Walleye Capital LLC bought a new position in shares of NewAmsterdam Pharma (NASDAQ:NAMS - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 46,947 shares of the company's stock, valued at approximately $779,000. Walleye Capital LLC owned about 0.05% of NewAmsterdam Pharma at the end of the most recent quarter.

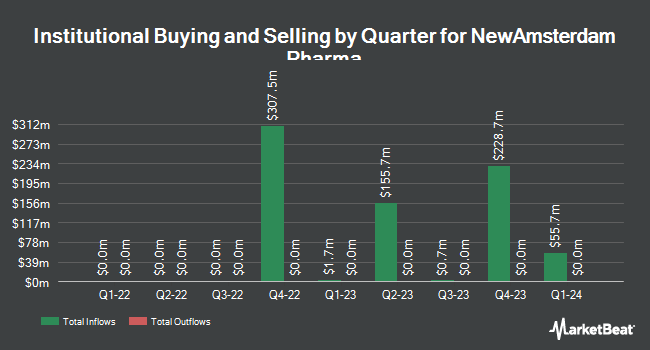

Several other large investors have also added to or reduced their stakes in the business. Banque Cantonale Vaudoise acquired a new position in NewAmsterdam Pharma during the second quarter worth $38,000. Sei Investments Co. boosted its holdings in NewAmsterdam Pharma by 49.1% during the second quarter. Sei Investments Co. now owns 24,561 shares of the company's stock worth $472,000 after purchasing an additional 8,087 shares during the last quarter. Wolverine Asset Management LLC lifted its stake in NewAmsterdam Pharma by 117.7% in the second quarter. Wolverine Asset Management LLC now owns 15,524 shares of the company's stock valued at $298,000 after acquiring an additional 8,394 shares during the last quarter. TimesSquare Capital Management LLC lifted its stake in NewAmsterdam Pharma by 3.7% in the third quarter. TimesSquare Capital Management LLC now owns 255,245 shares of the company's stock valued at $4,237,000 after acquiring an additional 9,160 shares during the last quarter. Finally, GSA Capital Partners LLP lifted its stake in NewAmsterdam Pharma by 79.9% in the third quarter. GSA Capital Partners LLP now owns 66,402 shares of the company's stock valued at $1,102,000 after acquiring an additional 29,496 shares during the last quarter. Institutional investors and hedge funds own 89.89% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have commented on NAMS shares. Piper Sandler reiterated an "overweight" rating and issued a $37.00 price target on shares of NewAmsterdam Pharma in a research note on Monday, September 23rd. Royal Bank of Canada reiterated an "outperform" rating and issued a $31.00 price target on shares of NewAmsterdam Pharma in a research note on Thursday, September 5th. Finally, Needham & Company LLC reiterated a "buy" rating and issued a $36.00 price target on shares of NewAmsterdam Pharma in a research note on Thursday. Six equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company has an average rating of "Buy" and a consensus target price of $33.80.

Check Out Our Latest Analysis on NAMS

NewAmsterdam Pharma Price Performance

Shares of NAMS traded up $0.28 during trading hours on Friday, hitting $18.35. The company had a trading volume of 398,520 shares, compared to its average volume of 731,910. The business has a fifty day moving average of $19.87 and a 200-day moving average of $18.55. NewAmsterdam Pharma has a 12 month low of $8.90 and a 12 month high of $26.35.

Insider Activity

In related news, major shareholder Nap B.V. Forgrowth sold 8,530 shares of the firm's stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $25.02, for a total transaction of $213,420.60. Following the transaction, the insider now directly owns 11,812,033 shares of the company's stock, valued at approximately $295,537,065.66. This trade represents a 0.07 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CAO Louise Frederika Kooij sold 45,000 shares of the firm's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $15.72, for a total transaction of $707,400.00. The disclosure for this sale can be found here. Insiders have sold 86,803 shares of company stock valued at $1,755,307 over the last ninety days. 19.50% of the stock is currently owned by company insiders.

NewAmsterdam Pharma Company Profile

(

Free Report)

NewAmsterdam Pharma Company N.V., a late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease. It is developing obicetrapib, an oral low-dose cholesteryl ester transfer protein (CETP) inhibitor, that is in various clinical trials as a monotherapy and a combination therapy with ezetimibe for lowering LDL-C for cardiovascular diseases.

Featured Stories

Before you consider NewAmsterdam Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NewAmsterdam Pharma wasn't on the list.

While NewAmsterdam Pharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.