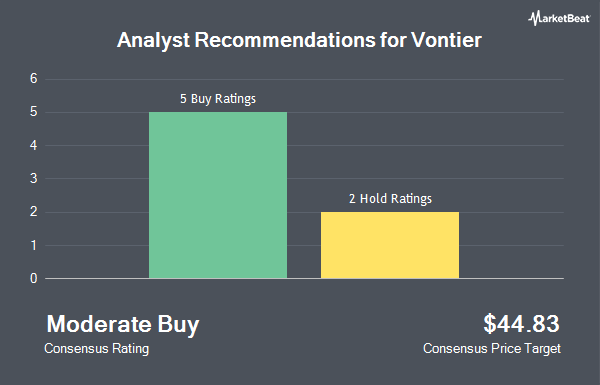

Vontier Co. (NYSE:VNT - Get Free Report) has earned an average rating of "Moderate Buy" from the eight research firms that are presently covering the company, MarketBeat reports. Three equities research analysts have rated the stock with a hold recommendation and five have assigned a buy recommendation to the company. The average 1-year price objective among brokers that have issued a report on the stock in the last year is $44.50.

A number of brokerages recently issued reports on VNT. Robert W. Baird decreased their price target on shares of Vontier from $44.00 to $42.00 and set a "neutral" rating for the company in a research note on Friday, August 2nd. Evercore ISI reduced their price objective on shares of Vontier from $45.00 to $40.00 and set an "outperform" rating on the stock in a report on Monday, August 19th. Argus downgraded shares of Vontier from a "buy" rating to a "hold" rating in a research note on Tuesday, August 20th. Finally, Barclays increased their target price on Vontier from $44.00 to $46.00 and gave the company an "overweight" rating in a report on Tuesday, November 5th.

View Our Latest Analysis on VNT

Vontier Stock Down 1.0 %

VNT traded down $0.40 during trading hours on Friday, hitting $40.05. 1,163,340 shares of the company's stock were exchanged, compared to its average volume of 845,253. The firm has a market cap of $6.02 billion, a P/E ratio of 15.34, a price-to-earnings-growth ratio of 1.87 and a beta of 1.25. Vontier has a 12-month low of $31.22 and a 12-month high of $45.62. The company has a current ratio of 1.64, a quick ratio of 1.23 and a debt-to-equity ratio of 2.10. The firm has a 50 day moving average of $34.37 and a 200 day moving average of $36.86.

Vontier (NYSE:VNT - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported $0.73 earnings per share for the quarter, topping analysts' consensus estimates of $0.69 by $0.04. Vontier had a return on equity of 45.48% and a net margin of 13.54%. The business had revenue of $750.00 million for the quarter, compared to analyst estimates of $729.23 million. During the same quarter in the prior year, the company earned $0.73 earnings per share. The company's revenue was down 2.0% on a year-over-year basis. Analysts predict that Vontier will post 2.89 EPS for the current fiscal year.

Vontier Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Thursday, December 12th. Stockholders of record on Thursday, November 21st will be issued a $0.025 dividend. The ex-dividend date is Thursday, November 21st. This represents a $0.10 dividend on an annualized basis and a dividend yield of 0.25%. Vontier's payout ratio is 3.83%.

Institutional Trading of Vontier

Several institutional investors and hedge funds have recently bought and sold shares of VNT. Envestnet Portfolio Solutions Inc. purchased a new stake in Vontier during the 1st quarter valued at approximately $205,000. Susquehanna Fundamental Investments LLC acquired a new position in Vontier in the 1st quarter valued at $971,000. Choate Investment Advisors raised its position in Vontier by 4.7% during the 1st quarter. Choate Investment Advisors now owns 90,375 shares of the company's stock worth $4,099,000 after buying an additional 4,088 shares during the last quarter. Inspire Investing LLC increased its stake in shares of Vontier by 17.6% during the first quarter. Inspire Investing LLC now owns 45,120 shares of the company's stock worth $2,047,000 after acquiring an additional 6,768 shares during the period. Finally, Headlands Technologies LLC purchased a new position in Vontier during the first quarter worth about $46,000. Hedge funds and other institutional investors own 95.83% of the company's stock.

Vontier Company Profile

(

Get Free ReportVontier Corporation provides mobility ecosystem solutions worldwide. The company operates through Mobility Technologies, Repair Solutions, and Environmental and Fueling Solutions segments. The Mobility Technologies segment provides digitally equipment solutions for mobility ecosystem, such as point-of-sale and payment systems, workflow automation, telematics, data analytics, software platform, and integrated solutions for alternative fuel dispensing.

Further Reading

Before you consider Vontier, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vontier wasn't on the list.

While Vontier currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.