FMR LLC reduced its stake in Warner Music Group Corp. (NASDAQ:WMG - Free Report) by 42.8% during the third quarter, according to its most recent filing with the SEC. The fund owned 5,637,038 shares of the company's stock after selling 4,225,502 shares during the quarter. FMR LLC owned 1.09% of Warner Music Group worth $176,439,000 at the end of the most recent quarter.

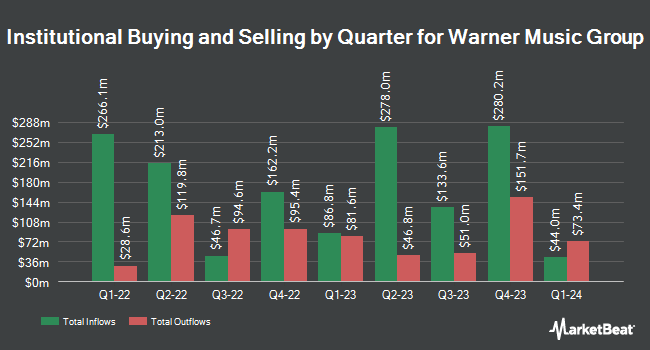

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Concord Wealth Partners bought a new position in shares of Warner Music Group in the third quarter worth approximately $30,000. Benjamin Edwards Inc. raised its holdings in Warner Music Group by 74.5% in the second quarter. Benjamin Edwards Inc. now owns 953 shares of the company's stock worth $29,000 after purchasing an additional 407 shares in the last quarter. Assetmark Inc. raised its holdings in Warner Music Group by 9,400.0% in the third quarter. Assetmark Inc. now owns 1,235 shares of the company's stock worth $39,000 after purchasing an additional 1,222 shares in the last quarter. ORG Partners LLC raised its holdings in Warner Music Group by 5,790.5% in the second quarter. ORG Partners LLC now owns 1,237 shares of the company's stock worth $37,000 after purchasing an additional 1,216 shares in the last quarter. Finally, ORG Wealth Partners LLC bought a new position in shares of Warner Music Group during the third quarter valued at $73,000. 96.88% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities analysts have recently weighed in on WMG shares. Bank of America restated an "underperform" rating and set a $30.00 price target (down from $33.00) on shares of Warner Music Group in a report on Friday, October 4th. JPMorgan Chase & Co. reduced their price objective on Warner Music Group from $41.00 to $40.00 and set an "overweight" rating for the company in a report on Friday, November 22nd. Deutsche Bank Aktiengesellschaft reduced their price objective on Warner Music Group from $42.00 to $36.00 and set a "buy" rating for the company in a report on Tuesday, August 13th. Guggenheim reiterated a "buy" rating and issued a $44.00 price objective on shares of Warner Music Group in a report on Friday, November 22nd. Finally, Citigroup lifted their price objective on Warner Music Group from $31.00 to $34.00 and gave the stock a "neutral" rating in a report on Friday. Two investment analysts have rated the stock with a sell rating, five have assigned a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat.com, Warner Music Group has a consensus rating of "Hold" and a consensus price target of $35.67.

Read Our Latest Report on Warner Music Group

Warner Music Group Price Performance

WMG traded up $0.05 on Tuesday, hitting $32.22. 213,905 shares of the company's stock traded hands, compared to its average volume of 1,805,278. The company's 50 day simple moving average is $31.97 and its 200-day simple moving average is $30.62. The firm has a market cap of $16.69 billion, a price-to-earnings ratio of 38.76, a P/E/G ratio of 0.70 and a beta of 1.35. Warner Music Group Corp. has a one year low of $27.06 and a one year high of $38.05. The company has a current ratio of 0.68, a quick ratio of 0.65 and a debt-to-equity ratio of 5.95.

Warner Music Group Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 3rd. Shareholders of record on Tuesday, November 19th will be paid a $0.18 dividend. This represents a $0.72 dividend on an annualized basis and a yield of 2.23%. The ex-dividend date of this dividend is Tuesday, November 19th. Warner Music Group's payout ratio is 86.75%.

Insiders Place Their Bets

In other news, CEO Max Lousada sold 428,834 shares of the business's stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $28.00, for a total transaction of $12,007,352.00. Following the transaction, the chief executive officer now owns 2,289,771 shares of the company's stock, valued at approximately $64,113,588. The trade was a 15.77 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Corporate insiders own 73.35% of the company's stock.

Warner Music Group Profile

(

Free Report)

Warner Music Group Corp. operates as a music entertainment company in the United States, the United Kingdom, Germany, and internationally. It operates through Recorded Music and Music Publishing segments. The Recorded Music segment is involved in the discovery and development of recording artists, as well as related marketing, promotion, distribution, sale, and licensing of music created by such recording artists; markets its music catalog through compilations and reissuances of previously released music and video titles, as well as previously unreleased materials; and conducts its operation primarily through a collection of record labels, such as Warner Records and Atlantic Records, as well as Asylum, Big Beat, Canvasback, East West, Erato, FFRR, Fueled by Ramen, Nonesuch, Parlophone, Reprise, Roadrunner, Sire, Spinnin' Records, Warner Classics, and Warner Music Nashville.

See Also

Before you consider Warner Music Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warner Music Group wasn't on the list.

While Warner Music Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.