Virtu Financial LLC bought a new stake in shares of KE Holdings Inc. (NYSE:BEKE - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund bought 51,885 shares of the company's stock, valued at approximately $1,033,000.

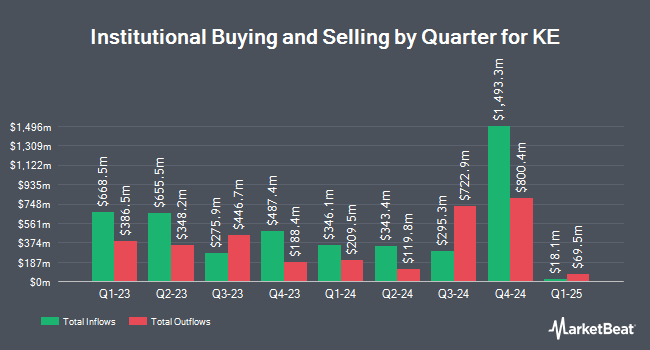

Other hedge funds also recently bought and sold shares of the company. Point72 Asia Singapore Pte. Ltd. purchased a new position in shares of KE in the third quarter valued at about $30,000. Blue Trust Inc. boosted its stake in KE by 2,662.2% in the 2nd quarter. Blue Trust Inc. now owns 3,287 shares of the company's stock worth $45,000 after purchasing an additional 3,168 shares during the period. Rakuten Securities Inc. grew its holdings in KE by 334,500.0% during the 3rd quarter. Rakuten Securities Inc. now owns 3,346 shares of the company's stock valued at $67,000 after buying an additional 3,345 shares in the last quarter. Venturi Wealth Management LLC raised its position in shares of KE by 5,089.9% during the third quarter. Venturi Wealth Management LLC now owns 4,100 shares of the company's stock valued at $82,000 after buying an additional 4,021 shares during the last quarter. Finally, Signaturefd LLC raised its position in shares of KE by 12.5% during the second quarter. Signaturefd LLC now owns 7,781 shares of the company's stock valued at $110,000 after buying an additional 866 shares during the last quarter. Institutional investors own 39.34% of the company's stock.

KE Stock Down 3.3 %

KE stock traded down $0.67 during mid-day trading on Friday, reaching $19.42. 10,994,243 shares of the company's stock traded hands, compared to its average volume of 9,316,723. KE Holdings Inc. has a 12-month low of $12.44 and a 12-month high of $26.05. The company has a market cap of $23.47 billion, a price-to-earnings ratio of 39.63, a PEG ratio of 4.76 and a beta of -0.77. The stock has a 50 day moving average of $20.70 and a two-hundred day moving average of $17.30.

Wall Street Analysts Forecast Growth

BEKE has been the subject of several research analyst reports. Citigroup began coverage on shares of KE in a research note on Tuesday, September 10th. They set a "buy" rating and a $23.80 target price for the company. Bank of America upgraded KE from a "neutral" rating to a "buy" rating and raised their price objective for the company from $24.00 to $28.00 in a research report on Wednesday, October 30th. Finally, Barclays boosted their target price on KE from $30.00 to $33.00 and gave the stock an "overweight" rating in a research report on Monday, November 25th.

View Our Latest Stock Analysis on KE

KE Company Profile

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

See Also

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.