Virtu Financial LLC purchased a new position in shares of Suncor Energy Inc. (NYSE:SU - Free Report) TSE: SU in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 25,601 shares of the oil and gas producer's stock, valued at approximately $913,000.

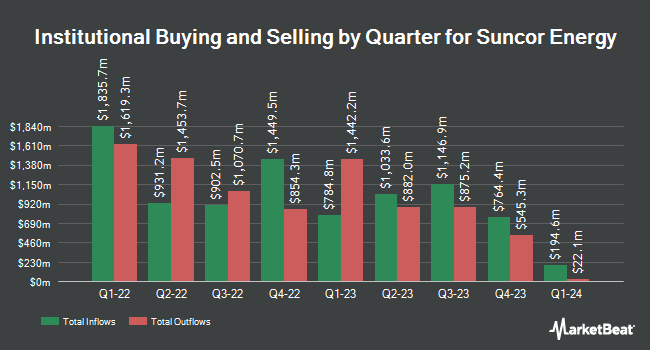

A number of other large investors also recently modified their holdings of SU. Assenagon Asset Management S.A. boosted its position in Suncor Energy by 1,324.8% during the 4th quarter. Assenagon Asset Management S.A. now owns 3,469,008 shares of the oil and gas producer's stock worth $123,774,000 after buying an additional 3,225,543 shares during the period. Principal Financial Group Inc. raised its stake in shares of Suncor Energy by 39.9% during the fourth quarter. Principal Financial Group Inc. now owns 9,706,616 shares of the oil and gas producer's stock valued at $346,298,000 after acquiring an additional 2,767,043 shares during the last quarter. Jupiter Asset Management Ltd. lifted its holdings in shares of Suncor Energy by 2,061.8% during the fourth quarter. Jupiter Asset Management Ltd. now owns 2,438,291 shares of the oil and gas producer's stock worth $86,990,000 after purchasing an additional 2,325,503 shares during the period. Fisher Asset Management LLC grew its stake in shares of Suncor Energy by 97.4% in the fourth quarter. Fisher Asset Management LLC now owns 3,734,572 shares of the oil and gas producer's stock worth $133,250,000 after purchasing an additional 1,842,791 shares during the last quarter. Finally, Bank of New York Mellon Corp grew its stake in shares of Suncor Energy by 104.2% in the fourth quarter. Bank of New York Mellon Corp now owns 3,083,440 shares of the oil and gas producer's stock worth $110,017,000 after purchasing an additional 1,573,726 shares during the last quarter. 67.37% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts have commented on the company. Scotiabank raised Suncor Energy to a "hold" rating in a report on Wednesday, March 19th. Tudor Pickering raised Suncor Energy from a "hold" rating to a "strong-buy" rating in a research note on Monday, February 10th. StockNews.com raised shares of Suncor Energy from a "hold" rating to a "buy" rating in a research report on Saturday, March 22nd. Bank of America initiated coverage on shares of Suncor Energy in a research report on Wednesday, February 26th. They issued a "neutral" rating on the stock. Finally, Tudor, Pickering, Holt & Co. upgraded shares of Suncor Energy from a "hold" rating to a "buy" rating in a research report on Monday, February 10th. Four research analysts have rated the stock with a hold rating, eight have given a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat, Suncor Energy has an average rating of "Moderate Buy" and an average target price of $58.00.

View Our Latest Research Report on Suncor Energy

Suncor Energy Stock Down 0.5 %

Shares of NYSE SU traded down $0.20 during trading on Thursday, hitting $38.66. 2,595,665 shares of the company traded hands, compared to its average volume of 4,196,836. The firm has a market capitalization of $47.82 billion, a price-to-earnings ratio of 11.20, a P/E/G ratio of 2.94 and a beta of 1.11. The business's fifty day moving average is $38.15 and its 200 day moving average is $38.15. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.86 and a current ratio of 1.33. Suncor Energy Inc. has a fifty-two week low of $33.81 and a fifty-two week high of $41.95.

Suncor Energy (NYSE:SU - Get Free Report) TSE: SU last announced its quarterly earnings data on Wednesday, February 5th. The oil and gas producer reported $0.89 EPS for the quarter, beating analysts' consensus estimates of $0.82 by $0.07. Suncor Energy had a return on equity of 15.37% and a net margin of 11.80%. Equities research analysts predict that Suncor Energy Inc. will post 3.42 earnings per share for the current fiscal year.

Suncor Energy Cuts Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, March 25th. Shareholders of record on Tuesday, March 4th were issued a dividend of $0.399 per share. The ex-dividend date was Tuesday, March 4th. This represents a $1.60 annualized dividend and a yield of 4.13%. Suncor Energy's payout ratio is 45.51%.

Suncor Energy Company Profile

(

Free Report)

Suncor Energy Inc operates as an integrated energy company in Canada, the United States, and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products.

See Also

Before you consider Suncor Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suncor Energy wasn't on the list.

While Suncor Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.