Hotchkis & Wiley Capital Management LLC lifted its stake in shares of Vital Energy, Inc. (NYSE:VTLE - Free Report) by 22.8% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 311,130 shares of the company's stock after acquiring an additional 57,810 shares during the quarter. Hotchkis & Wiley Capital Management LLC owned 0.82% of Vital Energy worth $8,369,000 as of its most recent filing with the Securities and Exchange Commission.

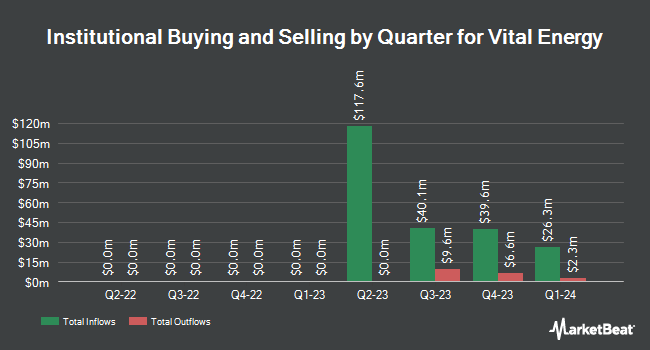

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Arizona State Retirement System raised its stake in Vital Energy by 5.4% in the second quarter. Arizona State Retirement System now owns 6,670 shares of the company's stock valued at $299,000 after buying an additional 342 shares in the last quarter. Versor Investments LP raised its position in shares of Vital Energy by 2.8% during the 3rd quarter. Versor Investments LP now owns 14,900 shares of the company's stock worth $401,000 after acquiring an additional 400 shares in the last quarter. State of Alaska Department of Revenue boosted its holdings in Vital Energy by 2.7% in the third quarter. State of Alaska Department of Revenue now owns 15,392 shares of the company's stock valued at $414,000 after purchasing an additional 409 shares in the last quarter. CWM LLC increased its stake in Vital Energy by 400.9% in the second quarter. CWM LLC now owns 581 shares of the company's stock valued at $26,000 after purchasing an additional 465 shares during the last quarter. Finally, Louisiana State Employees Retirement System lifted its position in shares of Vital Energy by 4.1% during the 2nd quarter. Louisiana State Employees Retirement System now owns 12,800 shares of the company's stock worth $574,000 after buying an additional 500 shares during the last quarter. 86.54% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

VTLE has been the topic of several research analyst reports. Mizuho cut their price target on shares of Vital Energy from $42.00 to $39.00 and set a "neutral" rating on the stock in a research note on Thursday, October 10th. BMO Capital Markets decreased their target price on Vital Energy from $48.00 to $40.00 and set a "market perform" rating for the company in a research report on Friday, October 4th. KeyCorp lowered Vital Energy from an "overweight" rating to a "sector weight" rating in a research report on Friday, August 16th. JPMorgan Chase & Co. increased their price objective on Vital Energy from $29.00 to $30.00 and gave the company an "underweight" rating in a report on Thursday. Finally, Wells Fargo & Company lifted their target price on shares of Vital Energy from $29.00 to $35.00 and gave the company an "equal weight" rating in a report on Tuesday, November 19th. Three equities research analysts have rated the stock with a sell rating, five have given a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat, Vital Energy presently has an average rating of "Hold" and a consensus target price of $47.00.

Get Our Latest Report on VTLE

Insiders Place Their Bets

In other news, EVP Mark David Denny sold 5,145 shares of the business's stock in a transaction that occurred on Tuesday, October 8th. The stock was sold at an average price of $30.22, for a total transaction of $155,481.90. Following the sale, the executive vice president now owns 26,358 shares of the company's stock, valued at $796,538.76. The trade was a 16.33 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, COO Kathryn Anne Hill sold 2,023 shares of the firm's stock in a transaction that occurred on Tuesday, October 8th. The shares were sold at an average price of $30.22, for a total value of $61,135.06. Following the completion of the transaction, the chief operating officer now directly owns 29,091 shares of the company's stock, valued at $879,130.02. The trade was a 6.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 17,168 shares of company stock worth $502,017. 1.20% of the stock is owned by corporate insiders.

Vital Energy Stock Performance

Shares of Vital Energy stock traded down $0.60 on Thursday, reaching $30.41. 762,152 shares of the stock were exchanged, compared to its average volume of 903,826. The firm has a market capitalization of $1.16 billion, a PE ratio of 2.14 and a beta of 3.19. Vital Energy, Inc. has a 1-year low of $25.85 and a 1-year high of $58.30. The business has a fifty day moving average price of $29.45 and a two-hundred day moving average price of $36.40. The company has a current ratio of 0.67, a quick ratio of 0.67 and a debt-to-equity ratio of 0.80.

Vital Energy (NYSE:VTLE - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported $1.61 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.46 by $0.15. The company had revenue of $459.23 million for the quarter, compared to analysts' expectations of $461.58 million. Vital Energy had a return on equity of 9.05% and a net margin of 25.09%. The firm's quarterly revenue was up 5.4% on a year-over-year basis. During the same quarter in the previous year, the firm posted $5.16 EPS. As a group, research analysts anticipate that Vital Energy, Inc. will post 6.9 earnings per share for the current fiscal year.

About Vital Energy

(

Free Report)

Vital Energy, Inc, an independent energy company, engages in the acquisition, exploration, and development of oil and natural gas properties in the Permian Basin of West Texas, the United States. The company was formerly known as Laredo Petroleum, Inc and changed its name to Vital Energy, Inc in January 2023.

Read More

Before you consider Vital Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vital Energy wasn't on the list.

While Vital Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.