Virtu Financial LLC purchased a new stake in shares of Cloudflare, Inc. (NYSE:NET - Free Report) in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm purchased 15,676 shares of the company's stock, valued at approximately $1,268,000.

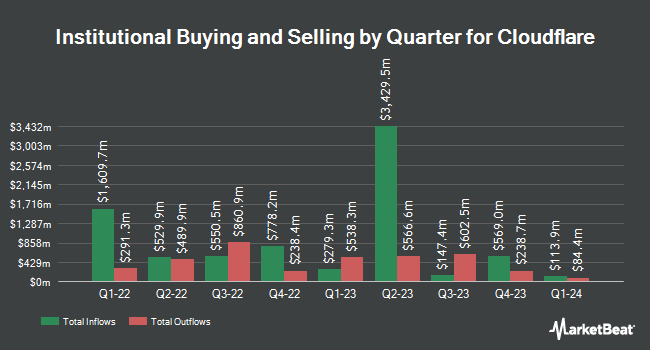

A number of other hedge funds have also bought and sold shares of NET. ORG Partners LLC increased its position in shares of Cloudflare by 7,510.0% during the 2nd quarter. ORG Partners LLC now owns 761 shares of the company's stock valued at $64,000 after purchasing an additional 751 shares during the last quarter. Blue Trust Inc. raised its position in Cloudflare by 37,600.0% in the second quarter. Blue Trust Inc. now owns 754 shares of the company's stock worth $62,000 after acquiring an additional 752 shares during the period. Sumitomo Mitsui Trust Holdings Inc. boosted its stake in Cloudflare by 1.2% in the second quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 1,661,425 shares of the company's stock valued at $137,616,000 after acquiring an additional 19,446 shares during the last quarter. Western Financial Corp CA grew its position in shares of Cloudflare by 13.2% during the 2nd quarter. Western Financial Corp CA now owns 12,140 shares of the company's stock valued at $1,006,000 after acquiring an additional 1,416 shares during the period. Finally, Hennion & Walsh Asset Management Inc. bought a new position in shares of Cloudflare during the 2nd quarter valued at approximately $320,000. 82.68% of the stock is currently owned by institutional investors.

Insider Activity at Cloudflare

In other news, COO Michelle Zatlyn sold 64,100 shares of the company's stock in a transaction on Monday, October 7th. The shares were sold at an average price of $81.60, for a total value of $5,230,560.00. Following the completion of the sale, the chief operating officer now owns 192,177 shares of the company's stock, valued at approximately $15,681,643.20. This represents a 25.01 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Matthew Prince sold 52,384 shares of Cloudflare stock in a transaction on Tuesday, October 15th. The stock was sold at an average price of $93.95, for a total transaction of $4,921,476.80. Following the completion of the transaction, the chief executive officer now owns 10,761 shares in the company, valued at approximately $1,010,995.95. The trade was a 82.96 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 524,824 shares of company stock valued at $49,037,888. Corporate insiders own 12.83% of the company's stock.

Cloudflare Price Performance

NET stock traded down $1.31 during midday trading on Friday, reaching $113.58. The company had a trading volume of 1,927,164 shares, compared to its average volume of 3,157,219. The firm has a 50-day moving average price of $96.10 and a 200-day moving average price of $84.95. The company has a market capitalization of $38.98 billion, a P/E ratio of -436.85 and a beta of 1.10. Cloudflare, Inc. has a 1 year low of $66.24 and a 1 year high of $116.00. The company has a debt-to-equity ratio of 1.32, a current ratio of 3.37 and a quick ratio of 3.37.

Cloudflare (NYSE:NET - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported ($0.03) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.03). The company had revenue of $430.08 million during the quarter, compared to analyst estimates of $423.65 million. Cloudflare had a negative net margin of 5.97% and a negative return on equity of 7.18%. On average, research analysts anticipate that Cloudflare, Inc. will post -0.1 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

NET has been the topic of a number of research reports. Piper Sandler lifted their price target on shares of Cloudflare from $83.00 to $92.00 and gave the stock a "neutral" rating in a report on Friday, November 8th. Morgan Stanley upgraded Cloudflare from an "equal weight" rating to an "overweight" rating and boosted their target price for the company from $92.00 to $130.00 in a research note on Monday, December 2nd. Wells Fargo & Company increased their price target on Cloudflare from $105.00 to $110.00 and gave the stock an "overweight" rating in a research note on Friday, November 8th. Mizuho boosted their price objective on Cloudflare from $102.00 to $125.00 and gave the company a "neutral" rating in a research note on Friday. Finally, BNP Paribas initiated coverage on shares of Cloudflare in a research report on Tuesday, October 8th. They set an "underperform" rating and a $65.00 target price for the company. Four research analysts have rated the stock with a sell rating, eleven have assigned a hold rating and eleven have issued a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $95.20.

Check Out Our Latest Research Report on Cloudflare

Cloudflare Profile

(

Free Report)

Cloudflare, Inc operates as a cloud services provider that delivers a range of services to businesses worldwide. The company provides an integrated cloud-based security solution to secure a range of combination of platforms, including public cloud, private cloud, on-premise, software-as-a-service applications, and IoT devices; and website and application security products comprising web application firewall, bot management, distributed denial of service, API gateways, SSL/TLS encryption, script management, security center, and rate limiting products.

Featured Stories

Before you consider Cloudflare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cloudflare wasn't on the list.

While Cloudflare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.