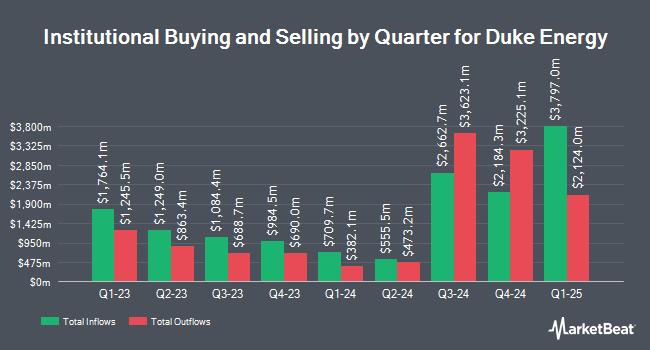

VSM Wealth Advisory LLC acquired a new stake in Duke Energy Co. (NYSE:DUK - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 3,597 shares of the utilities provider's stock, valued at approximately $388,000.

Other hedge funds have also recently added to or reduced their stakes in the company. Fox Hill Wealth Management raised its holdings in Duke Energy by 5.3% in the 4th quarter. Fox Hill Wealth Management now owns 26,125 shares of the utilities provider's stock valued at $2,815,000 after acquiring an additional 1,314 shares during the last quarter. Compass Ion Advisors LLC acquired a new position in Duke Energy in the fourth quarter valued at $208,000. Xponance Inc. boosted its stake in Duke Energy by 4.0% in the 4th quarter. Xponance Inc. now owns 110,162 shares of the utilities provider's stock worth $11,869,000 after buying an additional 4,278 shares during the last quarter. Horizon Investments LLC increased its stake in shares of Duke Energy by 2.7% during the 4th quarter. Horizon Investments LLC now owns 14,542 shares of the utilities provider's stock valued at $1,567,000 after acquiring an additional 386 shares during the last quarter. Finally, Advisors Asset Management Inc. lifted its holdings in shares of Duke Energy by 8.4% during the 4th quarter. Advisors Asset Management Inc. now owns 41,504 shares of the utilities provider's stock worth $4,472,000 after acquiring an additional 3,201 shares during the period. 65.31% of the stock is currently owned by hedge funds and other institutional investors.

Duke Energy Stock Performance

Shares of NYSE:DUK traded down $1.15 on Friday, hitting $119.01. The company's stock had a trading volume of 5,850,305 shares, compared to its average volume of 2,998,771. The company has a market capitalization of $92.47 billion, a price-to-earnings ratio of 20.84, a price-to-earnings-growth ratio of 2.79 and a beta of 0.48. The company has a debt-to-equity ratio of 1.52, a quick ratio of 0.44 and a current ratio of 0.67. Duke Energy Co. has a 12 month low of $92.75 and a 12 month high of $121.47. The stock's 50-day moving average is $114.16 and its two-hundred day moving average is $113.67.

Duke Energy (NYSE:DUK - Get Free Report) last released its earnings results on Thursday, February 13th. The utilities provider reported $1.66 EPS for the quarter, beating the consensus estimate of $1.61 by $0.05. Duke Energy had a net margin of 14.90% and a return on equity of 9.50%. On average, equities research analysts forecast that Duke Energy Co. will post 6.33 EPS for the current year.

Duke Energy Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, March 17th. Stockholders of record on Friday, February 14th were issued a $1.045 dividend. The ex-dividend date of this dividend was Friday, February 14th. This represents a $4.18 annualized dividend and a dividend yield of 3.51%. Duke Energy's dividend payout ratio (DPR) is 73.20%.

Wall Street Analysts Forecast Growth

A number of research firms have weighed in on DUK. Jefferies Financial Group increased their price target on shares of Duke Energy from $129.00 to $132.00 and gave the stock a "buy" rating in a research note on Friday, February 21st. BMO Capital Markets boosted their price objective on shares of Duke Energy from $123.00 to $128.00 and gave the stock an "outperform" rating in a research note on Tuesday, March 11th. Scotiabank boosted their price target on Duke Energy from $113.00 to $120.00 and gave the stock a "sector perform" rating in a research report on Thursday, December 12th. Morgan Stanley raised their target price on Duke Energy from $123.00 to $128.00 and gave the company an "equal weight" rating in a research note on Thursday. Finally, UBS Group raised their price objective on shares of Duke Energy from $123.00 to $127.00 and gave the stock a "neutral" rating in a report on Friday. Seven equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. According to data from MarketBeat, Duke Energy presently has a consensus rating of "Moderate Buy" and a consensus price target of $123.87.

Get Our Latest Stock Report on Duke Energy

Duke Energy Profile

(

Free Report)

Duke Energy Corporation, together with its subsidiaries, operates as an energy company in the United States. It operates through two segments: Electric Utilities and Infrastructure (EU&I), and Gas Utilities and Infrastructure (GU&I). The EU&I segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, and the Midwest.

Featured Stories

Before you consider Duke Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Duke Energy wasn't on the list.

While Duke Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.