Walleye Capital LLC purchased a new position in Franklin Electric Co., Inc. (NASDAQ:FELE - Free Report) during the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 5,506 shares of the industrial products company's stock, valued at approximately $577,000.

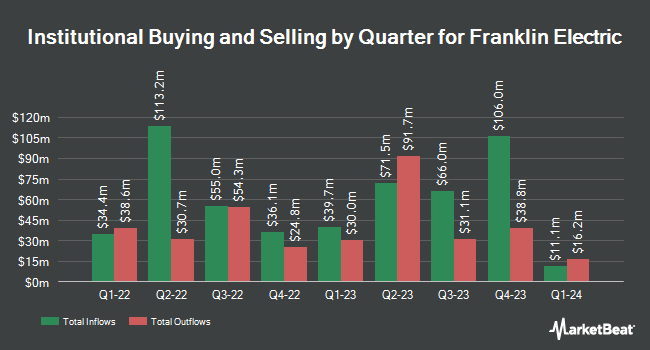

A number of other institutional investors also recently bought and sold shares of the business. First Merchants Corp purchased a new position in shares of Franklin Electric during the second quarter worth $19,054,000. F M Investments LLC purchased a new position in Franklin Electric during the second quarter valued at approximately $9,158,000. Assenagon Asset Management S.A. lifted its holdings in Franklin Electric by 116.5% in the second quarter. Assenagon Asset Management S.A. now owns 165,601 shares of the industrial products company's stock valued at $15,951,000 after acquiring an additional 89,128 shares during the period. KBC Group NV boosted its position in Franklin Electric by 19.6% in the 3rd quarter. KBC Group NV now owns 387,058 shares of the industrial products company's stock worth $40,571,000 after purchasing an additional 63,436 shares in the last quarter. Finally, Edgestream Partners L.P. grew its stake in shares of Franklin Electric by 328.4% during the 2nd quarter. Edgestream Partners L.P. now owns 64,431 shares of the industrial products company's stock worth $6,206,000 after purchasing an additional 49,391 shares during the period. 79.98% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Separately, Robert W. Baird lowered their price target on shares of Franklin Electric from $107.00 to $105.00 and set a "neutral" rating on the stock in a report on Wednesday, October 30th.

Read Our Latest Stock Report on Franklin Electric

Franklin Electric Price Performance

FELE traded down $0.40 during trading on Friday, hitting $106.57. The company's stock had a trading volume of 89,680 shares, compared to its average volume of 166,468. The company has a current ratio of 2.40, a quick ratio of 1.06 and a debt-to-equity ratio of 0.01. The firm has a market capitalization of $4.87 billion, a price-to-earnings ratio of 26.98, a P/E/G ratio of 2.36 and a beta of 0.98. The business's fifty day simple moving average is $104.93 and its 200 day simple moving average is $101.20. Franklin Electric Co., Inc. has a twelve month low of $90.79 and a twelve month high of $111.94.

Franklin Electric (NASDAQ:FELE - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The industrial products company reported $1.17 EPS for the quarter, missing the consensus estimate of $1.27 by ($0.10). The company had revenue of $531.40 million during the quarter, compared to analysts' expectations of $551.08 million. Franklin Electric had a return on equity of 15.03% and a net margin of 9.22%. Franklin Electric's revenue was down 1.4% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.23 EPS. On average, equities research analysts forecast that Franklin Electric Co., Inc. will post 3.81 EPS for the current fiscal year.

Franklin Electric Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, November 21st. Investors of record on Thursday, November 7th were issued a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 0.94%. The ex-dividend date was Thursday, November 7th. Franklin Electric's payout ratio is 25.32%.

Insider Buying and Selling

In other Franklin Electric news, insider Gregg C. Sengstack sold 1,500 shares of the firm's stock in a transaction on Tuesday, November 5th. The stock was sold at an average price of $100.22, for a total value of $150,330.00. Following the transaction, the insider now owns 9,032 shares in the company, valued at approximately $905,187.04. This trade represents a 14.24 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. 2.72% of the stock is currently owned by insiders.

Franklin Electric Profile

(

Free Report)

Franklin Electric Co, Inc, together with its subsidiaries, designs, manufactures, and distributes water and fuel pumping systems worldwide. The company operates through Water Systems, Fueling Systems, and Distribution segments. The Water Systems segment offers submersible motors, drives, pumps, electronic controls, water treatment systems, monitoring devices, and related parts and equipment.

Featured Articles

Before you consider Franklin Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franklin Electric wasn't on the list.

While Franklin Electric currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.