Cardano Risk Management B.V. raised its holdings in Visa Inc. (NYSE:V - Free Report) by 48.6% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 744,806 shares of the credit-card processor's stock after buying an additional 243,442 shares during the quarter. Visa comprises 3.6% of Cardano Risk Management B.V.'s investment portfolio, making the stock its 7th largest position. Cardano Risk Management B.V.'s holdings in Visa were worth $204,784,000 as of its most recent SEC filing.

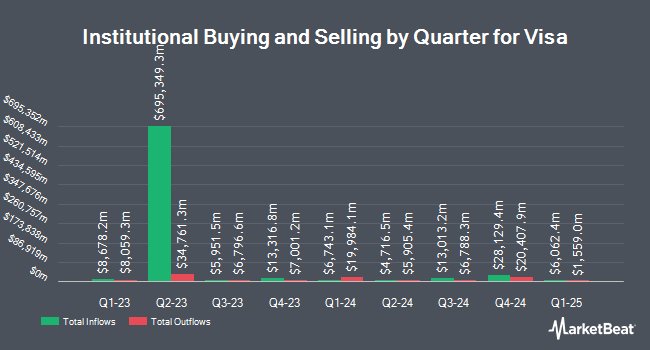

Several other hedge funds have also recently made changes to their positions in the business. Peterson Financial Group Inc. bought a new position in shares of Visa in the 3rd quarter worth approximately $26,000. POM Investment Strategies LLC lifted its position in Visa by 970.0% during the second quarter. POM Investment Strategies LLC now owns 107 shares of the credit-card processor's stock valued at $28,000 after buying an additional 97 shares during the period. Reston Wealth Management LLC bought a new stake in shares of Visa during the 3rd quarter valued at $31,000. TruNorth Capital Management LLC grew its position in shares of Visa by 211.9% in the 2nd quarter. TruNorth Capital Management LLC now owns 131 shares of the credit-card processor's stock worth $34,000 after buying an additional 89 shares during the period. Finally, Bbjs Financial Advisors LLC bought a new position in shares of Visa in the 2nd quarter worth about $35,000. 82.15% of the stock is owned by hedge funds and other institutional investors.

Visa Trading Up 0.5 %

V stock traded up $1.39 during midday trading on Friday, reaching $309.64. The company's stock had a trading volume of 5,106,284 shares, compared to its average volume of 5,762,525. The firm has a market capitalization of $564.26 billion, a price-to-earnings ratio of 31.82, a PEG ratio of 2.07 and a beta of 0.95. Visa Inc. has a 1 year low of $245.60 and a 1 year high of $312.44. The company has a debt-to-equity ratio of 0.55, a quick ratio of 1.37 and a current ratio of 1.28. The stock has a fifty day simple moving average of $287.04 and a two-hundred day simple moving average of $275.95.

Visa (NYSE:V - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The credit-card processor reported $2.71 earnings per share for the quarter, beating the consensus estimate of $2.58 by $0.13. Visa had a net margin of 54.96% and a return on equity of 53.16%. The firm had revenue of $9.62 billion during the quarter, compared to the consensus estimate of $9.49 billion. During the same quarter in the previous year, the firm posted $2.33 earnings per share. The company's revenue was up 11.7% on a year-over-year basis. On average, equities research analysts predict that Visa Inc. will post 11.19 EPS for the current year.

Visa Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 2nd. Stockholders of record on Tuesday, November 12th will be given a $0.59 dividend. This represents a $2.36 annualized dividend and a dividend yield of 0.76%. The ex-dividend date of this dividend is Tuesday, November 12th. This is a boost from Visa's previous quarterly dividend of $0.52. Visa's dividend payout ratio is presently 24.25%.

Wall Street Analysts Forecast Growth

V has been the subject of a number of analyst reports. Compass Point started coverage on Visa in a research report on Wednesday, September 4th. They set a "buy" rating and a $319.00 price objective for the company. Barclays lifted their price target on Visa from $319.00 to $347.00 and gave the stock an "overweight" rating in a research report on Monday, November 4th. BMO Capital Markets increased their price objective on shares of Visa from $310.00 to $320.00 and gave the company an "outperform" rating in a research report on Wednesday, October 30th. Monness Crespi & Hardt reaffirmed a "neutral" rating on shares of Visa in a report on Tuesday, September 24th. Finally, Susquehanna raised their price target on shares of Visa from $326.00 to $339.00 and gave the company a "positive" rating in a research report on Wednesday, October 30th. Four investment analysts have rated the stock with a hold rating, twenty-four have issued a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $321.74.

Read Our Latest Research Report on Visa

Insider Activity

In other news, CEO Ryan Mcinerney sold 8,620 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $276.37, for a total value of $2,382,309.40. Following the sale, the chief executive officer now directly owns 538 shares in the company, valued at approximately $148,687.06. This trade represents a 94.13 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 0.19% of the company's stock.

Visa Profile

(

Free Report)

Visa Inc operates as a payment technology company in the United States and internationally. The company operates VisaNet, a transaction processing network that enables authorization, clearing, and settlement of payment transactions. It also offers credit, debit, and prepaid card products; tap to pay, tokenization, and click to pay services; Visa Direct, a solution that facilitates the delivery of funds to eligible cards, deposit accounts, and digital wallets; Visa B2B Connect, a multilateral business-to-business cross-border payments network; Visa Cross-Border Solution, a cross-border consumer payments solution; and Visa DPS that provides a range of value-added services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions, and contact center services.

Featured Articles

Before you consider Visa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Visa wasn't on the list.

While Visa currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.