First Horizon Advisors Inc. trimmed its holdings in shares of Walmart Inc. (NYSE:WMT - Free Report) by 4.2% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 471,196 shares of the retailer's stock after selling 20,903 shares during the period. Walmart comprises 1.1% of First Horizon Advisors Inc.'s holdings, making the stock its 21st largest position. First Horizon Advisors Inc.'s holdings in Walmart were worth $38,049,000 as of its most recent SEC filing.

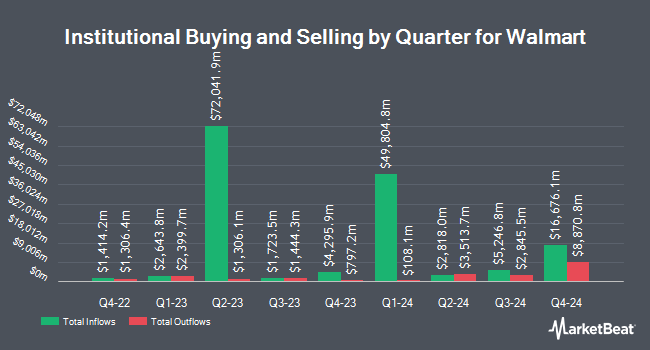

A number of other hedge funds and other institutional investors have also modified their holdings of WMT. WFA Asset Management Corp increased its holdings in shares of Walmart by 201.0% in the first quarter. WFA Asset Management Corp now owns 2,092 shares of the retailer's stock valued at $126,000 after purchasing an additional 1,397 shares during the last quarter. Dupont Capital Management Corp increased its holdings in shares of Walmart by 165.4% during the first quarter. Dupont Capital Management Corp now owns 270,147 shares of the retailer's stock worth $16,255,000 after purchasing an additional 168,346 shares during the period. Empowered Funds LLC raised its position in shares of Walmart by 307.1% in the first quarter. Empowered Funds LLC now owns 160,292 shares of the retailer's stock valued at $9,645,000 after buying an additional 120,919 shares in the last quarter. Rockport Wealth LLC bought a new stake in shares of Walmart in the first quarter valued at approximately $226,000. Finally, Alerus Financial NA grew its position in Walmart by 203.4% during the first quarter. Alerus Financial NA now owns 82,062 shares of the retailer's stock worth $4,938,000 after buying an additional 55,012 shares in the last quarter. Institutional investors and hedge funds own 26.76% of the company's stock.

Insider Buying and Selling

In other Walmart news, CEO C Douglas Mcmillon sold 29,124 shares of the firm's stock in a transaction on Thursday, September 26th. The shares were sold at an average price of $80.64, for a total value of $2,348,559.36. Following the completion of the transaction, the chief executive officer now directly owns 3,873,053 shares of the company's stock, valued at $312,322,993.92. This trade represents a 0.75 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Daniel J. Bartlett sold 2,063 shares of the company's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $80.76, for a total transaction of $166,607.88. Following the completion of the transaction, the executive vice president now directly owns 459,558 shares in the company, valued at approximately $37,113,904.08. The trade was a 0.45 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 12,337,337 shares of company stock valued at $958,823,647. 45.58% of the stock is owned by insiders.

Walmart Stock Performance

NYSE WMT traded up $0.58 during trading hours on Wednesday, reaching $87.18. 17,348,499 shares of the company were exchanged, compared to its average volume of 16,843,436. The company has a quick ratio of 0.22, a current ratio of 0.80 and a debt-to-equity ratio of 0.46. The stock has a market capitalization of $700.77 billion, a P/E ratio of 45.05, a P/E/G ratio of 4.19 and a beta of 0.51. Walmart Inc. has a 1 year low of $49.85 and a 1 year high of $88.29. The business's 50 day simple moving average is $81.58 and its 200-day simple moving average is $73.34.

Walmart (NYSE:WMT - Get Free Report) last posted its quarterly earnings data on Tuesday, November 19th. The retailer reported $0.58 EPS for the quarter, beating the consensus estimate of $0.53 by $0.05. Walmart had a return on equity of 21.72% and a net margin of 2.34%. The business had revenue of $169.59 billion for the quarter, compared to the consensus estimate of $167.69 billion. During the same quarter in the prior year, the business earned $0.51 earnings per share. Walmart's revenue for the quarter was up 5.5% on a year-over-year basis. On average, equities research analysts expect that Walmart Inc. will post 2.44 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of research analysts recently commented on the company. Morgan Stanley raised their price target on Walmart from $89.00 to $100.00 and gave the stock an "overweight" rating in a research report on Wednesday. Redburn Atlantic upgraded shares of Walmart to a "strong-buy" rating in a research report on Monday, September 23rd. Tigress Financial upped their price target on shares of Walmart from $75.00 to $86.00 and gave the stock a "buy" rating in a report on Tuesday, July 23rd. Bank of America raised their target price on Walmart from $95.00 to $105.00 and gave the company a "buy" rating in a report on Wednesday. Finally, Evercore ISI upped their price objective on Walmart from $66.00 to $89.00 and gave the stock an "overweight" rating in a research report on Monday. One investment analyst has rated the stock with a hold rating, twenty-eight have issued a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus target price of $91.51.

Read Our Latest Analysis on Walmart

Walmart Company Profile

(

Free Report)

Walmart Inc engages in the operation of retail, wholesale, other units, and eCommerce worldwide. The company operates through three segments: Walmart U.S., Walmart International, and Sam's Club. It operates supercenters, supermarkets, hypermarkets, warehouse clubs, cash and carry stores, and discount stores under Walmart and Walmart Neighborhood Market brands; membership-only warehouse clubs; ecommerce websites, such as walmart.com.mx, walmart.ca, flipkart.com, PhonePe and other sites; and mobile commerce applications.

Recommended Stories

Before you consider Walmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walmart wasn't on the list.

While Walmart currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.