Voya Financial (NYSE:VOYA - Get Free Report)'s stock had its "neutral" rating reaffirmed by equities research analysts at Bank of America in a research note issued to investors on Wednesday, Marketbeat.com reports. They currently have a $83.00 price target on the asset manager's stock, down from their previous price target of $91.00. Bank of America's target price would suggest a potential upside of 16.39% from the company's previous close.

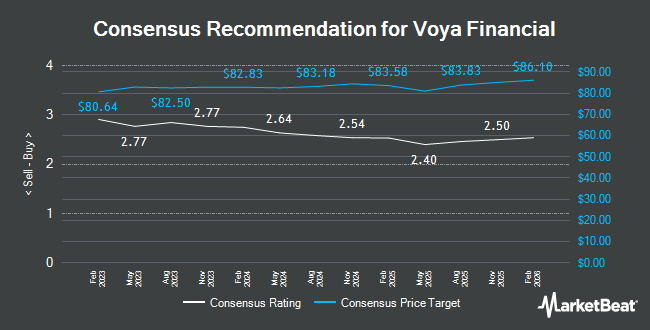

A number of other equities analysts have also recently issued reports on VOYA. UBS Group raised Voya Financial to a "strong-buy" rating in a report on Monday, November 11th. Keefe, Bruyette & Woods dropped their price objective on shares of Voya Financial from $95.00 to $92.00 and set an "outperform" rating for the company in a report on Tuesday. Morgan Stanley cut their target price on shares of Voya Financial from $76.00 to $75.00 and set an "equal weight" rating on the stock in a research report on Monday, August 19th. JPMorgan Chase & Co. downgraded shares of Voya Financial from an "overweight" rating to a "neutral" rating and set a $87.00 price target for the company. in a research note on Thursday, October 3rd. Finally, Evercore ISI decreased their price objective on Voya Financial from $94.00 to $89.00 and set an "outperform" rating for the company in a report on Tuesday. Seven analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $85.67.

Read Our Latest Stock Report on VOYA

Voya Financial Price Performance

Shares of VOYA traded down $0.90 during mid-day trading on Wednesday, reaching $71.31. The company had a trading volume of 1,788,926 shares, compared to its average volume of 820,396. The company has a market capitalization of $6.86 billion, a price-to-earnings ratio of 11.33, a P/E/G ratio of 0.56 and a beta of 1.02. The company has a debt-to-equity ratio of 0.54, a quick ratio of 0.31 and a current ratio of 0.31. The company's 50 day simple moving average is $80.94 and its 200 day simple moving average is $75.13. Voya Financial has a 1-year low of $63.11 and a 1-year high of $84.30.

Voya Financial (NYSE:VOYA - Get Free Report) last issued its earnings results on Monday, November 4th. The asset manager reported $2.12 earnings per share for the quarter, beating analysts' consensus estimates of $2.05 by $0.07. The firm had revenue of $1.96 billion for the quarter, compared to analyst estimates of $1.86 billion. Voya Financial had a net margin of 8.81% and a return on equity of 15.09%. The company's quarterly revenue was up 7.3% on a year-over-year basis. During the same quarter last year, the business posted $2.07 earnings per share. Analysts expect that Voya Financial will post 8.4 EPS for the current year.

Insiders Place Their Bets

In other news, insider Tony D. Oh sold 715 shares of Voya Financial stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $81.95, for a total transaction of $58,594.25. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 1.37% of the stock is currently owned by insiders.

Institutional Trading of Voya Financial

Hedge funds and other institutional investors have recently modified their holdings of the business. Retirement Systems of Alabama boosted its position in shares of Voya Financial by 8.2% in the third quarter. Retirement Systems of Alabama now owns 272,339 shares of the asset manager's stock valued at $21,575,000 after acquiring an additional 20,750 shares during the period. Wilmington Savings Fund Society FSB bought a new position in Voya Financial in the 3rd quarter valued at $209,000. Coldstream Capital Management Inc. boosted its holdings in Voya Financial by 8.1% in the 3rd quarter. Coldstream Capital Management Inc. now owns 3,591 shares of the asset manager's stock valued at $285,000 after purchasing an additional 270 shares during the period. Barclays PLC grew its position in shares of Voya Financial by 48.2% during the 3rd quarter. Barclays PLC now owns 48,890 shares of the asset manager's stock valued at $3,872,000 after purchasing an additional 15,902 shares in the last quarter. Finally, LRI Investments LLC increased its holdings in shares of Voya Financial by 780.5% in the third quarter. LRI Investments LLC now owns 1,039 shares of the asset manager's stock worth $85,000 after purchasing an additional 921 shares during the period. Institutional investors own 96.10% of the company's stock.

Voya Financial Company Profile

(

Get Free Report)

Voya Financial, Inc engages in the provision of workplace benefits and savings products in the United States and internationally. The company operates through three segments: Wealth Solutions, Health Solutions, and Investment Management. The Wealth Solutions segment offers full-service retirement products; recordkeeping services; stable value and fixed general account investment products; non-qualified plan administration services; and tools, guidance, and services to promote the financial well-being and retirement security of employees.

Featured Stories

Before you consider Voya Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Voya Financial wasn't on the list.

While Voya Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.