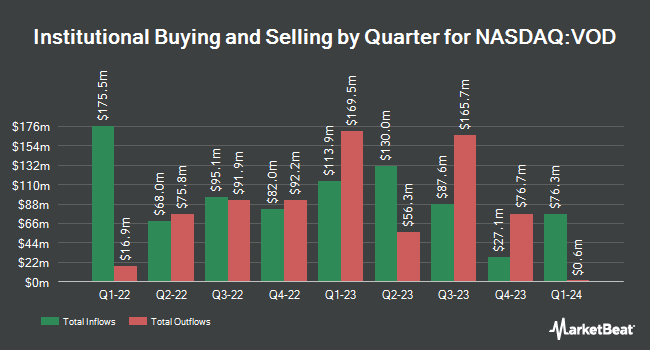

US Bancorp DE grew its position in shares of Vodafone Group Public Limited (NASDAQ:VOD - Free Report) by 79.0% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 131,685 shares of the cell phone carrier's stock after purchasing an additional 58,130 shares during the period. US Bancorp DE's holdings in Vodafone Group Public were worth $1,319,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. ACR Alpine Capital Research LLC grew its holdings in shares of Vodafone Group Public by 1.2% during the second quarter. ACR Alpine Capital Research LLC now owns 21,870,016 shares of the cell phone carrier's stock valued at $193,987,000 after purchasing an additional 261,060 shares during the last quarter. Mediolanum International Funds Ltd purchased a new stake in shares of Vodafone Group Public during the third quarter worth $82,716,000. Oppenheimer Asset Management Inc. increased its holdings in Vodafone Group Public by 9.6% in the second quarter. Oppenheimer Asset Management Inc. now owns 4,984,642 shares of the cell phone carrier's stock worth $44,214,000 after buying an additional 435,877 shares during the last quarter. Bank of Montreal Can boosted its holdings in Vodafone Group Public by 445.7% in the second quarter. Bank of Montreal Can now owns 3,805,044 shares of the cell phone carrier's stock worth $34,055,000 after purchasing an additional 3,107,734 shares in the last quarter. Finally, Hsbc Holdings PLC raised its stake in shares of Vodafone Group Public by 345.2% in the 2nd quarter. Hsbc Holdings PLC now owns 3,026,713 shares of the cell phone carrier's stock valued at $26,786,000 after acquiring an additional 2,346,815 shares in the last quarter. Hedge funds and other institutional investors own 7.84% of the company's stock.

Analyst Ratings Changes

VOD has been the subject of several research reports. UBS Group cut Vodafone Group Public from a "buy" rating to a "neutral" rating in a research report on Monday, August 5th. StockNews.com upgraded Vodafone Group Public from a "hold" rating to a "buy" rating in a research report on Friday, August 30th. One research analyst has rated the stock with a sell rating, one has issued a hold rating, two have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy".

Check Out Our Latest Report on VOD

Vodafone Group Public Price Performance

Shares of VOD traded down $0.04 on Friday, hitting $9.28. The company's stock had a trading volume of 5,505,085 shares, compared to its average volume of 6,074,084. The firm's fifty day moving average price is $9.78 and its 200-day moving average price is $9.37. The company has a debt-to-equity ratio of 0.79, a current ratio of 1.31 and a quick ratio of 1.29. Vodafone Group Public Limited has a fifty-two week low of $8.02 and a fifty-two week high of $10.39.

Vodafone Group Public Profile

(

Free Report)

Vodafone Group Public Limited Company provides telecommunication services in Europe and internationally. It offers mobile connectivity services comprising end-to-end services for mobile voice and data, messaging, device management, BYOx, and telecoms management, as well as professional and consulting services; and fixed line connectivity, such as fixed voice and data, broadband, software-defined networks, managed WAN, LAN, ethernet, and satellite; and financial services, as well as business and merchant services.

Further Reading

Before you consider Vodafone Group Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vodafone Group Public wasn't on the list.

While Vodafone Group Public currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.