Virtus Investment Advisers Inc. acquired a new position in Daktronics, Inc. (NASDAQ:DAKT - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund acquired 30,030 shares of the technology company's stock, valued at approximately $388,000. Virtus Investment Advisers Inc. owned about 0.06% of Daktronics at the end of the most recent reporting period.

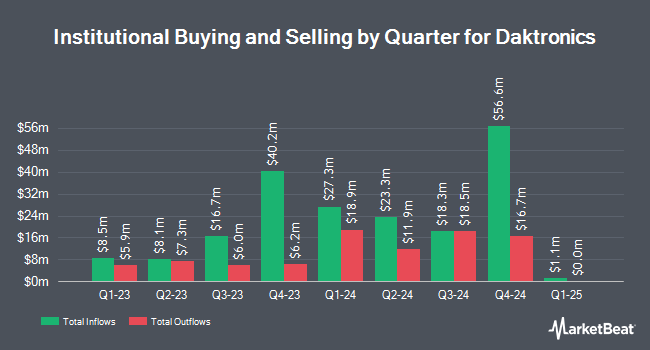

Other hedge funds and other institutional investors have also made changes to their positions in the company. Quarry LP grew its holdings in shares of Daktronics by 75.6% in the 3rd quarter. Quarry LP now owns 2,297 shares of the technology company's stock worth $30,000 after acquiring an additional 989 shares during the last quarter. Janus Henderson Group PLC purchased a new position in Daktronics in the 3rd quarter worth about $216,000. Progeny 3 Inc. increased its stake in Daktronics by 27.3% in the 3rd quarter. Progeny 3 Inc. now owns 2,284,608 shares of the technology company's stock worth $29,494,000 after purchasing an additional 489,700 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC acquired a new stake in Daktronics during the 3rd quarter worth about $427,000. Finally, PEAK6 Investments LLC lifted its stake in Daktronics by 269.9% during the third quarter. PEAK6 Investments LLC now owns 42,073 shares of the technology company's stock valued at $543,000 after buying an additional 30,699 shares in the last quarter. 61.69% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other Daktronics news, VP Matthew John Kurtenbach sold 15,400 shares of Daktronics stock in a transaction that occurred on Thursday, October 3rd. The shares were sold at an average price of $13.28, for a total value of $204,512.00. Following the completion of the sale, the vice president now directly owns 2,500 shares in the company, valued at $33,200. The trade was a 86.03 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Bradley T. Wiemann sold 25,000 shares of the stock in a transaction on Friday, September 27th. The stock was sold at an average price of $12.89, for a total transaction of $322,250.00. Following the transaction, the executive vice president now owns 85,446 shares in the company, valued at approximately $1,101,398.94. This trade represents a 22.64 % decrease in their position. The disclosure for this sale can be found here. 8.10% of the stock is owned by corporate insiders.

Daktronics Stock Up 1.5 %

Shares of DAKT traded up $0.29 during trading hours on Friday, reaching $19.50. The company's stock had a trading volume of 662,341 shares, compared to its average volume of 489,589. The company has a quick ratio of 1.48, a current ratio of 2.35 and a debt-to-equity ratio of 0.40. The firm has a market cap of $903.63 million, a price-to-earnings ratio of 78.00, a P/E/G ratio of 0.70 and a beta of 1.19. The company has a 50 day moving average of $14.30 and a two-hundred day moving average of $13.51. Daktronics, Inc. has a 1-year low of $7.20 and a 1-year high of $19.89.

Daktronics (NASDAQ:DAKT - Get Free Report) last released its earnings results on Wednesday, September 4th. The technology company reported $0.36 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.30 by $0.06. Daktronics had a net margin of 3.62% and a return on equity of 19.61%. The company had revenue of $226.09 million during the quarter, compared to the consensus estimate of $216.84 million. As a group, research analysts predict that Daktronics, Inc. will post 0.89 EPS for the current fiscal year.

Analyst Ratings Changes

A number of equities research analysts have recently issued reports on the stock. Singular Research upgraded shares of Daktronics to a "strong-buy" rating in a research report on Monday, September 9th. StockNews.com upgraded Daktronics from a "hold" rating to a "buy" rating in a report on Monday, October 14th.

Check Out Our Latest Analysis on DAKT

Daktronics Company Profile

(

Free Report)

Daktronics, Inc designs, manufactures, and sells electronic scoreboards, programmable display systems and large screen video displays for sporting, commercial, and transportation applications in the United States and internationally. It operates through Commercial, Live Events, High School Park and Recreation, Transportation, and International segments.

Featured Articles

Before you consider Daktronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Daktronics wasn't on the list.

While Daktronics currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.