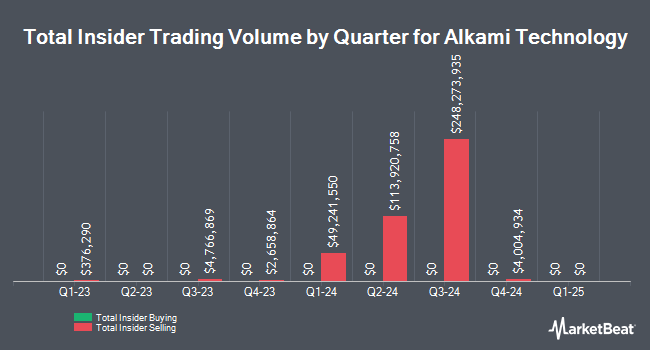

Alkami Technology, Inc. (NASDAQ:ALKT - Get Free Report) CFO W Bryan Hill sold 100,000 shares of Alkami Technology stock in a transaction on Monday, December 16th. The stock was sold at an average price of $39.77, for a total transaction of $3,977,000.00. Following the completion of the transaction, the chief financial officer now directly owns 353,841 shares of the company's stock, valued at approximately $14,072,256.57. This represents a 22.03 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink.

W Bryan Hill also recently made the following trade(s):

- On Tuesday, December 3rd, W Bryan Hill sold 17,807 shares of Alkami Technology stock. The shares were sold at an average price of $38.37, for a total transaction of $683,254.59.

- On Monday, November 25th, W Bryan Hill sold 99,755 shares of Alkami Technology stock. The stock was sold at an average price of $41.89, for a total transaction of $4,178,736.95.

- On Thursday, November 21st, W Bryan Hill sold 110,250 shares of Alkami Technology stock. The stock was sold at an average price of $38.62, for a total value of $4,257,855.00.

- On Monday, November 18th, W Bryan Hill sold 100,000 shares of Alkami Technology stock. The stock was sold at an average price of $36.31, for a total transaction of $3,631,000.00.

- On Monday, September 23rd, W Bryan Hill sold 55,046 shares of Alkami Technology stock. The shares were sold at an average price of $31.19, for a total transaction of $1,716,884.74.

Alkami Technology Price Performance

Shares of ALKT traded down $1.16 during trading hours on Wednesday, hitting $37.94. 891,352 shares of the company were exchanged, compared to its average volume of 543,117. The firm has a fifty day simple moving average of $37.80 and a 200-day simple moving average of $33.08. The company has a market capitalization of $3.81 billion, a PE ratio of -80.72 and a beta of 0.46. The company has a debt-to-equity ratio of 0.05, a current ratio of 3.52 and a quick ratio of 3.52. Alkami Technology, Inc. has a one year low of $22.62 and a one year high of $42.29.

Analyst Ratings Changes

ALKT has been the subject of several analyst reports. Needham & Company LLC boosted their price objective on Alkami Technology from $43.00 to $54.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Barclays increased their price target on Alkami Technology from $35.00 to $41.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 31st. JMP Securities lifted their price objective on shares of Alkami Technology from $38.00 to $41.00 and gave the company a "market outperform" rating in a research note on Tuesday, October 29th. Craig Hallum boosted their price target on shares of Alkami Technology from $38.00 to $45.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Finally, JPMorgan Chase & Co. raised their price objective on shares of Alkami Technology from $42.00 to $45.00 and gave the company an "overweight" rating in a research note on Monday, December 9th. Two research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company's stock. Based on data from MarketBeat, Alkami Technology presently has an average rating of "Moderate Buy" and a consensus price target of $40.88.

View Our Latest Analysis on ALKT

Institutional Trading of Alkami Technology

Institutional investors and hedge funds have recently bought and sold shares of the stock. Franklin Resources Inc. lifted its holdings in shares of Alkami Technology by 4.4% in the third quarter. Franklin Resources Inc. now owns 1,804,825 shares of the company's stock valued at $61,364,000 after purchasing an additional 75,469 shares in the last quarter. Geode Capital Management LLC boosted its position in Alkami Technology by 16.4% during the 3rd quarter. Geode Capital Management LLC now owns 1,231,987 shares of the company's stock worth $38,865,000 after acquiring an additional 173,394 shares during the period. Bullseye Asset Management LLC grew its stake in Alkami Technology by 6.2% during the 3rd quarter. Bullseye Asset Management LLC now owns 85,826 shares of the company's stock valued at $2,707,000 after acquiring an additional 5,000 shares in the last quarter. Barclays PLC increased its holdings in shares of Alkami Technology by 108.2% in the 3rd quarter. Barclays PLC now owns 95,391 shares of the company's stock valued at $3,009,000 after purchasing an additional 49,580 shares during the period. Finally, Castleark Management LLC purchased a new stake in shares of Alkami Technology in the third quarter worth approximately $6,050,000. Institutional investors and hedge funds own 54.97% of the company's stock.

Alkami Technology Company Profile

(

Get Free Report)

Alkami Technology, Inc offers cloud-based digital banking solutions in the United States. The company's Alkami Platform allows financial institutions to onboard and engage new users, accelerate revenues, and enhance operational efficiency, with the support of a proprietary, cloud-based, and multi-tenant architecture.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alkami Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkami Technology wasn't on the list.

While Alkami Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.