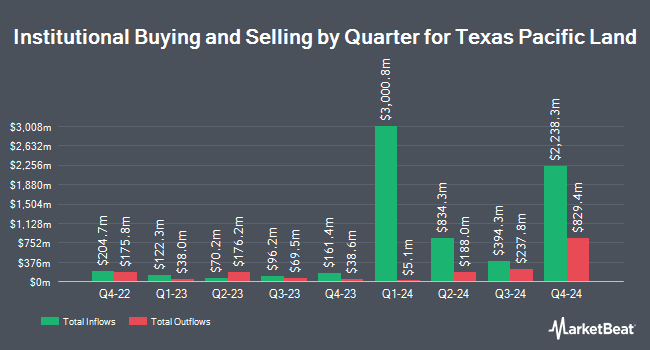

Vista Investment Partners II LLC acquired a new stake in shares of Texas Pacific Land Co. (NYSE:TPL - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 366 shares of the financial services provider's stock, valued at approximately $405,000.

A number of other institutional investors have also recently bought and sold shares of the company. Independent Advisor Alliance boosted its position in Texas Pacific Land by 1.4% during the fourth quarter. Independent Advisor Alliance now owns 3,679 shares of the financial services provider's stock valued at $4,069,000 after purchasing an additional 52 shares during the last quarter. Daiwa Securities Group Inc. boosted its position in Texas Pacific Land by 71.8% during the fourth quarter. Daiwa Securities Group Inc. now owns 2,658 shares of the financial services provider's stock valued at $2,940,000 after purchasing an additional 1,111 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its position in Texas Pacific Land by 72.1% during the fourth quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 6,640 shares of the financial services provider's stock valued at $7,344,000 after purchasing an additional 2,782 shares during the last quarter. Kendall Capital Management acquired a new stake in Texas Pacific Land during the fourth quarter valued at $232,000. Finally, AMF Tjanstepension AB acquired a new stake in Texas Pacific Land during the fourth quarter valued at $7,350,000. Institutional investors and hedge funds own 59.94% of the company's stock.

Texas Pacific Land Stock Up 1.7 %

Shares of NYSE:TPL traded up $22.04 on Wednesday, reaching $1,349.47. The company had a trading volume of 97,163 shares, compared to its average volume of 129,791. Texas Pacific Land Co. has a twelve month low of $529.03 and a twelve month high of $1,769.14. The stock has a 50-day moving average price of $1,339.88 and a 200 day moving average price of $1,200.57. The stock has a market capitalization of $31.02 billion, a P/E ratio of 68.43 and a beta of 1.68.

Texas Pacific Land (NYSE:TPL - Get Free Report) last announced its quarterly earnings results on Wednesday, February 19th. The financial services provider reported $5.14 earnings per share for the quarter. Texas Pacific Land had a return on equity of 40.23% and a net margin of 64.32%. The company had revenue of $185.78 million during the quarter.

Texas Pacific Land Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, March 17th. Shareholders of record on Monday, March 3rd will be given a $1.60 dividend. The ex-dividend date is Monday, March 3rd. This represents a $6.40 dividend on an annualized basis and a dividend yield of 0.47%. Texas Pacific Land's dividend payout ratio is currently 32.45%.

Texas Pacific Land Company Profile

(

Free Report)

Texas Pacific Land Corporation engages in the land and resource management, and water services and operations businesses. The company owns a 1/128th nonparticipating perpetual oil and gas royalty interest (NPRI) under approximately 85,000 acres of land; a 1/16th NPRI under approximately 371,000 acres of land; and approximately 4,000 additional net royalty acres, total of approximately 195,000 NRA located in the western part of Texas.

Read More

Before you consider Texas Pacific Land, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Pacific Land wasn't on the list.

While Texas Pacific Land currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.