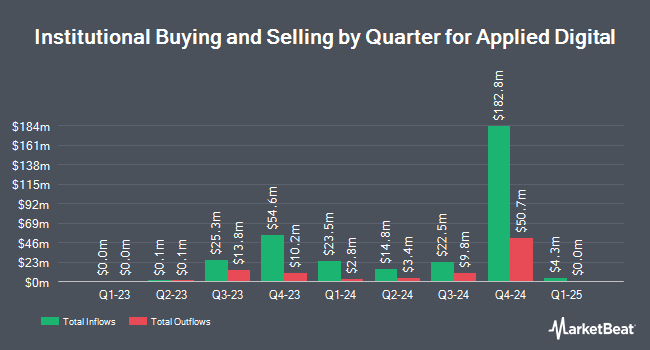

Virtu Financial LLC bought a new position in Applied Digital Co. (NASDAQ:APLD - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm bought 246,052 shares of the company's stock, valued at approximately $2,030,000. Virtu Financial LLC owned 0.11% of Applied Digital at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also recently bought and sold shares of the company. Geode Capital Management LLC lifted its holdings in shares of Applied Digital by 48.7% during the third quarter. Geode Capital Management LLC now owns 3,061,160 shares of the company's stock worth $25,258,000 after buying an additional 1,002,862 shares during the last quarter. Barclays PLC raised its stake in Applied Digital by 736.8% during the 3rd quarter. Barclays PLC now owns 486,577 shares of the company's stock valued at $4,014,000 after purchasing an additional 428,428 shares during the last quarter. Main Management ETF Advisors LLC bought a new stake in Applied Digital in the 3rd quarter valued at $1,575,000. Wellington Management Group LLP grew its position in Applied Digital by 8.8% in the 3rd quarter. Wellington Management Group LLP now owns 37,411 shares of the company's stock worth $309,000 after purchasing an additional 3,040 shares during the last quarter. Finally, State Street Corp increased its holdings in shares of Applied Digital by 14.0% during the 3rd quarter. State Street Corp now owns 2,337,267 shares of the company's stock worth $19,282,000 after purchasing an additional 286,852 shares during the period. Institutional investors and hedge funds own 65.67% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on the stock. Needham & Company LLC reiterated a "buy" rating and issued a $11.00 target price on shares of Applied Digital in a research note on Friday, November 1st. Lake Street Capital raised their price objective on Applied Digital from $7.00 to $11.00 and gave the stock a "buy" rating in a research report on Thursday, October 10th. HC Wainwright boosted their price objective on Applied Digital from $5.00 to $10.00 and gave the company a "buy" rating in a research report on Wednesday, October 16th. B. Riley raised their target price on Applied Digital from $8.00 to $9.00 and gave the stock a "buy" rating in a research report on Friday, September 13th. Finally, Roth Mkm reissued a "buy" rating and issued a $10.00 price target on shares of Applied Digital in a report on Thursday, October 10th. Six research analysts have rated the stock with a buy rating, According to MarketBeat, Applied Digital presently has a consensus rating of "Buy" and a consensus target price of $10.50.

Read Our Latest Stock Report on Applied Digital

Applied Digital Price Performance

APLD stock traded down $0.13 during trading on Friday, hitting $8.90. The company had a trading volume of 10,765,354 shares, compared to its average volume of 8,357,867. The company has a current ratio of 0.22, a quick ratio of 0.22 and a debt-to-equity ratio of 0.62. The company has a fifty day moving average price of $8.28 and a two-hundred day moving average price of $6.33. Applied Digital Co. has a fifty-two week low of $2.36 and a fifty-two week high of $11.25. The company has a market cap of $1.88 billion, a P/E ratio of -7.61 and a beta of 4.67.

Applied Digital (NASDAQ:APLD - Get Free Report) last posted its earnings results on Wednesday, October 9th. The company reported ($0.15) earnings per share for the quarter, topping the consensus estimate of ($0.28) by $0.13. The business had revenue of $60.70 million for the quarter, compared to analyst estimates of $54.85 million. Applied Digital had a negative net margin of 74.95% and a negative return on equity of 88.87%. The firm's quarterly revenue was up 67.2% compared to the same quarter last year. During the same quarter in the prior year, the firm earned ($0.10) EPS. Equities research analysts expect that Applied Digital Co. will post -0.4 earnings per share for the current fiscal year.

Insider Transactions at Applied Digital

In other Applied Digital news, CEO Wes Cummins sold 200,000 shares of the stock in a transaction dated Wednesday, November 27th. The shares were sold at an average price of $9.20, for a total transaction of $1,840,000.00. Following the sale, the chief executive officer now owns 3,875,955 shares of the company's stock, valued at $35,658,786. This represents a 4.91 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Douglas S. Miller sold 10,000 shares of the business's stock in a transaction dated Thursday, October 17th. The stock was sold at an average price of $8.01, for a total transaction of $80,100.00. Following the completion of the transaction, the director now directly owns 208,506 shares of the company's stock, valued at approximately $1,670,133.06. This represents a 4.58 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 359,369 shares of company stock valued at $3,115,161. Corporate insiders own 11.81% of the company's stock.

Applied Digital Profile

(

Free Report)

Applied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

See Also

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.