Rockefeller Capital Management L.P. cut its holdings in Vodafone Group Public Limited (NASDAQ:VOD - Free Report) by 16.3% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 649,455 shares of the cell phone carrier's stock after selling 126,430 shares during the period. Rockefeller Capital Management L.P.'s holdings in Vodafone Group Public were worth $6,507,000 as of its most recent filing with the SEC.

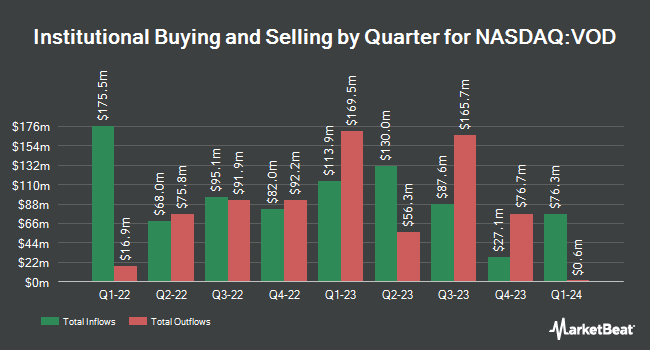

Other institutional investors have also made changes to their positions in the company. GAMMA Investing LLC increased its stake in Vodafone Group Public by 116.7% during the second quarter. GAMMA Investing LLC now owns 3,903 shares of the cell phone carrier's stock valued at $35,000 after acquiring an additional 2,102 shares during the period. Asset Dedication LLC increased its stake in Vodafone Group Public by 630.9% during the second quarter. Asset Dedication LLC now owns 4,634 shares of the cell phone carrier's stock valued at $41,000 after acquiring an additional 4,000 shares during the period. Trust Co. of Vermont increased its stake in Vodafone Group Public by 1,493.2% during the third quarter. Trust Co. of Vermont now owns 4,700 shares of the cell phone carrier's stock valued at $47,000 after acquiring an additional 4,405 shares during the period. Rothschild Investment LLC acquired a new stake in Vodafone Group Public during the second quarter valued at approximately $49,000. Finally, CENTRAL TRUST Co boosted its holdings in Vodafone Group Public by 37.8% during the third quarter. CENTRAL TRUST Co now owns 5,516 shares of the cell phone carrier's stock valued at $55,000 after purchasing an additional 1,513 shares in the last quarter. 7.84% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Separately, StockNews.com raised Vodafone Group Public from a "hold" rating to a "buy" rating in a report on Friday, August 30th. One investment analyst has rated the stock with a sell rating, one has given a hold rating, two have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy".

Get Our Latest Report on VOD

Vodafone Group Public Price Performance

Shares of VOD traded down $0.07 on Wednesday, hitting $8.76. The company's stock had a trading volume of 6,415,638 shares, compared to its average volume of 6,153,760. The company has a quick ratio of 1.34, a current ratio of 1.37 and a debt-to-equity ratio of 0.78. Vodafone Group Public Limited has a fifty-two week low of $8.02 and a fifty-two week high of $10.39. The company has a 50 day moving average price of $9.36 and a 200 day moving average price of $9.39.

Vodafone Group Public Cuts Dividend

The firm also recently announced a semi-annual dividend, which will be paid on Friday, February 7th. Stockholders of record on Friday, November 22nd will be issued a $0.2423 dividend. This represents a dividend yield of 8%. The ex-dividend date of this dividend is Friday, November 22nd.

Vodafone Group Public Company Profile

(

Free Report)

Vodafone Group Public Limited Company provides telecommunication services in Europe and internationally. It offers mobile connectivity services comprising end-to-end services for mobile voice and data, messaging, device management, BYOx, and telecoms management, as well as professional and consulting services; and fixed line connectivity, such as fixed voice and data, broadband, software-defined networks, managed WAN, LAN, ethernet, and satellite; and financial services, as well as business and merchant services.

Featured Articles

Before you consider Vodafone Group Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vodafone Group Public wasn't on the list.

While Vodafone Group Public currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.