola Europacific Partners by 6.4% during the third quarter. MML Investors Services LLC now owns 6,390 shares of the company's stock valued at $503,000 after buying an additional 384 shares in the last quarter. 31.35% of the stock is owned by institutional investors and hedge funds.

Coca-Cola Europacific Partners Stock Performance

NASDAQ CCEP traded down $0.25 during midday trading on Friday, hitting $78.86. The company had a trading volume of 988,995 shares, compared to its average volume of 1,406,710. The firm has a fifty day simple moving average of $77.46 and a two-hundred day simple moving average of $76.50. The company has a debt-to-equity ratio of 1.12, a quick ratio of 0.63 and a current ratio of 0.85. Coca-Cola Europacific Partners PLC has a fifty-two week low of $63.80 and a fifty-two week high of $82.32.

Coca-Cola Europacific Partners Increases Dividend

The company also recently declared a semi-annual dividend, which was paid on Tuesday, December 3rd. Investors of record on Friday, November 15th were paid a dividend of $1.34 per share. This represents a yield of 2.6%. This is a positive change from Coca-Cola Europacific Partners's previous semi-annual dividend of $0.79. The ex-dividend date was Friday, November 15th.

Wall Street Analyst Weigh In

Several research firms have recently issued reports on CCEP. JPMorgan Chase & Co. downgraded Coca-Cola Europacific Partners from an "overweight" rating to a "neutral" rating and decreased their price target for the stock from $85.00 to $82.00 in a research note on Wednesday, November 27th. Deutsche Bank Aktiengesellschaft increased their price target on Coca-Cola Europacific Partners from $78.00 to $90.00 and gave the company a "buy" rating in a report on Monday, September 9th. Citigroup upgraded shares of Coca-Cola Europacific Partners to a "strong-buy" rating in a research note on Thursday, October 3rd. Morgan Stanley raised shares of Coca-Cola Europacific Partners from an "equal weight" rating to an "overweight" rating in a report on Monday, December 9th. Finally, Evercore ISI lifted their target price on shares of Coca-Cola Europacific Partners from $78.00 to $82.00 and gave the stock an "outperform" rating in a report on Wednesday, November 6th. Four equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $84.44.

Read Our Latest Research Report on Coca-Cola Europacific Partners

Coca-Cola Europacific Partners Profile

(

Free Report)

Coca-Cola Europacific Partners PLC, together with its subsidiaries, produces, distributes, and sells a range of non-alcoholic ready to drink beverages. It offers flavours, mixers, and energy drinks; soft drinks, waters, enhanced water, and isotonic drinks; and ready-to-drink tea and coffee, juices, and other drinks.

See Also

Before you consider Coca-Cola Europacific Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Europacific Partners wasn't on the list.

While Coca-Cola Europacific Partners currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.