Virtu Financial LLC bought a new position in shares of ManpowerGroup Inc. (NYSE:MAN - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor bought 9,034 shares of the business services provider's stock, valued at approximately $664,000.

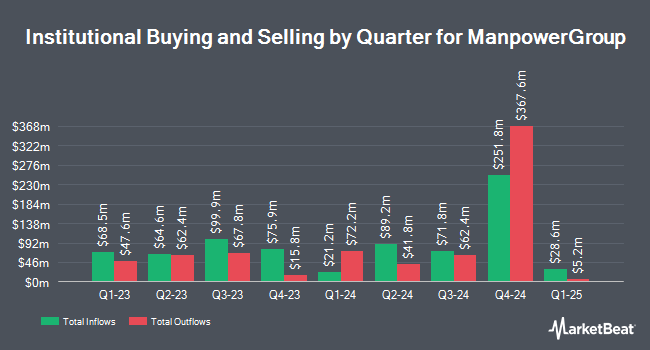

A number of other institutional investors have also recently modified their holdings of MAN. Pacer Advisors Inc. boosted its position in ManpowerGroup by 12,496.6% during the third quarter. Pacer Advisors Inc. now owns 901,536 shares of the business services provider's stock worth $66,281,000 after purchasing an additional 894,379 shares in the last quarter. AQR Capital Management LLC grew its stake in ManpowerGroup by 55.3% in the 2nd quarter. AQR Capital Management LLC now owns 1,608,368 shares of the business services provider's stock valued at $112,264,000 after acquiring an additional 573,027 shares during the period. Pzena Investment Management LLC acquired a new stake in ManpowerGroup in the 2nd quarter valued at $24,508,000. Point72 Asset Management L.P. increased its holdings in ManpowerGroup by 480.1% in the 3rd quarter. Point72 Asset Management L.P. now owns 324,866 shares of the business services provider's stock worth $23,884,000 after acquiring an additional 268,866 shares in the last quarter. Finally, Millennium Management LLC raised its position in ManpowerGroup by 163.7% during the second quarter. Millennium Management LLC now owns 407,970 shares of the business services provider's stock worth $28,476,000 after acquiring an additional 253,287 shares during the period. 98.03% of the stock is currently owned by institutional investors and hedge funds.

ManpowerGroup Price Performance

MAN stock traded up $0.34 during mid-day trading on Friday, reaching $61.18. The company's stock had a trading volume of 594,918 shares, compared to its average volume of 447,288. The company has a current ratio of 1.15, a quick ratio of 1.15 and a debt-to-equity ratio of 0.46. The company's 50 day moving average is $64.46 and its two-hundred day moving average is $69.26. ManpowerGroup Inc. has a fifty-two week low of $59.35 and a fifty-two week high of $80.25. The stock has a market cap of $2.87 billion, a PE ratio of 77.44 and a beta of 1.45.

ManpowerGroup (NYSE:MAN - Get Free Report) last announced its quarterly earnings data on Thursday, October 17th. The business services provider reported $1.29 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.28 by $0.01. The firm had revenue of $4.53 billion during the quarter, compared to analyst estimates of $4.48 billion. ManpowerGroup had a net margin of 0.21% and a return on equity of 11.05%. Equities research analysts expect that ManpowerGroup Inc. will post 4.55 EPS for the current year.

ManpowerGroup Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be paid a dividend of $1.545 per share. This represents a $6.18 annualized dividend and a yield of 10.10%. The ex-dividend date of this dividend is Monday, December 2nd. This is a positive change from ManpowerGroup's previous quarterly dividend of $1.01. ManpowerGroup's dividend payout ratio (DPR) is 389.87%.

Analyst Ratings Changes

A number of analysts have recently commented on the stock. Truist Financial cut their target price on shares of ManpowerGroup from $78.00 to $74.00 and set a "hold" rating for the company in a research note on Friday, October 18th. UBS Group cut their price objective on ManpowerGroup from $78.00 to $71.00 and set a "neutral" rating for the company in a research note on Friday, October 18th. Finally, BMO Capital Markets decreased their target price on ManpowerGroup from $87.00 to $71.00 and set a "market perform" rating on the stock in a research report on Friday, October 18th. Six analysts have rated the stock with a hold rating and one has issued a buy rating to the stock. According to data from MarketBeat, ManpowerGroup presently has an average rating of "Hold" and an average price target of $76.60.

Read Our Latest Stock Analysis on ManpowerGroup

Insiders Place Their Bets

In other ManpowerGroup news, CFO John T. Mcginnis purchased 8,000 shares of the business's stock in a transaction on Wednesday, October 23rd. The shares were bought at an average cost of $62.28 per share, for a total transaction of $498,240.00. Following the completion of the purchase, the chief financial officer now directly owns 70,639 shares of the company's stock, valued at approximately $4,399,396.92. This trade represents a 12.77 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 2.40% of the stock is owned by insiders.

ManpowerGroup Profile

(

Free Report)

ManpowerGroup Inc provides workforce solutions and services worldwide. The company offers recruitment services, including permanent, temporary, and contract recruitment of professionals, as well as administrative and industrial positions under the Manpower and Experis brands. It also offers various assessment services; training and development services; career and talent management; and outsourcing services related to human resources functions primarily in the areas of large-scale recruiting and workforce-intensive initiatives.

Featured Articles

Before you consider ManpowerGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ManpowerGroup wasn't on the list.

While ManpowerGroup currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.