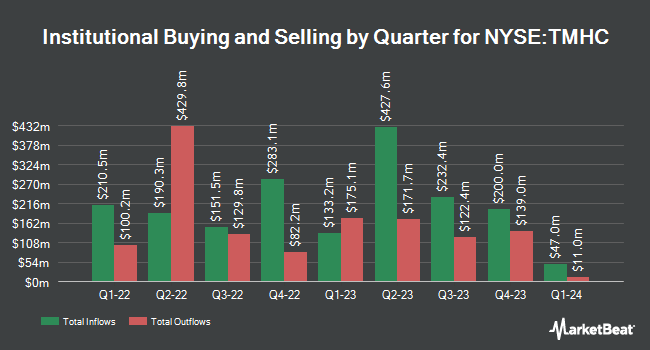

Vision Capital Corp acquired a new position in shares of Taylor Morrison Home Co. (NYSE:TMHC - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 543,316 shares of the construction company's stock, valued at approximately $38,173,000. Taylor Morrison Home comprises approximately 6.2% of Vision Capital Corp's holdings, making the stock its 2nd largest holding. Vision Capital Corp owned about 0.53% of Taylor Morrison Home as of its most recent SEC filing.

Other hedge funds have also added to or reduced their stakes in the company. Wedge Capital Management L L P NC increased its holdings in Taylor Morrison Home by 1,910.4% in the 2nd quarter. Wedge Capital Management L L P NC now owns 727,919 shares of the construction company's stock worth $40,356,000 after acquiring an additional 691,711 shares during the last quarter. Assenagon Asset Management S.A. raised its position in shares of Taylor Morrison Home by 271.0% in the third quarter. Assenagon Asset Management S.A. now owns 896,032 shares of the construction company's stock valued at $62,955,000 after purchasing an additional 654,541 shares during the period. Charles Schwab Investment Management Inc. lifted its stake in shares of Taylor Morrison Home by 26.1% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,362,020 shares of the construction company's stock valued at $95,696,000 after buying an additional 282,227 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its holdings in Taylor Morrison Home by 18.5% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 786,249 shares of the construction company's stock worth $43,590,000 after buying an additional 122,864 shares during the period. Finally, EMG Holdings L.P. purchased a new position in Taylor Morrison Home in the 2nd quarter valued at approximately $6,098,000. Institutional investors own 95.16% of the company's stock.

Taylor Morrison Home Price Performance

Shares of NYSE TMHC traded up $3.72 during mid-day trading on Monday, reaching $74.80. 1,421,225 shares of the company were exchanged, compared to its average volume of 799,826. The company's 50 day moving average price is $69.45 and its 200 day moving average price is $63.66. Taylor Morrison Home Co. has a 52 week low of $44.32 and a 52 week high of $75.49. The company has a quick ratio of 0.69, a current ratio of 6.24 and a debt-to-equity ratio of 0.37. The stock has a market capitalization of $7.74 billion, a PE ratio of 9.99 and a beta of 1.96.

Taylor Morrison Home (NYSE:TMHC - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The construction company reported $2.37 EPS for the quarter, topping the consensus estimate of $2.06 by $0.31. Taylor Morrison Home had a return on equity of 15.91% and a net margin of 10.39%. The firm had revenue of $2.12 billion for the quarter, compared to the consensus estimate of $1.96 billion. During the same quarter in the previous year, the business earned $1.62 earnings per share. The company's quarterly revenue was up 26.6% on a year-over-year basis. Sell-side analysts forecast that Taylor Morrison Home Co. will post 8.44 earnings per share for the current fiscal year.

Insider Buying and Selling at Taylor Morrison Home

In related news, Director William H. Lyon sold 9,075 shares of the business's stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $72.08, for a total transaction of $654,126.00. Following the transaction, the director now owns 2,136,241 shares in the company, valued at $153,980,251.28. The trade was a 0.42 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, EVP Darrell Sherman sold 26,757 shares of the firm's stock in a transaction dated Monday, October 28th. The stock was sold at an average price of $70.00, for a total transaction of $1,872,990.00. Following the completion of the sale, the executive vice president now owns 109,217 shares of the company's stock, valued at $7,645,190. This trade represents a 19.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 104,337 shares of company stock worth $7,356,683. 3.50% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

TMHC has been the topic of several recent research reports. StockNews.com upgraded Taylor Morrison Home from a "hold" rating to a "buy" rating in a research report on Thursday, October 24th. Wedbush upgraded Taylor Morrison Home from a "neutral" rating to an "outperform" rating and upped their price target for the company from $65.00 to $85.00 in a research report on Friday, October 25th. Royal Bank of Canada raised their price objective on shares of Taylor Morrison Home from $74.00 to $77.00 and gave the company an "outperform" rating in a research report on Thursday, October 24th. Raymond James reaffirmed an "outperform" rating and set a $84.00 target price (up previously from $81.00) on shares of Taylor Morrison Home in a report on Tuesday, October 29th. Finally, BTIG Research increased their target price on shares of Taylor Morrison Home from $78.00 to $86.00 and gave the stock a "buy" rating in a research note on Thursday, October 24th. Two investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $77.33.

Read Our Latest Stock Analysis on TMHC

About Taylor Morrison Home

(

Free Report)

Taylor Morrison Home Corporation, together with its subsidiaries, operates as a public homebuilder in the United States. The company designs, builds, and sells single and multi-family detached and attached homes; and develops lifestyle and master-planned communities. It develops and constructs multi-use properties consisting of commercial space, retail, and multi-family properties under the Urban Form brand name.

Recommended Stories

Before you consider Taylor Morrison Home, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taylor Morrison Home wasn't on the list.

While Taylor Morrison Home currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.