Telsey Advisory Group reaffirmed their outperform rating on shares of Warby Parker (NYSE:WRBY - Free Report) in a report published on Thursday morning,Benzinga reports. Telsey Advisory Group currently has a $19.00 price target on the stock.

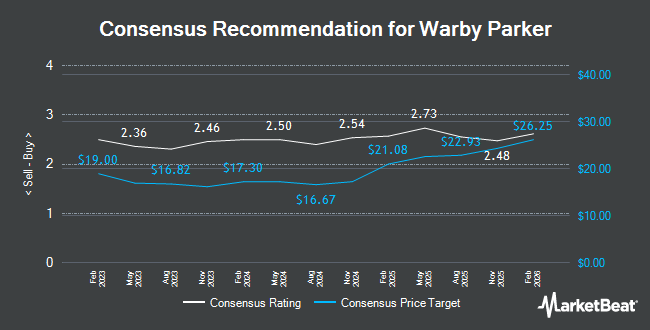

WRBY has been the topic of several other reports. Stifel Nicolaus lifted their price target on shares of Warby Parker from $14.00 to $15.00 and gave the company a "hold" rating in a research note on Friday, August 9th. JMP Securities upgraded shares of Warby Parker from a "market perform" rating to an "outperform" rating and set a $20.00 price target on the stock in a research note on Friday, August 23rd. Loop Capital lifted their price target on shares of Warby Parker from $15.00 to $16.00 and gave the company a "hold" rating in a research note on Wednesday, July 10th. Deutsche Bank Aktiengesellschaft upgraded shares of Warby Parker from a "neutral" rating to a "buy" rating and lifted their price target for the company from $15.00 to $18.00 in a research note on Monday, October 21st. Finally, BTIG Research lifted their price target on shares of Warby Parker from $18.00 to $20.00 and gave the company a "buy" rating in a research note on Friday, November 1st. Four research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat, Warby Parker presently has an average rating of "Moderate Buy" and an average target price of $17.30.

Get Our Latest Stock Report on WRBY

Warby Parker Stock Up 1.8 %

WRBY traded up $0.34 during trading on Thursday, hitting $19.31. The company had a trading volume of 2,506,453 shares, compared to its average volume of 1,409,360. The company has a market capitalization of $1.94 billion, a PE ratio of -49.13 and a beta of 1.80. Warby Parker has a one year low of $9.83 and a one year high of $19.60. The firm's 50-day moving average price is $15.74 and its 200 day moving average price is $15.48.

Warby Parker (NYSE:WRBY - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported ($0.03) EPS for the quarter, beating the consensus estimate of ($0.04) by $0.01. The business had revenue of $188.22 million for the quarter, compared to analysts' expectations of $186.89 million. Warby Parker had a negative net margin of 6.38% and a negative return on equity of 11.09%. Sell-side analysts forecast that Warby Parker will post -0.04 earnings per share for the current year.

Insider Transactions at Warby Parker

In other news, Director Bradley E. Singer acquired 50,000 shares of the stock in a transaction dated Tuesday, August 13th. The shares were bought at an average cost of $13.00 per share, for a total transaction of $650,000.00. Following the purchase, the director now directly owns 100,000 shares of the company's stock, valued at approximately $1,300,000. This trade represents a 100.00 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, CFO Steven Clive Miller sold 6,763 shares of the company's stock in a transaction dated Wednesday, September 11th. The shares were sold at an average price of $13.90, for a total value of $94,005.70. Following the transaction, the chief financial officer now owns 177,488 shares in the company, valued at approximately $2,467,083.20. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Bradley E. Singer purchased 50,000 shares of the firm's stock in a transaction that occurred on Tuesday, August 13th. The stock was bought at an average price of $13.00 per share, for a total transaction of $650,000.00. Following the purchase, the director now owns 100,000 shares in the company, valued at $1,300,000. The trade was a 100.00 % increase in their position. The disclosure for this purchase can be found here. Insiders have sold 99,178 shares of company stock worth $1,339,901 in the last ninety days. Insiders own 26.55% of the company's stock.

Institutional Trading of Warby Parker

A number of institutional investors have recently bought and sold shares of the business. Vanguard Group Inc. boosted its holdings in Warby Parker by 2.6% in the 1st quarter. Vanguard Group Inc. now owns 8,677,106 shares of the company's stock valued at $118,095,000 after purchasing an additional 219,120 shares during the period. Vaughan Nelson Investment Management L.P. boosted its holdings in Warby Parker by 3.2% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 2,555,705 shares of the company's stock valued at $41,735,000 after purchasing an additional 78,295 shares during the period. TimesSquare Capital Management LLC boosted its holdings in Warby Parker by 12.8% in the 3rd quarter. TimesSquare Capital Management LLC now owns 1,856,370 shares of the company's stock valued at $30,315,000 after purchasing an additional 211,050 shares during the period. Renaissance Technologies LLC boosted its holdings in Warby Parker by 44.3% in the 2nd quarter. Renaissance Technologies LLC now owns 1,568,600 shares of the company's stock valued at $25,192,000 after purchasing an additional 481,900 shares during the period. Finally, Marshall Wace LLP boosted its holdings in Warby Parker by 1,013.4% in the 2nd quarter. Marshall Wace LLP now owns 1,422,940 shares of the company's stock valued at $22,852,000 after purchasing an additional 1,295,136 shares during the period. Institutional investors own 93.24% of the company's stock.

Warby Parker Company Profile

(

Get Free Report)

Warby Parker Inc provides eyewear products in the United States and Canada. The company offers eyeglasses, sunglasses, light-responsive lenses, blue-light-filtering lenses, non-prescription lenses, and contact lenses. It also provides accessories, such as cases, lenses kit with anti-fog spray, pouches, and anti-fog lens spray through its retail stores, website, and mobile apps.

Featured Stories

Before you consider Warby Parker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warby Parker wasn't on the list.

While Warby Parker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.