Walleye Capital LLC acquired a new position in shares of Littelfuse, Inc. (NASDAQ:LFUS - Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 20,318 shares of the technology company's stock, valued at approximately $5,389,000. Walleye Capital LLC owned about 0.08% of Littelfuse at the end of the most recent quarter.

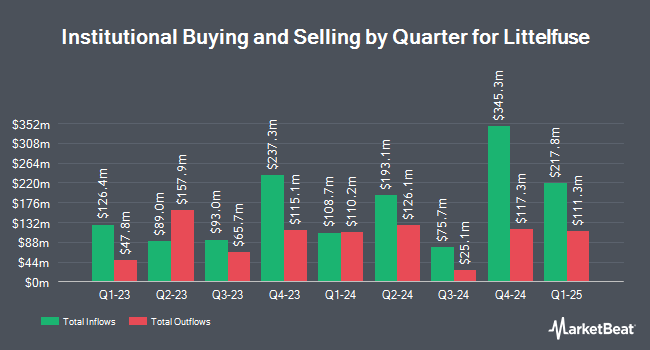

Several other large investors have also recently added to or reduced their stakes in the company. SG Americas Securities LLC raised its holdings in shares of Littelfuse by 399.7% during the second quarter. SG Americas Securities LLC now owns 4,712 shares of the technology company's stock worth $1,204,000 after acquiring an additional 3,769 shares during the period. Chesapeake Capital Corp IL bought a new position in Littelfuse in the third quarter valued at $570,000. Thrivent Financial for Lutherans grew its position in Littelfuse by 1.4% in the third quarter. Thrivent Financial for Lutherans now owns 278,158 shares of the technology company's stock valued at $73,781,000 after purchasing an additional 3,831 shares in the last quarter. Victory Capital Management Inc. grew its position in shares of Littelfuse by 13.2% in the 2nd quarter. Victory Capital Management Inc. now owns 501,504 shares of the technology company's stock valued at $128,179,000 after acquiring an additional 58,529 shares during the period. Finally, Federated Hermes Inc. grew its position in shares of Littelfuse by 3.4% in the 2nd quarter. Federated Hermes Inc. now owns 209,976 shares of the technology company's stock valued at $53,668,000 after acquiring an additional 6,814 shares during the period. 96.14% of the stock is owned by institutional investors.

Insider Buying and Selling at Littelfuse

In related news, SVP Matthew Cole sold 1,436 shares of Littelfuse stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $246.02, for a total transaction of $353,284.72. Following the completion of the transaction, the senior vice president now directly owns 5,522 shares of the company's stock, valued at approximately $1,358,522.44. The trade was a 20.64 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. 2.30% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

A number of research analysts have recently commented on the stock. Oppenheimer raised shares of Littelfuse from a "market perform" rating to an "outperform" rating and set a $310.00 price objective for the company in a research report on Thursday, October 17th. Stifel Nicolaus upgraded shares of Littelfuse from a "hold" rating to a "buy" rating and raised their target price for the stock from $270.00 to $280.00 in a research note on Tuesday, August 13th. Benchmark reiterated a "hold" rating on shares of Littelfuse in a research note on Wednesday, October 30th. Robert W. Baird boosted their target price on shares of Littelfuse from $300.00 to $315.00 and gave the company an "outperform" rating in a research report on Thursday, August 29th. Finally, StockNews.com raised shares of Littelfuse from a "hold" rating to a "buy" rating in a report on Friday, October 18th. Three investment analysts have rated the stock with a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, Littelfuse presently has an average rating of "Moderate Buy" and an average target price of $285.00.

Check Out Our Latest Stock Analysis on Littelfuse

Littelfuse Stock Performance

NASDAQ:LFUS traded up $1.15 during mid-day trading on Monday, reaching $247.82. The company's stock had a trading volume of 109,611 shares, compared to its average volume of 127,565. The firm's fifty day moving average price is $253.38 and its two-hundred day moving average price is $255.99. The stock has a market cap of $6.15 billion, a P/E ratio of 31.85, a PEG ratio of 2.43 and a beta of 1.28. The company has a current ratio of 3.55, a quick ratio of 2.52 and a debt-to-equity ratio of 0.31. Littelfuse, Inc. has a 12-month low of $222.91 and a 12-month high of $275.58.

Littelfuse (NASDAQ:LFUS - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The technology company reported $2.71 earnings per share for the quarter, topping the consensus estimate of $2.09 by $0.62. The business had revenue of $567.39 million during the quarter, compared to the consensus estimate of $557.38 million. Littelfuse had a return on equity of 8.49% and a net margin of 8.88%. The company's quarterly revenue was down 6.5% on a year-over-year basis. During the same quarter last year, the company earned $2.97 earnings per share. On average, equities analysts forecast that Littelfuse, Inc. will post 8.47 EPS for the current fiscal year.

Littelfuse Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, December 5th. Shareholders of record on Thursday, November 21st will be issued a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a yield of 1.13%. The ex-dividend date is Thursday, November 21st. Littelfuse's payout ratio is presently 35.99%.

Littelfuse Profile

(

Free Report)

Littelfuse, Inc designs, manufactures, and sells electronic components, modules, and subassemblies in the Americas, Asia-Pacific, and Europe. The company operates through Electronic, Transportation, and Industrial segments. The Electronics segment offers fuses and fuse accessories, positive temperature coefficient resettable fuses, electromechanical switches and interconnect solutions, polymer electrostatic discharge suppressors, varistors, reed switch based magnetic sensing products, and gas discharge tubes; and discrete transient voltage suppressor (TVS) diodes, TVS diode arrays, protection and switching thyristors, metal-oxide-semiconductor field-effect transistors and diodes, and insulated gate bipolar transistors.

See Also

Before you consider Littelfuse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Littelfuse wasn't on the list.

While Littelfuse currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.