Virtu Financial LLC purchased a new stake in Laboratory Co. of America Holdings (NYSE:LH - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 2,701 shares of the medical research company's stock, valued at approximately $604,000.

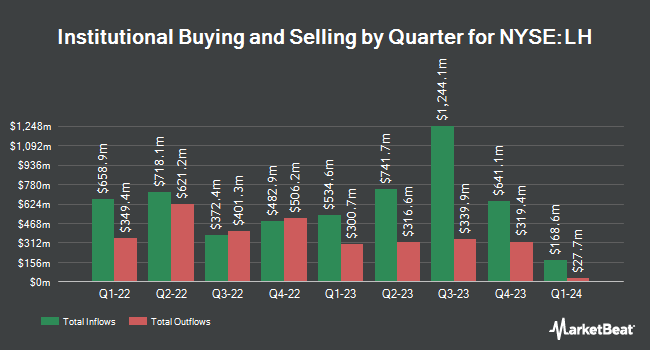

Other hedge funds also recently made changes to their positions in the company. Bank of New York Mellon Corp boosted its position in shares of Laboratory Co. of America by 135.0% in the second quarter. Bank of New York Mellon Corp now owns 1,609,826 shares of the medical research company's stock worth $327,616,000 after buying an additional 924,881 shares during the period. Diamond Hill Capital Management Inc. lifted its position in shares of Laboratory Co. of America by 25.4% in the second quarter. Diamond Hill Capital Management Inc. now owns 1,949,640 shares of the medical research company's stock worth $396,771,000 after buying an additional 395,197 shares during the last quarter. Select Equity Group L.P. bought a new stake in shares of Laboratory Co. of America during the 2nd quarter worth $73,928,000. Allspring Global Investments Holdings LLC boosted its position in shares of Laboratory Co. of America by 16.4% in the third quarter. Allspring Global Investments Holdings LLC now owns 1,865,460 shares of the medical research company's stock valued at $416,893,000 after acquiring an additional 263,105 shares during the period. Finally, FMR LLC increased its holdings in shares of Laboratory Co. of America by 17.0% during the 3rd quarter. FMR LLC now owns 1,586,397 shares of the medical research company's stock worth $354,528,000 after purchasing an additional 230,708 shares during the period. Institutional investors own 95.94% of the company's stock.

Laboratory Co. of America Stock Up 0.1 %

Shares of LH stock traded up $0.17 during trading on Friday, reaching $232.01. The company's stock had a trading volume of 318,499 shares, compared to its average volume of 660,595. The company has a market cap of $19.41 billion, a price-to-earnings ratio of 44.88, a price-to-earnings-growth ratio of 1.89 and a beta of 1.05. Laboratory Co. of America Holdings has a one year low of $191.97 and a one year high of $247.99. The business has a fifty day moving average price of $230.72 and a 200-day moving average price of $220.36. The company has a quick ratio of 1.30, a current ratio of 1.44 and a debt-to-equity ratio of 0.66.

Laboratory Co. of America (NYSE:LH - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The medical research company reported $3.50 earnings per share for the quarter, beating the consensus estimate of $3.48 by $0.02. The company had revenue of $3.28 billion during the quarter, compared to analysts' expectations of $3.26 billion. Laboratory Co. of America had a return on equity of 15.27% and a net margin of 3.43%. Laboratory Co. of America's revenue for the quarter was up 7.4% compared to the same quarter last year. During the same quarter last year, the company earned $3.38 EPS. Analysts anticipate that Laboratory Co. of America Holdings will post 14.52 earnings per share for the current year.

Laboratory Co. of America Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, December 13th. Investors of record on Tuesday, November 26th were paid a $0.72 dividend. The ex-dividend date of this dividend was Tuesday, November 26th. This represents a $2.88 dividend on an annualized basis and a yield of 1.24%. Laboratory Co. of America's dividend payout ratio (DPR) is 55.71%.

Insider Buying and Selling at Laboratory Co. of America

In other news, CEO Adam H. Schechter sold 6,189 shares of Laboratory Co. of America stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $243.47, for a total transaction of $1,506,835.83. Following the sale, the chief executive officer now directly owns 87,441 shares of the company's stock, valued at approximately $21,289,260.27. This trade represents a 6.61 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, Director Kerrii B. Anderson sold 1,000 shares of the firm's stock in a transaction that occurred on Thursday, October 24th. The shares were sold at an average price of $230.00, for a total transaction of $230,000.00. Following the completion of the transaction, the director now owns 13,722 shares of the company's stock, valued at approximately $3,156,060. This trade represents a 6.79 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 24,572 shares of company stock worth $5,910,209 over the last three months. Corporate insiders own 0.85% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts have recently commented on LH shares. Piper Sandler lifted their target price on shares of Laboratory Co. of America from $235.00 to $240.00 and gave the company a "neutral" rating in a research report on Monday, October 28th. Jefferies Financial Group restated a "buy" rating and set a $275.00 target price (up previously from $265.00) on shares of Laboratory Co. of America in a report on Tuesday, December 10th. Barclays lifted their target price on Laboratory Co. of America from $234.00 to $249.00 and gave the company an "equal weight" rating in a research note on Friday, October 25th. Robert W. Baird increased their price objective on shares of Laboratory Co. of America from $282.00 to $289.00 and gave the company an "outperform" rating in a report on Friday, October 25th. Finally, StockNews.com downgraded Laboratory Co. of America from a "buy" rating to a "hold" rating in a research note on Friday, October 25th. Five analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $257.67.

Read Our Latest Stock Report on LH

Laboratory Co. of America Company Profile

(

Free Report)

Labcorp Holdings Inc provides laboratory services. It operates through two segments, Diagnostics Laboratories and Biopharma Laboratory Services. The company offers various tests, such as blood chemistry analyses, urinalyses, blood cell counts, thyroid, PAP, hemoglobin A1C and vitamin D, prostate-specific antigens, sexually transmitted diseases, hepatitis C, microbiology cultures and procedures, and alcohol and other substance-abuse tests.

Recommended Stories

Before you consider Laboratory Co. of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Laboratory Co. of America wasn't on the list.

While Laboratory Co. of America currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report